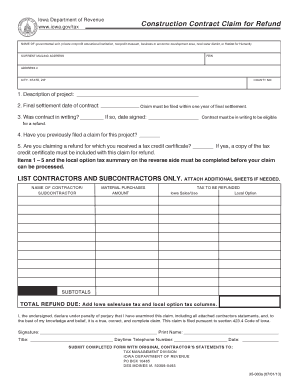

Opwa Department of Revenue Form 35 003a

What is the Opwa Department Of Revenue Form 35 003a

The Opwa Department of Revenue Form 35 003a is a specific document used for various tax-related purposes within the state. This form is essential for individuals and businesses to report certain financial information accurately. It serves as a means for the state to collect necessary data for tax assessment and compliance. Understanding the purpose and requirements of this form is crucial for ensuring proper filing and adherence to state regulations.

How to use the Opwa Department Of Revenue Form 35 003a

Using the Opwa Department of Revenue Form 35 003a involves several steps to ensure accurate completion. First, gather all relevant financial documents and information that will be needed to fill out the form. Next, carefully read the instructions provided with the form to understand each section's requirements. After filling out the form, review it thoroughly for any errors or omissions before submission. This process helps ensure compliance with state tax laws and minimizes the risk of penalties.

Steps to complete the Opwa Department Of Revenue Form 35 003a

Completing the Opwa Department of Revenue Form 35 003a requires attention to detail. Follow these steps:

- Obtain the form from the official state website or other authorized sources.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide the necessary financial details as required, ensuring accuracy.

- Review all entries for completeness and correctness.

- Sign and date the form to validate your submission.

Legal use of the Opwa Department Of Revenue Form 35 003a

The legal use of the Opwa Department of Revenue Form 35 003a is governed by state tax laws. To be considered valid, the form must be filled out accurately and submitted within the prescribed deadlines. Electronic signatures are accepted, provided they comply with the legal standards set forth by the state. Ensuring compliance with these regulations is essential for the form to hold legal weight in any tax-related matters.

Key elements of the Opwa Department Of Revenue Form 35 003a

Key elements of the Opwa Department of Revenue Form 35 003a include:

- Taxpayer identification details.

- Financial reporting sections relevant to the specific tax obligations.

- Signature and date fields for validation.

- Instructions for filing and submission methods.

Form Submission Methods

The Opwa Department of Revenue Form 35 003a can be submitted through various methods. Taxpayers have the option to file the form online, which is often the fastest and most efficient method. Alternatively, the form can be mailed to the appropriate state department or submitted in person at designated offices. Each submission method has its own guidelines and deadlines, which should be adhered to for successful filing.

Quick guide on how to complete opwa department of revenue form 35 003a

Complete Opwa Department Of Revenue Form 35 003a seamlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Opwa Department Of Revenue Form 35 003a on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and electronically sign Opwa Department Of Revenue Form 35 003a effortlessly

- Locate Opwa Department Of Revenue Form 35 003a and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to preserve your changes.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searching, or errors that require printing additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Opwa Department Of Revenue Form 35 003a to ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the opwa department of revenue form 35 003a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a form 35 PDF?

A form 35 PDF is a specific document format used for various official submissions and transactions. It typically requires digital signatures and approvals to ensure authenticity. Using airSlate SignNow, you can easily create and manage your form 35 PDF, making the process efficient and streamlined.

-

How can I eSign a form 35 PDF using airSlate SignNow?

To eSign a form 35 PDF with airSlate SignNow, upload the PDF to our platform, and use our intuitive eSignature tools. You can add your signature, initials, and any necessary fields before sending it to others for their signatures. This way, you ensure that your form 35 PDF is signed securely and quickly.

-

Is there a cost associated with using airSlate SignNow for form 35 PDFs?

Yes, airSlate SignNow offers flexible pricing plans tailored to different business needs. You can choose the plan that best fits your requirements when handling form 35 PDFs. Our cost-effective solution ensures you get the most value for your digital signature needs.

-

What are the benefits of using airSlate SignNow for form 35 PDFs?

Using airSlate SignNow for your form 35 PDFs provides numerous benefits, including enhanced security and faster turnaround times. It allows for easy collaboration, eliminating the hassle of paperwork. Plus, our platform is user-friendly, making it accessible for everyone.

-

Can I integrate airSlate SignNow with other applications for form 35 PDFs?

Absolutely! airSlate SignNow offers seamless integration options with various applications, enhancing your workflow for handling form 35 PDFs. You can sync data, automate document management, and streamline your processes across platforms with just a few clicks.

-

Are my documents safe when signing a form 35 PDF with airSlate SignNow?

Yes, your documents are secure when using airSlate SignNow. We implement strong encryption and authentication measures to protect your sensitive information while signing form 35 PDFs. Your data integrity and confidentiality are our top priorities.

-

Can I track the status of my form 35 PDF after sending it for signature?

Yes, you can easily track the status of your form 35 PDF after sending it for signatures. airSlate SignNow provides real-time updates on the document's progress, so you are always informed about who has signed and who still needs to sign.

Get more for Opwa Department Of Revenue Form 35 003a

- Terms of registration waiver hockey north america form

- Va form 21 0960g 1 esophageal abnormalities disability benefits questionnaire

- Wcpss email form

- Suddenlink buyout form

- Preschool re enrollment form dom christian

- Referral form affinity womens health

- Patient assistance form

- Lease car agreement template form

Find out other Opwa Department Of Revenue Form 35 003a

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online