Morgan Stanley Ira Distribution Form 2013

What is the Morgan Stanley IRA Distribution Form

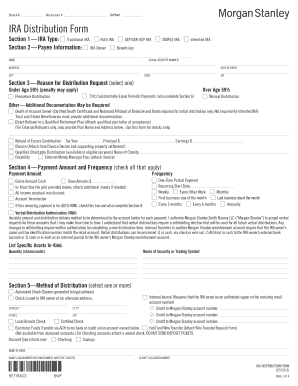

The Morgan Stanley IRA Distribution Form is a crucial document used by individuals to request distributions from their Individual Retirement Accounts (IRAs). This form is essential for managing retirement funds, allowing account holders to withdraw money for various purposes, such as retirement income, unexpected expenses, or other financial needs. By completing this form, individuals can specify the amount they wish to withdraw and the method of distribution, ensuring compliance with IRS regulations.

How to use the Morgan Stanley IRA Distribution Form

Using the Morgan Stanley IRA Distribution Form involves several straightforward steps. First, obtain the form from the Morgan Stanley website or through your financial advisor. Next, fill out the required sections, including personal information, account details, and the distribution amount. It is important to review the form for accuracy before submission. Once completed, the form can be submitted online, by mail, or in person at a Morgan Stanley branch, depending on your preference.

Steps to complete the Morgan Stanley IRA Distribution Form

To effectively complete the Morgan Stanley IRA Distribution Form, follow these steps:

- Download the form from the Morgan Stanley website or request it from your advisor.

- Provide your personal information, including your name, address, and Social Security number.

- Enter your account number and specify the type of IRA from which you are requesting a distribution.

- Indicate the amount you wish to withdraw and the reason for the distribution.

- Choose your preferred method of receiving the funds, such as a check or direct deposit.

- Sign and date the form, confirming that all information is accurate.

Key elements of the Morgan Stanley IRA Distribution Form

The Morgan Stanley IRA Distribution Form includes several key elements that are essential for processing your request. These elements typically consist of:

- Personal Information: This section requires your name, address, and Social Security number.

- Account Details: You must provide your IRA account number and specify the type of IRA.

- Distribution Amount: Clearly state the amount you wish to withdraw.

- Distribution Method: Choose how you would like to receive your funds.

- Signature: Your signature is required to authorize the distribution.

IRS Guidelines

When completing the Morgan Stanley IRA Distribution Form, it is important to adhere to IRS guidelines regarding withdrawals. The IRS imposes specific rules on the timing and amounts of distributions, particularly concerning penalties for early withdrawals. Individuals under the age of fifty-nine and a half may face a ten percent penalty on distributions unless they qualify for exceptions. Understanding these guidelines can help ensure compliance and avoid unnecessary penalties.

Form Submission Methods

The Morgan Stanley IRA Distribution Form can be submitted through various methods, providing flexibility based on individual preferences. The available submission methods include:

- Online Submission: Many users prefer to submit the form electronically through the Morgan Stanley client portal.

- Mail: You can print the completed form and send it to the designated address provided by Morgan Stanley.

- In-Person: Alternatively, visit a local Morgan Stanley branch to submit the form directly to a representative.

Create this form in 5 minutes or less

Find and fill out the correct morgan stanley ira distribution form 35147194

Create this form in 5 minutes!

How to create an eSignature for the morgan stanley ira distribution form 35147194

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Morgan Stanley Ira Distribution Form?

The Morgan Stanley Ira Distribution Form is a document used to request distributions from your IRA account held at Morgan Stanley. This form is essential for initiating withdrawals, ensuring compliance with IRS regulations, and managing your retirement funds effectively.

-

How can I obtain the Morgan Stanley Ira Distribution Form?

You can easily obtain the Morgan Stanley Ira Distribution Form by visiting the Morgan Stanley website or contacting your financial advisor. Additionally, airSlate SignNow provides a streamlined process for filling out and eSigning this form, making it convenient for users.

-

What are the benefits of using airSlate SignNow for the Morgan Stanley Ira Distribution Form?

Using airSlate SignNow for the Morgan Stanley Ira Distribution Form offers several benefits, including ease of use, cost-effectiveness, and secure eSigning capabilities. This platform allows you to complete and send your forms quickly, reducing the time spent on paperwork.

-

Is there a cost associated with using airSlate SignNow for the Morgan Stanley Ira Distribution Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides access to features that simplify the process of managing documents like the Morgan Stanley Ira Distribution Form.

-

Can I integrate airSlate SignNow with other applications for the Morgan Stanley Ira Distribution Form?

Absolutely! airSlate SignNow supports integrations with various applications, allowing you to streamline your workflow when handling the Morgan Stanley Ira Distribution Form. This integration capability enhances productivity and ensures a seamless experience.

-

What features does airSlate SignNow offer for managing the Morgan Stanley Ira Distribution Form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and real-time tracking for the Morgan Stanley Ira Distribution Form. These features help you manage your documents efficiently and ensure that all necessary steps are completed.

-

How does airSlate SignNow ensure the security of the Morgan Stanley Ira Distribution Form?

airSlate SignNow prioritizes security by implementing advanced encryption and compliance measures for documents like the Morgan Stanley Ira Distribution Form. This ensures that your sensitive information remains protected throughout the signing process.

Get more for Morgan Stanley Ira Distribution Form

Find out other Morgan Stanley Ira Distribution Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors