Il Dept of Revenue Form

What is the Il Dept Of Revenue Form

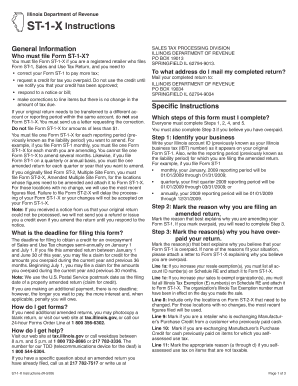

The Il Dept Of Revenue Form is an official document used by residents of Illinois for various tax-related purposes. This form is essential for reporting income, claiming deductions, and ensuring compliance with state tax laws. It serves as a means for individuals and businesses to communicate their financial information to the Illinois Department of Revenue, facilitating the accurate assessment of tax liabilities.

How to use the Il Dept Of Revenue Form

Using the Il Dept Of Revenue Form involves several key steps. First, identify the specific purpose of the form, such as income reporting or tax credits. Next, gather all necessary financial documents, including W-2s, 1099s, and any relevant receipts. Carefully fill out the form, ensuring that all information is accurate and complete. Finally, submit the form according to the instructions provided, whether online, by mail, or in person.

Steps to complete the Il Dept Of Revenue Form

Completing the Il Dept Of Revenue Form requires a systematic approach:

- Review the form instructions thoroughly to understand the requirements.

- Collect all necessary documentation, such as income statements and deduction records.

- Fill out the form accurately, ensuring that all sections are completed as required.

- Double-check your entries for accuracy, particularly Social Security numbers and financial figures.

- Sign and date the form before submission.

Legal use of the Il Dept Of Revenue Form

The Il Dept Of Revenue Form is legally binding when filled out correctly and submitted according to state regulations. It must be completed with truthful information, as providing false information can lead to penalties, including fines or legal action. Understanding the legal implications of the form ensures compliance with Illinois tax laws and helps avoid potential issues with the Department of Revenue.

Required Documents

To complete the Il Dept Of Revenue Form, several documents are typically required:

- W-2 forms from employers to report wages.

- 1099 forms for reporting other income sources.

- Receipts for deductible expenses, if applicable.

- Previous year’s tax return for reference.

Form Submission Methods

The Il Dept Of Revenue Form can be submitted through various methods, providing flexibility for taxpayers:

- Online submission via the Illinois Department of Revenue website.

- Mailing the completed form to the appropriate address provided in the instructions.

- In-person submission at designated state offices.

Penalties for Non-Compliance

Failing to comply with the requirements of the Il Dept Of Revenue Form can result in several penalties. These may include monetary fines, interest on unpaid taxes, and potential legal actions. It is crucial to adhere to filing deadlines and ensure that all information is accurate to avoid these consequences.

Quick guide on how to complete il dept of revenue form

Complete Il Dept Of Revenue Form effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily access the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without any hold-ups. Manage Il Dept Of Revenue Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

The easiest way to modify and eSign Il Dept Of Revenue Form with minimal effort

- Locate Il Dept Of Revenue Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of your documents or redact sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Il Dept Of Revenue Form to ensure outstanding communication at every phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the il dept of revenue form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Il Dept Of Revenue Form and who needs it?

The Il Dept Of Revenue Form is a crucial document for businesses and individuals in Illinois who need to report their taxes accurately. It is designed to streamline the tax filing process, making it easier for taxpayers to comply with state regulations. If you are conducting business or earning income in Illinois, you may need to fill out this form.

-

How does airSlate SignNow simplify the process of completing the Il Dept Of Revenue Form?

airSlate SignNow provides a user-friendly interface that allows you to easily fill out the Il Dept Of Revenue Form electronically. With features like templates and drag-and-drop functionality, users can quickly create and customize forms to meet their specific needs. This reduces the time and hassle typically associated with paper forms.

-

Can I eSign the Il Dept Of Revenue Form using airSlate SignNow?

Yes, airSlate SignNow allows you to eSign the Il Dept Of Revenue Form securely online. Our platform ensures that each eSignature is legally binding and compliant with regulations, which simplifies the submission process signNowly. This feature saves time and improves the overall efficiency of tax filing.

-

What are the pricing options for airSlate SignNow when using it for the Il Dept Of Revenue Form?

airSlate SignNow offers competitive pricing plans tailored for various user needs, including small businesses and enterprises. You can choose a plan that best fits your requirements for eSigning and sending documents like the Il Dept Of Revenue Form. Monthly and annual subscriptions are available, providing flexibility in costs.

-

Does airSlate SignNow integrate with other software for managing the Il Dept Of Revenue Form?

Absolutely! airSlate SignNow integrates seamlessly with a variety of popular software solutions, allowing you to manage the Il Dept Of Revenue Form alongside your existing tools. This integration enhances your workflow and helps maintain efficiency in processing your documents and tax forms.

-

What are the benefits of using airSlate SignNow for the Il Dept Of Revenue Form?

Using airSlate SignNow for the Il Dept Of Revenue Form enhances compliance, reduces paperwork, and speeds up the submission process. Our platform also ensures that your documents are stored securely and confidentially. Additionally, users benefit from real-time tracking of document status, which keeps everyone informed throughout the process.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning processes for the Il Dept Of Revenue Form?

Yes, airSlate SignNow is designed to be intuitive and user-friendly, even for those unfamiliar with eSigning processes. Comprehensive guides and support are available to assist users in completing the Il Dept Of Revenue Form with ease. Our platform's straightforward navigation minimizes the learning curve.

Get more for Il Dept Of Revenue Form

- Sa100 form

- Human resources franklin county ohio franklincountyohio form

- Medicaid application state of north dakota coverageforall form

- Bridgeway rehabilitation services referral form

- Office sublease agreement template form

- Official lease agreement template form

- Office space sublease agreement template form

- One page lease agreement template form

Find out other Il Dept Of Revenue Form

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT