Loan Repayment Letter Friend Form

What is the loan repayment letter?

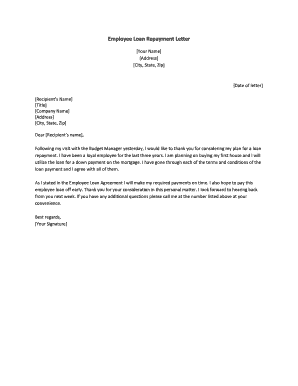

A loan repayment letter serves as a formal document between a borrower and a lender, confirming the terms and conditions of repaying a loan. This letter outlines the repayment schedule, including the amount due, the due dates, and any applicable interest rates. It is essential for both parties to have a clear understanding of their obligations and rights regarding the loan. The letter can also serve as proof of repayment in case of disputes or misunderstandings.

Key elements of the loan repayment letter

When drafting a loan repayment letter, several key elements should be included to ensure clarity and legality:

- Borrower and lender information: Include the full names and addresses of both parties.

- Loan details: Specify the loan amount, interest rate, and original loan agreement date.

- Repayment schedule: Clearly outline the repayment terms, including the amount of each payment and the due dates.

- Payment methods: Indicate acceptable methods for making payments, such as bank transfers or checks.

- Signatures: Both parties should sign the letter to validate the agreement.

Steps to complete the loan repayment letter

Completing a loan repayment letter involves a few straightforward steps:

- Gather information: Collect all necessary details about the loan, including the original agreement and payment history.

- Draft the letter: Use a clear and professional tone to outline the key elements discussed above.

- Review the letter: Ensure all information is accurate and that both parties' rights and obligations are clearly stated.

- Sign the letter: Both the borrower and lender should sign the document to make it legally binding.

- Distribute copies: Provide a copy of the signed letter to both parties for their records.

Legal use of the loan repayment letter

The loan repayment letter is legally binding when it meets specific criteria, such as being signed by both parties and containing all necessary details. In the United States, eSignatures are recognized under the ESIGN Act and UETA, making electronic versions of the letter equally valid. It is important to ensure that the letter complies with state laws regarding loan agreements and repayment terms.

Examples of using the loan repayment letter

Loan repayment letters can be used in various scenarios, such as:

- A personal loan between friends or family members to formalize repayment terms.

- A business loan agreement between a small business owner and a bank.

- A student loan repayment arrangement with a financial institution.

In each case, the letter serves to clarify the expectations and responsibilities of both parties, reducing the likelihood of disputes.

Digital vs. paper version of the loan repayment letter

Both digital and paper versions of the loan repayment letter are valid, but each has its advantages. Digital letters can be signed electronically, making the process faster and more efficient. They also allow for easier storage and retrieval. On the other hand, paper letters may be preferred for those who feel more comfortable with physical documents. Regardless of the format, it is essential to ensure that the letter is properly signed and stored securely.

Quick guide on how to complete loan repayment letter friend

Easily prepare Loan Repayment Letter Friend on any device

Managing documents online has gained popularity among businesses and individuals. It serves as a superb eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents promptly without delays. Handle Loan Repayment Letter Friend on any platform using airSlate SignNow's Android or iOS applications and streamline any document-based task today.

The easiest way to modify and eSign Loan Repayment Letter Friend effortlessly

- Find Loan Repayment Letter Friend and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or obscure sensitive information with features specifically offered by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your preference. Edit and eSign Loan Repayment Letter Friend to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the loan repayment letter friend

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a loan repayment letter?

A loan repayment letter is a formal document that outlines the repayment terms and conditions of a loan. It serves as a record for both the lender and borrower detailing the amount owed, payment schedule, and any other pertinent details. Using airSlate SignNow, you can easily create, send, and eSign your loan repayment letter to ensure a smooth process.

-

How can airSlate SignNow help me create a loan repayment letter?

airSlate SignNow offers a user-friendly platform that allows you to create customized loan repayment letters quickly. With pre-built templates and an easy editing interface, you can insert necessary details and tailor the document to your specific needs. Plus, eSigning features ensure that all parties can sign the loan repayment letter seamlessly.

-

Is airSlate SignNow affordable for creating loan repayment letters?

Yes, airSlate SignNow provides a cost-effective solution for creating loan repayment letters. With flexible pricing plans, you can choose one that suits your business needs and budget. This affordability ensures that you can efficiently manage your loan documentation without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for loan repayment letters?

Absolutely! airSlate SignNow integrates with various applications to enhance your document management process, including CRMs and accounting software. This means you can automate and streamline the creation and management of your loan repayment letters directly within your existing workflows.

-

What are the benefits of using airSlate SignNow for loan repayment letters?

Using airSlate SignNow for your loan repayment letters provides several benefits, including ease of use, time savings, and enhanced security. The platform enables you to quickly send documents for signature and track their status in real-time. Additionally, your loan repayment letters are stored securely, ensuring compliance and peace of mind.

-

Can loan repayment letters be sent internationally using airSlate SignNow?

Yes, loan repayment letters can be sent internationally using airSlate SignNow, making it perfect for global business transactions. The platform allows you to send documents to recipients across the world, and they can eSign from anywhere at any time. This flexibility is crucial for businesses that operate across borders.

-

What types of loan repayment letters can I create with airSlate SignNow?

With airSlate SignNow, you can create various types of loan repayment letters, including personal, student, and business loan repayment letters. The platform offers customizable templates that can address specific loan types and unique conditions. This versatility ensures you have the right documentation for any situation.

Get more for Loan Repayment Letter Friend

Find out other Loan Repayment Letter Friend

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form