State of Illinois Blank Form Ptax 762

What is the State of Illinois Blank Form PTAX 762

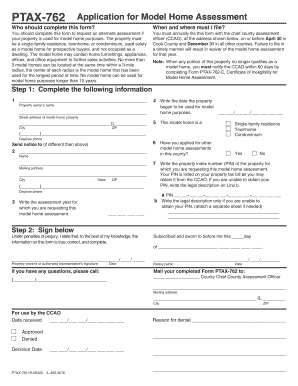

The State of Illinois Blank Form PTAX 762 is a property tax exemption application designed for homeowners in Illinois. This form allows eligible individuals to apply for various property tax exemptions, which can significantly reduce their property tax burden. The form is essential for those seeking to benefit from exemptions such as the General Homestead Exemption or the Disabled Persons' Homestead Exemption. Proper completion of this form is crucial to ensure that the application is processed efficiently and accurately.

How to Obtain the State of Illinois Blank Form PTAX 762

To obtain the State of Illinois Blank Form PTAX 762, individuals can visit the official Illinois Department of Revenue website. The form is typically available for download in PDF format, allowing users to print it for completion. Additionally, local county assessor offices may provide physical copies of the form. It is advisable to ensure that you are using the most current version of the form to avoid any issues during the application process.

Steps to Complete the State of Illinois Blank Form PTAX 762

Completing the State of Illinois Blank Form PTAX 762 involves several key steps:

- Gather necessary information, including property details and personal identification.

- Fill out the form accurately, ensuring all required fields are completed.

- Attach any supporting documentation that may be required, such as proof of residency or disability.

- Review the completed form for accuracy before submission.

- Submit the form to the appropriate local assessor's office by the designated deadline.

Legal Use of the State of Illinois Blank Form PTAX 762

The legal use of the State of Illinois Blank Form PTAX 762 is governed by state laws regarding property tax exemptions. When completed and submitted correctly, the form serves as a formal request for property tax relief. It is important to understand that providing false information on the form can lead to penalties, including denial of the exemption and potential fines. Therefore, ensuring the accuracy and truthfulness of the information provided is essential.

Key Elements of the State of Illinois Blank Form PTAX 762

Key elements of the State of Illinois Blank Form PTAX 762 include:

- Property identification details, including the property address and parcel number.

- Applicant's personal information, such as name and contact details.

- Specific exemption types being applied for, which may vary based on eligibility.

- Signature and date fields to verify the authenticity of the application.

Form Submission Methods

The State of Illinois Blank Form PTAX 762 can be submitted through various methods:

- By mail: Send the completed form to the local county assessor's office.

- In-person: Deliver the form directly to the assessor's office during business hours.

- Online: Some counties may offer electronic submission options through their websites.

Quick guide on how to complete state of illinois blank form ptax 762

Effortlessly prepare State Of Illinois Blank Form Ptax 762 on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides all the features necessary to create, modify, and electronically sign your documents promptly without any hold-ups. Handle State Of Illinois Blank Form Ptax 762 on any device using airSlate SignNow's Android or iOS applications and enhance your document-driven workflows today.

How to modify and electronically sign State Of Illinois Blank Form Ptax 762 effortlessly

- Find State Of Illinois Blank Form Ptax 762 and click on Get Form to begin.

- Take advantage of the tools we offer to complete your form.

- Mark important sections of your documents or redact confidential information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Put aside concerns about lost or mislaid files, tedious form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow meets all your document management needs within a few clicks from any device you choose. Modify and electronically sign State Of Illinois Blank Form Ptax 762 and ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of illinois blank form ptax 762

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the state of Illinois blank form ptax 762?

The state of Illinois blank form ptax 762 is an official document used for property tax assessment appeals. This form helps property owners contest the assessed value of their properties. By utilizing the state of Illinois blank form ptax 762, users can potentially lower their tax liabilities.

-

How can airSlate SignNow assist me in completing the state of Illinois blank form ptax 762?

AirSlate SignNow provides an intuitive platform for filling out the state of Illinois blank form ptax 762 electronically. Users can easily input their information, sign, and send the document securely. This streamlines the process and eliminates the need for paper forms.

-

Are there any costs associated with using airSlate SignNow for the state of Illinois blank form ptax 762?

AirSlate SignNow offers various pricing plans to accommodate different needs, including features to fill out the state of Illinois blank form ptax 762. There are options for businesses of all sizes, and many users find it to be a cost-effective solution for managing their documents.

-

Can I integrate airSlate SignNow with other applications to manage the state of Illinois blank form ptax 762?

Yes, airSlate SignNow integrates seamlessly with various applications and services. This allows you to manage your documents, including the state of Illinois blank form ptax 762, more efficiently by connecting with your existing workflows and tools.

-

What are the benefits of using airSlate SignNow for the state of Illinois blank form ptax 762?

Using airSlate SignNow for the state of Illinois blank form ptax 762 offers numerous benefits, including ease of use, fast document turnaround times, and secure signing. This platform ensures that your forms are processed quickly and accurately, saving you time and reducing paperwork.

-

Is it safe to use airSlate SignNow for the state of Illinois blank form ptax 762?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that your documents, including the state of Illinois blank form ptax 762, are handled safely. With encryption and secure storage, you can trust that your sensitive information remains protected throughout the signing process.

-

How can I track the status of my state of Illinois blank form ptax 762 with airSlate SignNow?

AirSlate SignNow provides tools to track and manage all of your documents, including the state of Illinois blank form ptax 762. You can easily monitor who has signed it and whether any further actions are required, thus maintaining control of your paperwork.

Get more for State Of Illinois Blank Form Ptax 762

- Word form math

- State of alaska vpn form

- Statement of surrender form roche surety and casualty

- File my dba online registration form

- Inter territorial movement permit for dogs and cats form

- Student information change form waubonsee community college waubonsee

- Los angeles fire department bureau of fire prevent form

- Translation contract template form

Find out other State Of Illinois Blank Form Ptax 762

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form