Ira Sep Roth Ira Distribution Form PDF 2024-2026

What is the Ira sep roth ira distribution form pdf

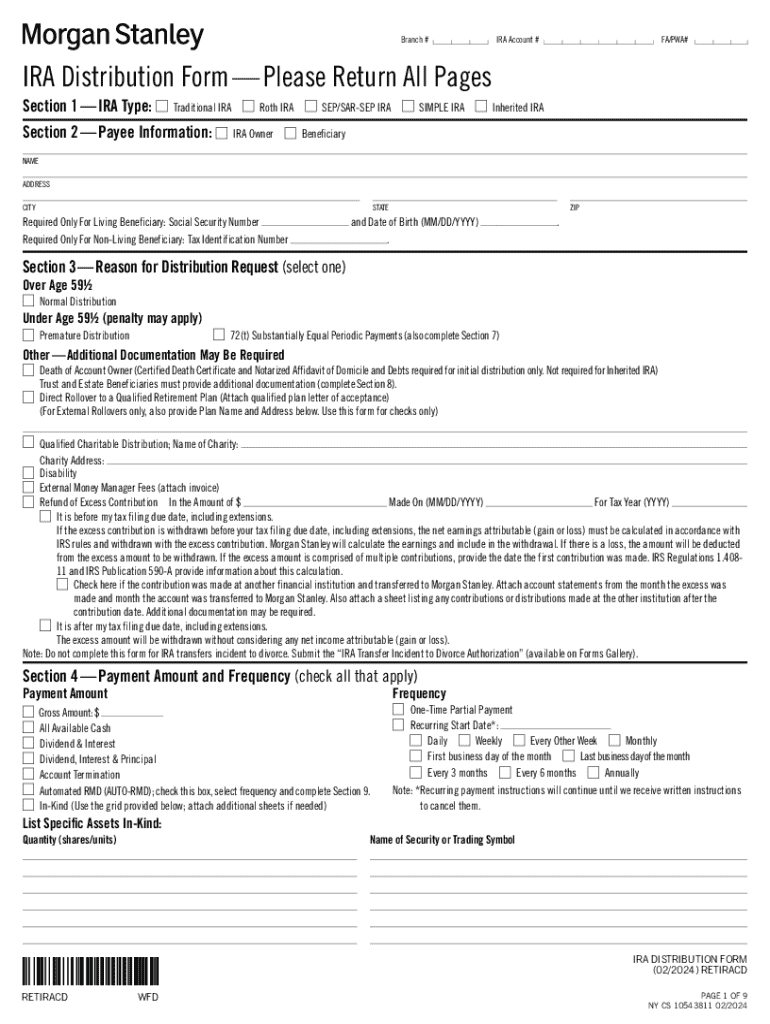

The Ira sep roth ira distribution form pdf is a document used by individuals to request distributions from their Simplified Employee Pension (SEP) or Roth Individual Retirement Accounts (IRAs). This form is essential for ensuring that withdrawals are processed correctly and in compliance with IRS regulations. It typically includes sections for personal information, account details, and the specific amount being withdrawn. Understanding this form is crucial for anyone looking to manage their retirement savings effectively.

How to use the Ira sep roth ira distribution form pdf

To use the Ira sep roth ira distribution form pdf, begin by downloading the form from a reliable source. Fill in your personal information, including your name, address, and Social Security number. Next, specify the type of account from which you are withdrawing funds, along with the amount you wish to distribute. It is important to review the form for accuracy before submitting it to ensure that there are no delays in processing your request.

Steps to complete the Ira sep roth ira distribution form pdf

Completing the Ira sep roth ira distribution form pdf involves several steps:

- Download the form and open it in a PDF viewer.

- Enter your personal and account information in the designated fields.

- Indicate the amount you wish to withdraw and the reason for the distribution.

- Sign and date the form to validate your request.

- Submit the completed form to your financial institution via mail, fax, or in person, as per their submission guidelines.

Legal use of the Ira sep roth ira distribution form pdf

The Ira sep roth ira distribution form pdf must be used in accordance with IRS regulations governing retirement account distributions. This includes adhering to rules regarding the timing and amount of distributions. Failure to comply with these legal requirements can result in penalties or tax implications. It is advisable to consult a tax professional or financial advisor if you have questions about the legal aspects of using this form.

Key elements of the Ira sep roth ira distribution form pdf

Key elements of the Ira sep roth ira distribution form pdf include:

- Personal Information: Name, address, and Social Security number.

- Account Information: Type of account and account number.

- Distribution Amount: The specific amount you wish to withdraw.

- Reason for Distribution: Explanation of why the funds are being withdrawn.

- Signature: Required to validate the request.

IRS Guidelines

The IRS provides guidelines for distributions from retirement accounts, including the Ira sep roth ira distribution form pdf. These guidelines outline eligibility criteria, tax implications, and deadlines for submitting distribution requests. It is important to familiarize yourself with these guidelines to ensure compliance and avoid potential penalties. Review the IRS website or consult a tax professional for the most current information regarding retirement account distributions.

Create this form in 5 minutes or less

Find and fill out the correct ira sep roth ira distribution form pdf

Create this form in 5 minutes!

How to create an eSignature for the ira sep roth ira distribution form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ira sep roth ira distribution form pdf?

The Ira sep roth ira distribution form pdf is a document used to request distributions from a SEP IRA or Roth IRA. This form ensures that the distribution process is compliant with IRS regulations and helps account holders manage their retirement funds effectively.

-

How can I obtain the Ira sep roth ira distribution form pdf?

You can easily obtain the Ira sep roth ira distribution form pdf by visiting the official IRS website or through your financial institution's website. Additionally, airSlate SignNow provides templates that can help you create and customize this form quickly.

-

Is there a cost associated with using the Ira sep roth ira distribution form pdf?

Using the Ira sep roth ira distribution form pdf itself is typically free, but there may be fees associated with processing the distribution through your financial institution. With airSlate SignNow, you can streamline the eSigning process at a cost-effective rate, ensuring you save time and money.

-

What features does airSlate SignNow offer for managing the Ira sep roth ira distribution form pdf?

airSlate SignNow offers features such as eSigning, document templates, and secure cloud storage for managing the Ira sep roth ira distribution form pdf. These features enhance efficiency and ensure that your documents are easily accessible and securely stored.

-

Can I integrate airSlate SignNow with other applications for the Ira sep roth ira distribution form pdf?

Yes, airSlate SignNow offers integrations with various applications, allowing you to manage the Ira sep roth ira distribution form pdf seamlessly. This includes popular tools like Google Drive, Dropbox, and CRM systems, enhancing your workflow.

-

What are the benefits of using airSlate SignNow for the Ira sep roth ira distribution form pdf?

Using airSlate SignNow for the Ira sep roth ira distribution form pdf provides numerous benefits, including faster processing times, reduced paperwork, and enhanced security. This solution empowers businesses to manage their documents efficiently while ensuring compliance with regulations.

-

How does airSlate SignNow ensure the security of the Ira sep roth ira distribution form pdf?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your Ira sep roth ira distribution form pdf. This ensures that your sensitive information remains confidential and secure throughout the signing process.

Get more for Ira sep roth ira distribution form pdf

Find out other Ira sep roth ira distribution form pdf

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed