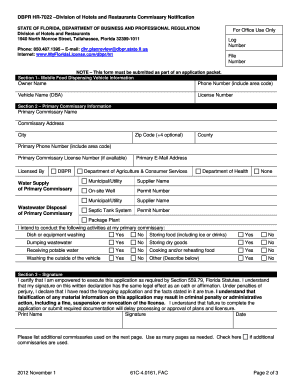

Form 7022

What is the Form 7022

The Form 7022 is a document used primarily for tax purposes in the United States. It serves as a declaration or request that must be filled out by individuals or businesses when specific tax-related information is required. Understanding the purpose of the form is essential for ensuring compliance with IRS regulations.

How to use the Form 7022

Using the Form 7022 involves several steps. First, determine the specific requirements for your situation, as the form may vary based on individual or business needs. Next, gather all necessary information, such as identification numbers and relevant financial details. Once you have completed the form, review it for accuracy before submission. This ensures that all provided information is correct and up to date.

Steps to complete the Form 7022

Completing the Form 7022 can be broken down into clear steps:

- Review the instructions provided with the form to understand what information is needed.

- Fill in your personal or business details accurately, including names, addresses, and identification numbers.

- Provide any required financial information, ensuring it aligns with your records.

- Double-check all entries for accuracy and completeness.

- Sign and date the form as required.

Legal use of the Form 7022

The legal use of the Form 7022 is crucial for ensuring that all submitted information is valid and compliant with IRS guidelines. When properly completed and submitted, the form can serve as an official record for tax purposes. It is important to adhere to legal requirements, as any discrepancies may lead to penalties or issues with tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the Form 7022 can vary based on the specific tax year and the nature of the information being reported. Typically, it is essential to submit the form by the designated due date to avoid penalties. Keeping track of important dates related to tax filings will help ensure compliance and prevent unnecessary complications.

Required Documents

When preparing to complete the Form 7022, certain documents may be required. These can include:

- Identification documents, such as Social Security numbers or Employer Identification Numbers.

- Financial records relevant to the information being reported.

- Previous tax returns, if applicable, to ensure consistency and accuracy.

Who Issues the Form

The Form 7022 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. It is important to use the official version of the form provided by the IRS to ensure compliance with current tax regulations.

Quick guide on how to complete form 7022

Effortlessly Prepare Form 7022 on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, enabling you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without unnecessary delays. Handle Form 7022 seamlessly on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Alter and eSign Form 7022 with Ease

- Locate Form 7022 and then click Get Form to begin.

- Use the tools provided to fill out your document.

- Emphasize important sections of the documents or redact sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating searches for forms, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs with just a few clicks from any device. Adjust and eSign Form 7022 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 7022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 7022 and why is it important?

The form 7022 is a crucial document used for [specific purpose]. It ensures accurate data collection and compliance with regulations. Understanding how to use it effectively can streamline your processes and save time.

-

How can airSlate SignNow help with filling out the form 7022?

airSlate SignNow provides an intuitive platform that makes filling out the form 7022 straightforward. You can easily upload, edit, and send the form for eSignature, ensuring that your documents are processed quickly and efficiently.

-

What are the pricing options for using airSlate SignNow for form 7022?

airSlate SignNow offers flexible pricing plans that cater to a variety of business needs. Whether you are a small business or a large enterprise, you can select a plan that suits your usage of the form 7022 without breaking the bank.

-

What features does airSlate SignNow offer for managing the form 7022?

airSlate SignNow includes features like document templates, real-time collaboration, and secure storage, all designed to simplify your management of the form 7022. These tools enhance productivity and ensure your team can work together effectively.

-

Can I integrate airSlate SignNow with other applications to manage form 7022?

Yes, airSlate SignNow seamlessly integrates with numerous applications to enhance the management of the form 7022. You can connect it with tools like Google Drive, Salesforce, and more, making your workflow fluent and efficient.

-

Is airSlate SignNow mobile-friendly for managing form 7022?

Absolutely! airSlate SignNow is fully optimized for mobile use, allowing you to manage the form 7022 anytime and anywhere. This flexibility ensures that you can eSign documents and track progress on the go.

-

How does airSlate SignNow ensure the security of my form 7022?

Security is a top priority at airSlate SignNow. The platform uses state-of-the-art encryption and secure access controls to protect your form 7022, ensuring that sensitive information remains confidential and safe from unauthorized access.

Get more for Form 7022

Find out other Form 7022

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online