Tpg 196 Form

What is the Tpg 196 Form

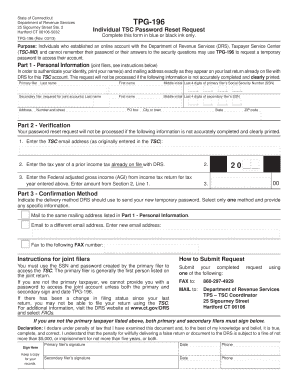

The Tpg 196 Form is a specific document used in the United States for tax purposes. It is primarily utilized by taxpayers to report certain financial information to the Internal Revenue Service (IRS). This form plays a crucial role in ensuring compliance with federal tax regulations and helps in the accurate assessment of tax liabilities. Understanding the purpose and requirements of the Tpg 196 Form is essential for individuals and businesses alike to avoid potential penalties and ensure proper reporting.

How to use the Tpg 196 Form

Using the Tpg 196 Form involves several key steps to ensure accurate completion and submission. First, gather all necessary financial documents, such as income statements and expense records. Next, fill out the form by providing the required information, including personal identification details and financial data. It is important to double-check all entries for accuracy before submission. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements set by the IRS.

Steps to complete the Tpg 196 Form

Completing the Tpg 196 Form involves a systematic approach:

- Gather Documentation: Collect all relevant financial records and documents.

- Fill Out the Form: Enter your personal information and financial details accurately.

- Review for Accuracy: Check all entries to ensure there are no mistakes.

- Submit the Form: Choose your submission method—online or by mail—and send the form to the appropriate IRS address.

Following these steps will help ensure that your Tpg 196 Form is completed correctly and submitted on time.

Legal use of the Tpg 196 Form

The Tpg 196 Form is legally binding when completed and submitted in accordance with IRS regulations. To ensure its legal validity, it is essential to provide accurate information and adhere to all guidelines set forth by the IRS. Additionally, electronic submissions must comply with eSignature laws to be recognized as legitimate. Understanding the legal implications of the Tpg 196 Form can help taxpayers avoid issues with compliance and potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the Tpg 196 Form are crucial for compliance. Typically, the form must be submitted by a specific date each year, often aligning with the general tax filing deadline. It is important to stay informed about any changes in deadlines, especially for extensions or specific circumstances that may apply. Missing the filing deadline can result in penalties, so keeping track of important dates is essential for all taxpayers.

Who Issues the Form

The Tpg 196 Form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. As the authoritative body for tax-related matters, the IRS provides the necessary guidelines and updates regarding the form, ensuring that taxpayers have access to the most current information. Familiarizing oneself with the IRS's role in issuing the Tpg 196 Form can help individuals and businesses navigate their tax obligations more effectively.

Quick guide on how to complete tpg 196 form

Complete Tpg 196 Form effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the correct form and securely keep it online. airSlate SignNow provides all the resources you need to create, edit, and electronically sign your documents quickly without delays. Manage Tpg 196 Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and electronically sign Tpg 196 Form without hassle

- Locate Tpg 196 Form and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Highlight important sections of the documents or redact sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information carefully and click the Done button to save your changes.

- Choose your preferred method to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes requiring new document printouts. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Tpg 196 Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tpg 196 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tpg 196 Form and why is it important?

The Tpg 196 Form is a crucial document used for various tax-related processes. Understanding it is essential for businesses to ensure compliance and efficient handling of tax obligations. With airSlate SignNow, you can easily create, send, and eSign the Tpg 196 Form, simplifying your documentation workflow.

-

How can airSlate SignNow help with the Tpg 196 Form?

airSlate SignNow provides features that enable seamless creation, sharing, and signing of the Tpg 196 Form. The platform's user-friendly interface allows for quick access to templates and electronic signatures, making document handling faster and more efficient for your business.

-

Is airSlate SignNow cost-effective for managing the Tpg 196 Form?

Yes, airSlate SignNow offers a cost-effective solution for managing the Tpg 196 Form and other documents. With various pricing plans tailored to fit different business needs, you can streamline your document processes without overspending.

-

Can I integrate airSlate SignNow with other software for Tpg 196 Form handling?

Absolutely! airSlate SignNow can be integrated with various software applications, enhancing your efficiency when managing the Tpg 196 Form. This integration allows you to automate workflows and synchronize data, ensuring a seamless experience across platforms.

-

What features does airSlate SignNow offer for the Tpg 196 Form?

airSlate SignNow offers a range of features for the Tpg 196 Form, including customizable templates, electronic signatures, and real-time tracking. These features help ensure that your documents are completed accurately and promptly, improving overall business efficiency.

-

Is the eSigning process for the Tpg 196 Form secure with airSlate SignNow?

Yes, the eSigning process for the Tpg 196 Form is highly secure with airSlate SignNow. The platform employs industry-standard encryption and authentication measures, ensuring that your documents are safe and compliant with legal regulations.

-

How can I get started with using airSlate SignNow for the Tpg 196 Form?

To get started with airSlate SignNow for the Tpg 196 Form, simply sign up for an account. Once registered, you can access a variety of templates and tools designed for efficient document management, allowing you to begin creating and sending Tpg 196 Forms immediately.

Get more for Tpg 196 Form

- Omb approval no 1405 0144 form

- Registration form t ball 2 wyomingvalleycycorg

- Colorado 4h dog project showmanship scoresheet nam form

- Immunization complianceuniversity health services form

- Dbq forms

- Souvenir tee shirt order form ohio music education omea ohio

- 4 h exhibit goal sheet extension iastate form

- 4h 620wmy record of 4h achievementto be kept in form

Find out other Tpg 196 Form

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document