Form 8949 Fillable

What is the Form 8949 Fillable

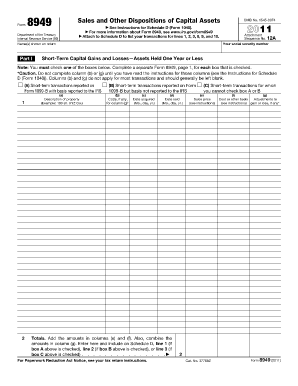

The Form 8949 is a crucial document used by taxpayers in the United States to report capital gains and losses from the sale of assets. This form is essential for accurately calculating tax liabilities related to investments, including stocks, bonds, and real estate. The fillable version of Form 8949 allows users to complete the document electronically, facilitating easier data entry and submission. By using a digital format, taxpayers can ensure that their information is organized and legible, which can help streamline the filing process.

How to Use the Form 8949 Fillable

To effectively use the Form 8949 fillable, taxpayers should first gather all necessary documentation related to their capital transactions. This includes purchase and sale records, as well as any supporting documents that detail the cost basis of the assets sold. Once the information is organized, users can begin entering data into the fillable form. It's important to accurately report each transaction, including the date acquired, date sold, proceeds, and cost basis. After completing the form, users can save it digitally or print it for submission with their tax return.

Steps to Complete the Form 8949 Fillable

Completing the Form 8949 fillable involves several key steps:

- Gather Documentation: Collect all relevant records of capital gains and losses.

- Access the Form: Open the fillable Form 8949 on a compatible device.

- Enter Transaction Details: Fill in the required fields for each transaction, including dates, proceeds, and cost basis.

- Review Entries: Double-check all information for accuracy to avoid errors.

- Save or Print: Save the completed form electronically or print it for submission.

Legal Use of the Form 8949 Fillable

The Form 8949 fillable is legally recognized for reporting capital gains and losses, provided it is completed accurately and submitted in accordance with IRS guidelines. To ensure that the form is legally binding, users should adhere to the requirements set forth by the IRS, including proper signatures and submission methods. Utilizing a reliable eSignature solution can further enhance the legal validity of the completed document, ensuring compliance with electronic signature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8949 are typically aligned with the annual tax return due dates. For most taxpayers, the deadline to file is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may qualify for, which can provide additional time to file. Staying informed about these important dates helps ensure timely compliance with tax obligations.

Examples of Using the Form 8949 Fillable

Examples of using the Form 8949 fillable include reporting the sale of stocks, bonds, or real estate. For instance, if a taxpayer sells shares of a corporation for a profit, they would report the transaction on the form, detailing the purchase date, sale date, proceeds, and cost basis. Similarly, if a loss is incurred from the sale of an asset, this too must be reported. Properly documenting these transactions helps taxpayers accurately calculate their capital gains or losses, which is essential for tax reporting.

Quick guide on how to complete form 8949 fillable

Complete Form 8949 Fillable effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Form 8949 Fillable on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to adjust and electronically sign Form 8949 Fillable with ease

- Find Form 8949 Fillable and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all information and click the Done button to save your modifications.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Adjust and electronically sign Form 8949 Fillable and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8949 fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8949 and who needs it?

Form 8949 is used by taxpayers to report capital gains and losses from the sale of investments or assets. Individuals, businesses, and investors who sell securities or properties must complete Form 8949 to accurately report their transactions on their tax returns.

-

How can airSlate SignNow assist with Form 8949 submissions?

airSlate SignNow facilitates the eSigning of Form 8949, allowing users to easily prepare and electronically sign their tax documents. With our user-friendly interface, you can streamline the signing process, ensuring that Form 8949 is submitted promptly and securely.

-

What features does airSlate SignNow offer for managing Form 8949?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and real-time collaboration tools. These features help you manage Form 8949 efficiently and ensure all necessary parties can review and sign the document without hassle.

-

Is there a cost associated with using airSlate SignNow for Form 8949?

Yes, airSlate SignNow offers various pricing plans to fit different business needs, including options for individuals and teams. While costs can vary, our service provides cost-effective solutions for managing and eSigning Form 8949, making compliance easier.

-

Can I integrate airSlate SignNow with other software for handling Form 8949?

Absolutely! airSlate SignNow integrates seamlessly with numerous software applications, including popular accounting and tax preparation tools. This integration simplifies the process of completing Form 8949 and syncing your eSigned documents with your financial data.

-

What are the benefits of using airSlate SignNow for Form 8949?

Using airSlate SignNow for Form 8949 provides numerous benefits such as increased efficiency in document handling, enhanced security features, and a reduced risk of errors. Our platform also ensures that your Form 8949 is compliant with legal standards, giving you peace of mind.

-

How secure is airSlate SignNow when it comes to Form 8949?

airSlate SignNow employs advanced encryption methods and secure cloud storage to protect your Form 8949 and other sensitive documents. We prioritize data security, so you can eSign and manage your tax forms with confidence.

Get more for Form 8949 Fillable

- Borrowers personal information auto loan philippines

- Penndot form mv 44 commonwealth auto tags

- Crime busters science olympiad practice test form

- Harris teeter vaccine consent form

- Medical for families form

- Injury assessment form

- Virginia individual income tax declaration for electronic filing form

- Virginia individual income tax declaration for electronic filing 772038996 form

Find out other Form 8949 Fillable

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer