High Efficiency Water Heaters Energy StarEnergy Incentives for Individuals IRS Tax FormsSuper Efficient Water HeaterProductsENER

Understanding High Efficiency Water Heaters

High efficiency water heaters are designed to use less energy while providing the same amount of hot water as traditional models. These appliances often carry the ENERGY STAR label, indicating they meet strict energy efficiency guidelines set by the U.S. Environmental Protection Agency. By investing in a high efficiency water heater, homeowners can reduce their energy bills and contribute to environmental sustainability.

Energy Incentives for Individuals

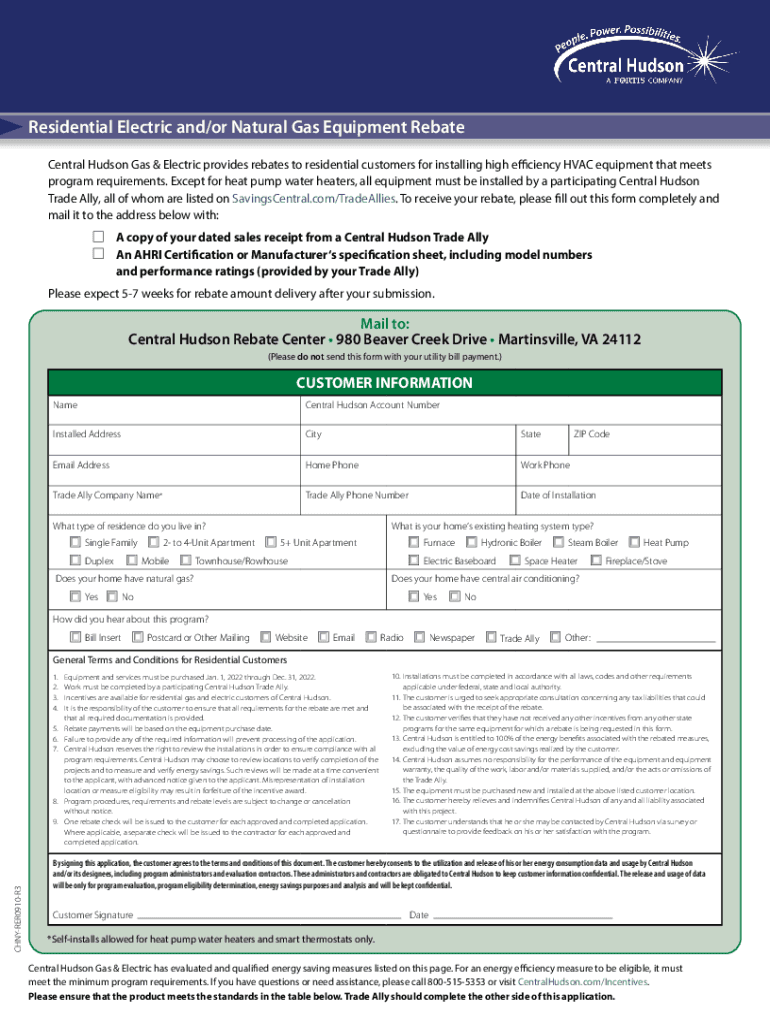

Individuals purchasing high efficiency water heaters may be eligible for various energy incentives. These can include federal tax credits, state rebates, and utility company incentives. The IRS provides guidelines on the specific forms required to claim these benefits, which can significantly offset the initial purchase cost. It is essential to check local and federal programs to maximize savings.

IRS Tax Forms for Energy Efficiency

To claim energy efficiency tax credits, individuals must complete specific IRS tax forms. Common forms include the Form 5695, which is used to report residential energy credits. It is important to accurately fill out these forms to ensure compliance and avoid penalties. Keeping records of the purchase and installation of the water heater is also crucial for tax purposes.

Steps to Obtain a High Efficiency Water Heater

Acquiring a high efficiency water heater involves several steps:

- Research available models that meet ENERGY STAR criteria.

- Evaluate local incentives and rebates that may apply.

- Select a licensed installer to ensure proper installation.

- Complete necessary IRS forms to claim tax credits.

- Schedule regular maintenance to ensure optimal performance.

Eligibility Criteria for Incentives

Eligibility for energy efficiency incentives often depends on various factors, including:

- The type of water heater purchased (must be ENERGY STAR certified).

- Installation date, as programs may have specific timeframes.

- Homeowner's income level, which may affect eligibility for certain rebates.

Common Filing Deadlines

Filing deadlines for tax credits related to energy efficiency can vary. Typically, individuals must file their tax returns by April 15 each year. However, it is advisable to check for any updates or changes to deadlines, especially when new energy efficiency programs are introduced. Keeping track of these dates ensures that homeowners do not miss out on potential savings.

Quick guide on how to complete high efficiency water heaters energy starenergy incentives for individuals irs tax formssuper efficient water

Complete High Efficiency Water Heaters Energy StarEnergy Incentives For Individuals IRS Tax FormsSuper Efficient Water HeaterProductsENER effortlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, alter, and eSign your documents quickly and without delays. Handle High Efficiency Water Heaters Energy StarEnergy Incentives For Individuals IRS Tax FormsSuper Efficient Water HeaterProductsENER on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign High Efficiency Water Heaters Energy StarEnergy Incentives For Individuals IRS Tax FormsSuper Efficient Water HeaterProductsENER seamlessly

- Locate High Efficiency Water Heaters Energy StarEnergy Incentives For Individuals IRS Tax FormsSuper Efficient Water HeaterProductsENER and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign High Efficiency Water Heaters Energy StarEnergy Incentives For Individuals IRS Tax FormsSuper Efficient Water HeaterProductsENER and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the high efficiency water heaters energy starenergy incentives for individuals irs tax formssuper efficient water

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are High Efficiency Water Heaters and how do they work?

High Efficiency Water Heaters are designed to use less energy while providing the same amount of hot water as traditional models. They achieve this through advanced technology and insulation, which minimizes heat loss. By choosing ENERGY STAR certified models, you can ensure that you are investing in products that meet strict energy efficiency guidelines.

-

What are the benefits of using ENERGY STAR High Efficiency Water Heaters?

Using ENERGY STAR High Efficiency Water Heaters can signNowly reduce your energy bills and environmental impact. These products are designed to operate more efficiently, which means they consume less energy while delivering reliable hot water. Additionally, many utility companies offer incentives for individuals who install these energy-efficient systems.

-

Are there any energy incentives available for purchasing High Efficiency Water Heaters?

Yes, there are various energy incentives available for individuals who purchase High Efficiency Water Heaters. These can include rebates from local utility companies and federal tax credits. It's important to check the latest IRS Tax Forms and local programs to maximize your savings when investing in super efficient water heater products.

-

How do I determine the right size High Efficiency Water Heater for my home?

To determine the right size High Efficiency Water Heater, consider your household's hot water needs, including the number of people living in your home and your peak usage times. A professional assessment can help you choose a model that meets your demands without wasting energy. This ensures you get the most out of your ENERGY STAR water heater.

-

What features should I look for in a High Efficiency Water Heater?

When selecting a High Efficiency Water Heater, look for features such as advanced insulation, digital thermostats, and smart technology that allows for remote monitoring. Additionally, ensure that the model is ENERGY STAR certified, as this guarantees it meets high energy efficiency standards. These features contribute to lower energy costs and improved performance.

-

How can I integrate a High Efficiency Water Heater into my existing system?

Integrating a High Efficiency Water Heater into your existing system may require professional installation to ensure compatibility and optimal performance. It's advisable to consult with a qualified technician who can assess your current setup and recommend the best approach. This ensures that you benefit from the energy efficiency of your new water heater.

-

What is the average cost of installing a High Efficiency Water Heater?

The average cost of installing a High Efficiency Water Heater can vary based on the model and installation complexity, typically ranging from $1,000 to $3,000. While the upfront cost may be higher than traditional models, the long-term savings on energy bills and potential rebates make it a worthwhile investment. Always consider the total cost of ownership when evaluating your options.

Get more for High Efficiency Water Heaters Energy StarEnergy Incentives For Individuals IRS Tax FormsSuper Efficient Water HeaterProductsENER

Find out other High Efficiency Water Heaters Energy StarEnergy Incentives For Individuals IRS Tax FormsSuper Efficient Water HeaterProductsENER

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself