Oregon Exempt Income Schedule for American Indians Form

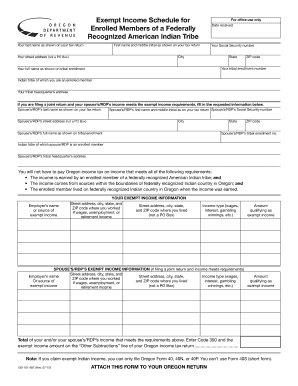

What is the Oregon Exempt Income Schedule For American Indians Form

The Oregon Exempt Income Schedule for American Indians Form is a specific tax form used by eligible American Indian individuals residing in Oregon. This form allows these individuals to report their exempt income, which may include certain income types that are not subject to state taxation. Understanding the purpose of this form is crucial for ensuring compliance with state tax regulations while maximizing eligible tax benefits.

How to use the Oregon Exempt Income Schedule For American Indians Form

Using the Oregon Exempt Income Schedule for American Indians Form involves accurately reporting exempt income on your state tax return. First, gather all necessary documentation related to your income sources. Then, complete the form by entering the required information in the designated fields. Ensure that all figures are accurate and reflect your income accurately. Finally, attach the completed form to your Oregon state tax return when filing.

Steps to complete the Oregon Exempt Income Schedule For American Indians Form

Completing the Oregon Exempt Income Schedule for American Indians Form requires careful attention to detail. Follow these steps:

- Obtain the form from the appropriate state tax authority or download it from their official website.

- Fill in your personal information, including your name, address, and Social Security number.

- List all sources of exempt income, ensuring to categorize them correctly.

- Calculate the total exempt income and enter it in the designated section.

- Review the completed form for accuracy before submission.

Legal use of the Oregon Exempt Income Schedule For American Indians Form

The legal use of the Oregon Exempt Income Schedule for American Indians Form is essential for compliance with state tax laws. This form is recognized by the Oregon Department of Revenue and must be completed accurately to avoid potential penalties. It is important to understand the legal implications of reporting exempt income, as misrepresentation can lead to audits or fines.

Eligibility Criteria

To be eligible to use the Oregon Exempt Income Schedule for American Indians Form, individuals must meet specific criteria. Primarily, applicants must identify as American Indian and demonstrate residency in Oregon. Additionally, the income being reported must qualify as exempt under Oregon tax laws. Verification of tribal affiliation and income sources may be required to support the claims made on the form.

Form Submission Methods

The Oregon Exempt Income Schedule for American Indians Form can be submitted through various methods. Individuals may choose to file their tax returns online, where they can upload the completed form as part of their electronic submission. Alternatively, the form can be printed and mailed to the appropriate state tax office. In-person submission is also an option at designated tax offices across Oregon.

Quick guide on how to complete oregon exempt income schedule for american indians form

Complete Oregon Exempt Income Schedule For American Indians Form with ease on any device

Online document administration has become increasingly popular among companies and individuals. It offers a fantastic eco-friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely save it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents promptly without delays. Manage Oregon Exempt Income Schedule For American Indians Form on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to alter and eSign Oregon Exempt Income Schedule For American Indians Form effortlessly

- Locate Oregon Exempt Income Schedule For American Indians Form and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes moments and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Stop worrying about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Oregon Exempt Income Schedule For American Indians Form and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oregon exempt income schedule for american indians form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oregon Exempt Income Schedule For American Indians Form?

The Oregon Exempt Income Schedule For American Indians Form is a document that allows eligible American Indians to report their income exempt from state taxation. This form is crucial for individuals who qualify under specific treaties or statutes. It helps ensure compliance with state regulations while maximizing tax benefits.

-

How can airSlate SignNow help with the Oregon Exempt Income Schedule For American Indians Form?

airSlate SignNow streamlines the process of preparing and signing the Oregon Exempt Income Schedule For American Indians Form. Our user-friendly platform allows you to fill out, sign, and send your documents electronically, saving you time and reducing paperwork. It's an efficient solution for individuals needing to ensure correct submission of their tax forms.

-

Is there a fee associated with using airSlate SignNow for the Oregon Exempt Income Schedule For American Indians Form?

Yes, airSlate SignNow offers various pricing plans tailored to different needs, including free trials for new users. While there may be a nominal fee for advanced features, the basic functionalities for handling your Oregon Exempt Income Schedule For American Indians Form are affordable and cost-effective. Investing in our platform can save you time and money in the long run.

-

What features does airSlate SignNow offer for managing the Oregon Exempt Income Schedule For American Indians Form?

airSlate SignNow provides numerous features, including easy document creation, real-time collaboration, and electronic signatures for the Oregon Exempt Income Schedule For American Indians Form. Our solution also includes templates and customizable fields, ensuring that your forms are completed accurately and efficiently. Additionally, you can track the status of your documents to stay updated.

-

Can I integrate airSlate SignNow with other tools for handling the Oregon Exempt Income Schedule For American Indians Form?

Absolutely! airSlate SignNow can be integrated with various applications, including CRM systems and cloud storage solutions. This makes it easier to access and manage the Oregon Exempt Income Schedule For American Indians Form alongside your existing tools. Streamlining your workflow with integrations enhances efficiency and productivity.

-

What are the benefits of using airSlate SignNow for the Oregon Exempt Income Schedule For American Indians Form?

By using airSlate SignNow for your Oregon Exempt Income Schedule For American Indians Form, you gain quick access to a reliable eSignature solution. Benefits include enhanced security, improved collaboration with multiple signers, and the ability to keep your documents organized in one place. Furthermore, our platform helps expedite the filing process, ensuring you meet deadlines without hassle.

-

Is airSlate SignNow secure for handling sensitive documents like the Oregon Exempt Income Schedule For American Indians Form?

Yes, airSlate SignNow prioritizes security and confidentiality when handling sensitive documents, including the Oregon Exempt Income Schedule For American Indians Form. Our platform is compliant with industry standards, featuring encryption and secure data storage. You can trust us to keep your personal information safe while you eSign and manage your documents.

Get more for Oregon Exempt Income Schedule For American Indians Form

Find out other Oregon Exempt Income Schedule For American Indians Form

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online