Prudential Withdrawal Online 2013-2026

What is the Prudential Withdrawal Online

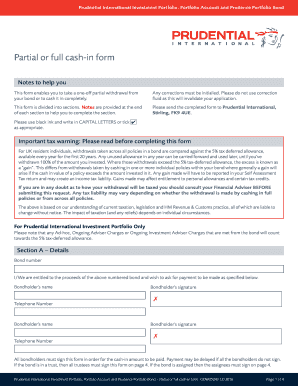

The Prudential withdrawal online refers to the digital process of submitting a request for withdrawal from a Prudential investment bond. This service allows policyholders to access their funds conveniently from anywhere, eliminating the need for physical paperwork. The online platform is designed to streamline the withdrawal process, making it more efficient and user-friendly.

Steps to complete the Prudential Withdrawal Online

Completing the Prudential withdrawal online involves several straightforward steps:

- Log in to your Prudential account using your credentials.

- Navigate to the withdrawal section of your account dashboard.

- Select the type of withdrawal you wish to make, such as a full or partial withdrawal.

- Fill out the Prudential bond withdrawal form with the required information, including your policy number and the amount to withdraw.

- Review the details for accuracy and submit the form electronically.

Once submitted, you will receive a confirmation of your request, and the processing time will vary based on the specifics of your withdrawal.

Legal use of the Prudential Withdrawal Online

The Prudential withdrawal online is legally binding when completed in accordance with applicable regulations. Digital signatures are recognized under the ESIGN Act and UETA, ensuring that your electronically submitted form holds the same legal weight as a traditional paper document. It is essential to ensure that all required fields are filled out accurately to avoid any issues with processing your withdrawal.

Required Documents

To successfully complete the Prudential withdrawal online, you may need to provide specific documentation, including:

- Your Prudential policy number.

- Identification verification, such as a driver's license or Social Security number.

- Any additional documents requested by Prudential based on your withdrawal type.

Having these documents ready can facilitate a smoother withdrawal process.

Form Submission Methods

The Prudential bond withdrawal form can be submitted through various methods, including:

- Online via the Prudential website, which is the most efficient option.

- By mail, if you prefer to send a physical copy of the completed form.

- In-person at a Prudential office, where assistance can be provided if needed.

Choosing the online submission method typically results in faster processing times.

Eligibility Criteria

Eligibility for making a withdrawal using the Prudential withdrawal online generally includes:

- Having an active Prudential investment bond policy.

- Meeting any specific requirements outlined in your policy regarding withdrawals.

- Being of legal age to authorize the transaction.

It is advisable to review your policy details to ensure compliance with all eligibility criteria before initiating a withdrawal.

Quick guide on how to complete prudential withdrawal online

Complete Prudential Withdrawal Online effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the required form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Prudential Withdrawal Online on any device with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The easiest method to edit and eSign Prudential Withdrawal Online with ease

- Obtain Prudential Withdrawal Online and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign Prudential Withdrawal Online and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the prudential withdrawal online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a prudential withdrawal form?

The prudential withdrawal form is a document used to request a withdrawal from your Prudential life insurance or annuity account. This form allows policyholders to specify the amount they wish to withdraw and ensure proper processing of their request. Completing this form accurately is crucial for timely access to your funds.

-

How can I obtain a prudential withdrawal form?

You can obtain a prudential withdrawal form directly from the Prudential website or by contacting their customer service. Additionally, financial advisors may provide the necessary forms to their clients. Once you have the form, you can easily fill it out and submit it through the appropriate channels.

-

What are the fees associated with using the prudential withdrawal form?

There are typically no fees associated with submitting a prudential withdrawal form; however, processing times may vary depending on the type of account. Be sure to review your policy terms or contact customer service for any potential fees linked to withdrawals. Understanding these aspects will help you plan your finances effectively.

-

Can I eSign my prudential withdrawal form with airSlate SignNow?

Yes, airSlate SignNow allows you to easily eSign your prudential withdrawal form online. This convenient feature streamlines the process of submitting your document, saving you time and ensuring it's processed securely. With airSlate, you can manage all your document signing needs from one platform.

-

What are the benefits of using airSlate SignNow for my prudential withdrawal form?

Using airSlate SignNow for your prudential withdrawal form provides a user-friendly experience and enhances document security. You can track the status of your form, receive notifications, and access it from any device. These features make the submission process efficient and stress-free.

-

How long does it take to process a prudential withdrawal form?

The processing time for a prudential withdrawal form can vary based on several factors but is typically processed within 7-10 business days. Ensuring all information on the form is accurately provided will help avoid delays. For urgent requests, contact Prudential's support for assistance.

-

Are there integrations available for managing prudential withdrawal forms?

Yes, airSlate SignNow offers various integrations that can enhance how you manage prudential withdrawal forms. You can connect with CRM systems and other document management tools to streamline your workflow. These integrations provide a comprehensive solution for handling financial documentation efficiently.

Get more for Prudential Withdrawal Online

Find out other Prudential Withdrawal Online

- eSign California Sublease Agreement Template Safe

- How To eSign Colorado Sublease Agreement Template

- How Do I eSign Colorado Sublease Agreement Template

- eSign Florida Sublease Agreement Template Free

- How Do I eSign Hawaii Lodger Agreement Template

- eSign Arkansas Storage Rental Agreement Now

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application