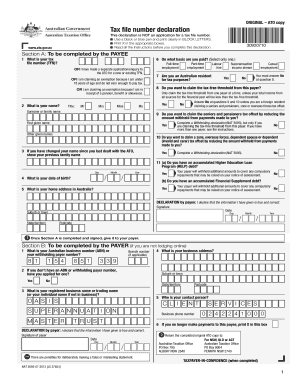

Tax File Declaration Form

What is the Tax File Declaration Form

The Tax File Declaration Form is a crucial document used in the United States for individuals to declare their tax file number (TFN) to their employers or financial institutions. This form ensures that the correct amount of tax is withheld from an individual's income. It is particularly important for new employees or those who have recently changed their tax status. By providing this information, taxpayers can avoid over-withholding and ensure compliance with federal tax regulations.

How to use the Tax File Declaration Form

Using the Tax File Declaration Form involves several steps. First, individuals must obtain the form, which is typically available from the IRS website or through their employer. Once the form is in hand, taxpayers should fill out their personal information, including their name, address, and Social Security number. Additionally, they need to indicate their tax file number and any relevant exemptions. After completing the form, it should be submitted to the employer or the relevant financial institution to ensure proper tax withholding.

Steps to complete the Tax File Declaration Form

Completing the Tax File Declaration Form requires careful attention to detail. Here are the essential steps:

- Obtain the form from the IRS or your employer.

- Fill in your personal details, including your full name and address.

- Provide your Social Security number for identification purposes.

- Enter your tax file number accurately.

- Indicate any exemptions or special circumstances that apply.

- Review the completed form for accuracy.

- Submit the form to your employer or financial institution.

Legal use of the Tax File Declaration Form

The legal use of the Tax File Declaration Form is governed by federal tax laws. It is essential for ensuring that the correct amount of taxes is withheld from an individual's income. When completed accurately, the form serves as a legal declaration of a taxpayer's information and entitlements. Failure to submit this form may result in incorrect tax withholding, which can lead to penalties or unexpected tax liabilities. Therefore, it is crucial to understand the legal implications of the information provided on the form.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the Tax File Declaration Form. Taxpayers are advised to refer to the IRS website for the most current instructions and any updates to the form. These guidelines include details on eligibility, required information, and deadlines for submission. Adhering to these guidelines helps ensure compliance with tax laws and minimizes the risk of errors that could lead to audits or penalties.

Required Documents

When filling out the Tax File Declaration Form, certain documents may be required to support the information provided. These typically include:

- Proof of identity, such as a driver's license or passport.

- Social Security card for verification of your Social Security number.

- Any previous tax documents that may be relevant, such as W-2 forms.

Having these documents ready can streamline the process and ensure that the form is completed accurately.

Form Submission Methods

The Tax File Declaration Form can be submitted through various methods, depending on the employer or financial institution's requirements. Common submission methods include:

- Online submission through the employer's payroll system.

- Mailing a printed copy of the form directly to the employer.

- In-person submission at the employer's HR department.

It is advisable to confirm the preferred method with the employer to ensure proper processing of the form.

Quick guide on how to complete tax file declaration form

Effortlessly Prepare Tax File Declaration Form on Any Device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Tax File Declaration Form on any device through the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign Tax File Declaration Form with Ease

- Find Tax File Declaration Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight relevant sections of the documents or redact sensitive information with the tools specifically provided by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Tax File Declaration Form while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax file declaration form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax form PDF and why is it important?

A tax form PDF is a digital version of various tax-related documents that can be filled out, signed, and submitted electronically. It is important because it simplifies the process of submitting tax information, reduces paper usage, and helps ensure your documents are securely stored and easily accessible.

-

How does airSlate SignNow facilitate the completion of a tax form PDF?

airSlate SignNow enables users to easily create, fill out, and eSign a tax form PDF in a streamlined manner. Its user-friendly interface and powerful features allow for quick edits, the addition of electronic signatures, and seamless sharing of documents, making tax season less stressful.

-

Is airSlate SignNow compatible with various tax form PDF templates?

Yes, airSlate SignNow is compatible with a wide range of tax form PDF templates. Users can upload any tax form PDF and customize it according to their needs, allowing for efficient handling of various tax documents throughout the year.

-

What are the pricing options for using airSlate SignNow to manage tax form PDFs?

airSlate SignNow offers several pricing plans designed to accommodate different user needs, starting with a free trial for new users. Subscription plans provide advanced features for managing tax form PDFs, such as enhanced security and integrations, ensuring users only pay for what they need.

-

Can I integrate airSlate SignNow with other software to manage tax form PDFs?

Absolutely! airSlate SignNow integrates smoothly with various accounting and tax software, allowing users to upload and manage tax form PDFs directly within their existing systems. This integration streamlines the workflow, making it easier to manage all tax-related documents in one place.

-

What security measures does airSlate SignNow implement for tax form PDFs?

airSlate SignNow incorporates advanced security measures including encryption, secure signing processes, and compliance with legal standards to protect your tax form PDFs. Users can trust that their sensitive tax information is safe, ensuring peace of mind while eSigning documents.

-

How can I track the status of my tax form PDF when using airSlate SignNow?

With airSlate SignNow, tracking the status of your tax form PDF is simple. The platform provides real-time updates and notifications, allowing users to see when documents are viewed, signed, or completed, ensuring that you never lose track of important tax submissions.

Get more for Tax File Declaration Form

- Ap biology practice exam pdf 483942219 form

- Non disclosure agreement nda template sample form

- Summer camp budget example form

- Up 1intreo centerbranch officeapplication form fo

- Birth certificate correction form haryana pdf

- Taguig city building permit form

- Physics worksheets for grade 9 pdf form

- Gas 1276 397593748 form

Find out other Tax File Declaration Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors