Instructions to Cash in Childrens Bonds 2023-2026

Understanding Children's Bonds

Children's bonds, often referred to as U.S. savings bonds, are government-backed securities designed to encourage saving among families. These bonds can be purchased for minors and are a popular way to save for future expenses, such as education. The most common types include Series EE and Series I bonds, which earn interest over time and can be cashed in when the child reaches a certain age or for specific purposes. Knowing how to cash in these bonds is essential for parents or guardians managing these investments.

Steps to Cash In Children's Bonds

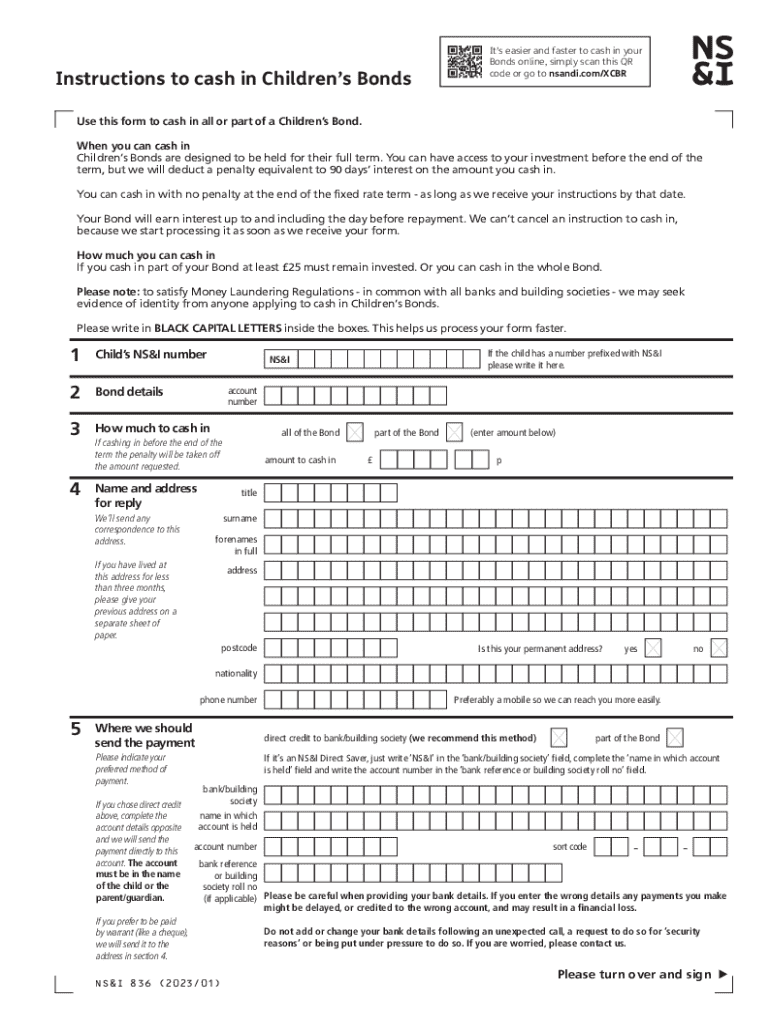

Cashing in children's bonds involves a straightforward process. Here are the essential steps:

- Determine the type of bond you hold, as the cashing process may vary slightly between Series EE and Series I bonds.

- Gather necessary documentation, including the bonds themselves, proof of identity, and any required forms.

- Visit a financial institution, such as a bank or credit union, that processes savings bonds. Some institutions may require an appointment.

- Complete any required forms provided by the bank, which may include a request to cash the bonds.

- Submit the bonds and documentation to the bank representative for processing.

Required Documents for Cashing In

To successfully cash in children's bonds, you will need to prepare specific documents. These typically include:

- The physical savings bonds you wish to cash.

- Proof of identity, such as a government-issued photo ID.

- Documentation proving your relationship to the child, if applicable, such as a birth certificate or adoption papers.

Having these documents ready can streamline the process and ensure a smooth transaction.

Legal Considerations for Cashing In

When cashing in children's bonds, it's important to understand the legal implications. Generally, the bonds must be cashed by the owner or a designated guardian. If the child is under eighteen, a parent or legal guardian typically handles the transaction. Additionally, be aware of any tax implications, as interest earned on savings bonds may be subject to federal income tax. However, if used for qualified education expenses, there may be tax exemptions available.

Form Submission Methods

Cashing in children's bonds can be done through various methods. The most common approach is in-person at a financial institution. However, some bonds can also be cashed online through the U.S. Department of the Treasury's website if they are held in a TreasuryDirect account. It is advisable to check the specific requirements for each method to ensure compliance with all necessary regulations.

Eligibility Criteria for Cashing In

Eligibility to cash in children's bonds typically depends on the ownership of the bonds. If the bonds are registered in the child's name, a parent or guardian must act on their behalf until they reach the age of majority. Additionally, the bonds must be fully matured to be cashed. Series EE bonds, for instance, reach full maturity after twenty years, while Series I bonds may have different terms.

Create this form in 5 minutes or less

Find and fill out the correct instructions to cash in childrens bonds

Create this form in 5 minutes!

How to create an eSignature for the instructions to cash in childrens bonds

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the basic Instructions To Cash In Childrens Bonds?

To cash in children's bonds, you need to gather the necessary documentation, including the bonds themselves and identification. Follow the specific instructions provided by the issuing authority, which typically involves filling out a form and submitting it either online or in person. Ensure you understand the tax implications of cashing in these bonds.

-

Are there any fees associated with cashing in children's bonds?

Generally, there are no fees for cashing in children's bonds directly through the U.S. Treasury. However, if you choose to use a third-party service, there may be associated costs. Always check the terms and conditions to understand any potential fees involved in the process.

-

What benefits do I gain from following the Instructions To Cash In Childrens Bonds?

Following the Instructions To Cash In Childrens Bonds ensures that you complete the process correctly and efficiently. This can help you avoid delays and potential issues with your cashing request. Additionally, understanding these instructions can maximize the financial benefits of the bonds.

-

Can I cash in children's bonds online?

Yes, you can cash in children's bonds online through the U.S. Treasury's website if you have a TreasuryDirect account. The online process is straightforward and follows the Instructions To Cash In Childrens Bonds provided on the site. Make sure to have all necessary information ready for a smooth transaction.

-

What documents do I need to cash in children's bonds?

To cash in children's bonds, you typically need the bonds themselves, proof of identity, and possibly a Social Security number. Depending on the method you choose, additional documentation may be required. Always refer to the Instructions To Cash In Childrens Bonds for a complete list of necessary documents.

-

How long does it take to cash in children's bonds?

The time it takes to cash in children's bonds can vary based on the method used. If you follow the Instructions To Cash In Childrens Bonds and submit your request online, it may be processed faster than through traditional mail. Generally, expect a few days to a couple of weeks for the transaction to complete.

-

What should I do if I lost my children's bonds?

If you have lost your children's bonds, you can apply for a replacement through the U.S. Treasury. You'll need to complete a specific form and provide details about the bonds. Following the Instructions To Cash In Childrens Bonds will guide you through the replacement process effectively.

Get more for Instructions To Cash In Childrens Bonds

- Alaskas unemployment insurance ui claim assistance form

- Request for certification home health services form bcbsal

- Vitals form

- Forms arkansas blue cross and blue shield

- 508c subscriber health care claim form update go 568

- Thank you for your interest in delta dental of arkansas form

- Banner diabetes education referral form

- Credentialing alliance facility credentialing and recredentialing application facility credentialing application form

Find out other Instructions To Cash In Childrens Bonds

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney