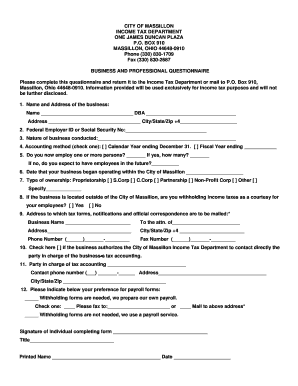

Massillon Tax Department Form

What is the Massillon Tax Department

The Massillon Tax Department is the local government agency responsible for administering and collecting income taxes within the city of Massillon, Ohio. This department ensures compliance with local tax laws and regulations, providing essential services to residents and businesses. It plays a critical role in maintaining the financial health of the city by collecting revenue that funds public services and infrastructure.

Steps to complete the Massillon Tax Department form

Completing the Massillon city income tax form online involves several straightforward steps. First, gather all necessary financial documents, including W-2 forms, 1099s, and any other relevant income statements. Next, access the online filing portal provided by the Massillon Tax Department. Follow the prompts to input your personal information, income details, and any deductions or credits you may qualify for. After filling out the form, review all entries for accuracy before submitting it electronically. Ensure you save a copy of your completed form for your records.

Required Documents

To successfully complete the Massillon city income tax form, certain documents are necessary. These typically include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any other income sources

- Documentation for deductions, such as receipts for charitable contributions

- Previous year’s tax return for reference

Having these documents ready will streamline the filing process and help ensure accurate reporting.

Form Submission Methods

The Massillon city income tax form can be submitted through various methods to accommodate different preferences. Residents have the option to file online via the Massillon Tax Department's website, which is the most efficient method. Alternatively, individuals can print the form, complete it manually, and submit it by mail. In-person submissions may also be accepted at the Tax Department office during business hours. Each method has its own advantages, but online filing typically offers quicker processing times.

Penalties for Non-Compliance

Failure to comply with Massillon city tax regulations can result in penalties. These may include late fees, interest on unpaid taxes, and potential legal actions. It is crucial for residents and businesses to file their tax forms on time and pay any owed taxes to avoid these consequences. The Massillon Tax Department provides resources and guidance to help taxpayers understand their obligations and stay compliant.

Digital vs. Paper Version

When it comes to filing the Massillon city income tax form, taxpayers can choose between digital and paper versions. The digital version offers several advantages, including faster processing times, immediate confirmation of submission, and reduced risk of errors. In contrast, the paper version may take longer to process and requires physical mailing. However, some individuals may prefer the paper method for personal record-keeping or if they are less comfortable with technology. Regardless of the choice, both versions are accepted by the Massillon Tax Department.

Quick guide on how to complete massillon tax department

Complete Massillon Tax Department effortlessly on any device

Digital document management has gained popularity among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly and without difficulties. Manage Massillon Tax Department on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to adjust and eSign Massillon Tax Department without any hassle

- Find Massillon Tax Department and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or black out sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in merely a few clicks from any device you prefer. Revise and eSign Massillon Tax Department and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the massillon tax department

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the massillon city income tax form online and who needs it?

The massillon city income tax form online is a digital version of the tax form required for residents and businesses to report income taxes in Massillon. Individuals earning income within the city limits must fill out this form to comply with local tax regulations. Using the online version streamlines the process, making it easier to submit and manage your tax obligations.

-

How do I access the massillon city income tax form online?

You can access the massillon city income tax form online through the official city website or a trusted e-signature platform like airSlate SignNow. These platforms provide a user-friendly interface that guides you through the process, ensuring that you can easily find and complete the required forms.

-

Is it safe to submit the massillon city income tax form online?

Yes, submitting the massillon city income tax form online is safe when using a secure platform like airSlate SignNow. Our comprehensive security measures ensure that your sensitive information is protected. You can confidently submit your tax forms knowing they are encrypted and securely stored.

-

What features does airSlate SignNow offer for filing the massillon city income tax form online?

airSlate SignNow offers features like e-signatures, document templates, and easy sharing options that enhance your experience when filing the massillon city income tax form online. Our platform also allows you to track the status of submitted documents and ensure compliance with local regulations for a seamless filing process.

-

Are there any costs associated with using airSlate SignNow for the massillon city income tax form online?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when filing the massillon city income tax form online. While there is a nominal fee for certain advanced features, our platform remains cost-effective compared to traditional filing methods, saving you both time and money.

-

Can I integrate airSlate SignNow with other tools while filing the massillon city income tax form online?

Absolutely! airSlate SignNow supports integrations with popular tools such as Google Drive, Dropbox, and CRM systems. This compatibility allows you to streamline your document management process while filing the massillon city income tax form online, enhancing your overall workflow.

-

What benefits come with using airSlate SignNow for the massillon city income tax form online?

Using airSlate SignNow for the massillon city income tax form online provides numerous benefits, such as increased efficiency and reduced processing time. The platform simplifies the e-signature process, helps you avoid costly delays in tax submissions, and ensures you're compliant with Massillon's tax regulations.

Get more for Massillon Tax Department

- Review and practice protein synthesis form

- Drie short form renewal

- Appendix ii a part b book of specifications form

- Shawnee county kansas district attorney form

- Chandler police department identity theft packet form

- Mampp bodyguard rebate form

- 10o3 section form

- Application for recertification program sponsors ohio department agri ohio form

Find out other Massillon Tax Department

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form