Kmdc Indemnity Bond Form

What is the Kmdc Indemnity Bond

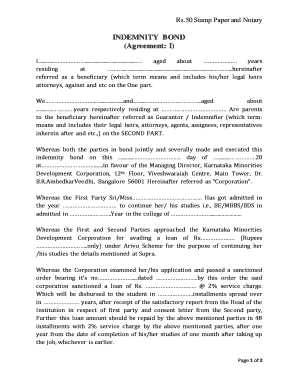

The Kmdc indemnity bond is a legally binding document that provides a guarantee against potential losses or damages incurred by a lender or financial institution. This bond is often required in the context of loans, such as the arivu loan, to protect the lender's interests. Essentially, it serves as a safeguard, ensuring that if the borrower defaults on the loan, the lender can recover the owed amount through the bond. Understanding the purpose and implications of this bond is crucial for both borrowers and lenders.

How to use the Kmdc Indemnity Bond

Using the Kmdc indemnity bond involves several steps to ensure it is executed properly. First, the borrower must fill out the indemnity bond form accurately, providing all necessary information, including personal details and loan specifics. After completing the form, the borrower must sign it, either physically or electronically, depending on the requirements of the lender. It is essential to keep a copy of the signed bond for personal records and future reference. This documentation can be crucial in case any disputes arise regarding the loan.

Steps to complete the Kmdc Indemnity Bond

Completing the Kmdc indemnity bond requires careful attention to detail. Here are the steps involved:

- Gather necessary information, including loan details and personal identification.

- Obtain the official Kmdc indemnity bond form from the lender or relevant authority.

- Fill out the form, ensuring all sections are completed accurately.

- Review the completed form for any errors or omissions.

- Sign the form, either by hand or using a secure electronic signature.

- Submit the completed bond to the lender, following their specified submission method.

Legal use of the Kmdc Indemnity Bond

The legal use of the Kmdc indemnity bond is governed by various regulations that ensure its validity and enforceability. To be considered legally binding, the bond must meet specific criteria, including proper execution and adherence to relevant laws. In the United States, electronic signatures are recognized under the ESIGN and UETA acts, which means that an electronically signed Kmdc indemnity bond can hold the same legal weight as a traditional paper document. It is important for borrowers to understand these legal frameworks to ensure their bond is enforceable.

Key elements of the Kmdc Indemnity Bond

Several key elements define the Kmdc indemnity bond, making it a comprehensive legal instrument. These elements typically include:

- The names and contact information of the parties involved, including the borrower and lender.

- A clear description of the loan amount and terms.

- Specific conditions under which the bond will be activated, such as loan default.

- The signature of the borrower, which signifies acceptance of the bond's terms.

- Any additional clauses that may pertain to the specific loan or borrower situation.

How to obtain the Kmdc Indemnity Bond

Obtaining the Kmdc indemnity bond typically involves a straightforward process. Borrowers can request the bond form directly from their lender or financial institution. Many lenders provide these forms online for easy access. Once the form is obtained, borrowers should carefully complete it, ensuring that all required information is included. After submission, the lender will review the bond and may provide a copy for the borrower's records. It is advisable to keep all documentation related to the bond for future reference.

Quick guide on how to complete indemnity bond for kmdc loan

Effortlessly Prepare indemnity bond for kmdc loan on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage kmdc indemnity bond on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign kmdc meaning Effortlessly

- Locate indemnity bond for arivu loan and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign arivu loan indemnity bond while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to kmdc indemnity bond

Create this form in 5 minutes!

How to create an eSignature for the kmdc meaning

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask arivu loan indemnity bond

-

What is a KMDC indemnity bond?

A KMDC indemnity bond is a financial guarantee often required in various business and legal transactions. This bond serves to protect against potential losses resulting from specific obligations not being met. Understanding its importance can help businesses navigate legal requirements efficiently.

-

How can airSlate SignNow assist with managing a KMDC indemnity bond?

airSlate SignNow provides a user-friendly platform to create, send, and electronically sign documents related to a KMDC indemnity bond. The solution ensures all necessary legal documents are easily accessible and securely stored. Utilizing SignNow helps in maintaining compliance and tracking document status seamlessly.

-

What are the costs associated with a KMDC indemnity bond?

The costs of a KMDC indemnity bond can vary based on factors like the bond amount and the risk assessment of your business. While airSlate SignNow does not issue bonds directly, we streamline the process of managing related documents, potentially saving costs on administrative tasks. Always consult with a bonding agent for precise pricing.

-

What features does airSlate SignNow offer for KMDC indemnity bond documents?

airSlate SignNow offers features such as customizable templates for KMDC indemnity bond documents, secure eSigning, and real-time tracking. These tools enhance efficiency and reduce the time spent on paper-based processes. Our platform ensures that all transactions regarding your indemnity bond are smooth and reliable.

-

What are the benefits of using airSlate SignNow for a KMDC indemnity bond?

Using airSlate SignNow for your KMDC indemnity bond provides enhanced efficiency, cost savings, and reduced turnaround times. Our platform allows for easy access to documents, quick collaboration, and secure electronic signatures. These benefits improve the overall management of your indemnity bond and related legal requirements.

-

Can I integrate airSlate SignNow with other tools for my KMDC indemnity bond?

Yes, airSlate SignNow offers seamless integrations with various business tools and applications to enhance your workflow. These integrations allow you to connect your document management processes related to the KMDC indemnity bond with other software you use. This interconnectedness simplifies operations and boosts productivity.

-

Is airSlate SignNow compliant with legal regulations for KMDC indemnity bonds?

Absolutely! airSlate SignNow complies with all major legal regulations regarding electronic signatures and document management for KMDC indemnity bonds. Our platform is designed to meet strict security standards, ensuring that your documents are handled legally and securely in compliance with applicable laws.

Get more for indemnity bond for kmdc loan

- Form search results us legal forms inc nonprofit network

- Editable notice of petition holdover form fill out ampamp print forms

- State of ohio hereinafter referred to as the trustor and the trustee designated form

- How to dissolve an llc in pennsylvanianolo form

- State of pennsylvania hereinafter referred to as the trustor and the trustee form

- Forming an llc in south carolina findlaw state laws

- Revocable living trust and is created in accordance with section 62 7101 et form

- Sdlrc codified law 47 sd legislature form

Find out other kmdc surety form

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF