Natwest Mortgage Application Form

What is the Natwest Mortgage Application Form

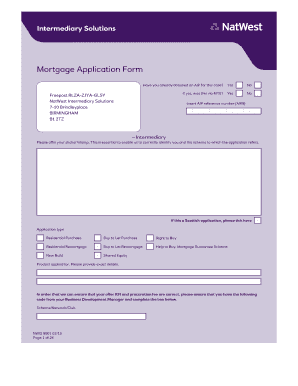

The Natwest Mortgage Application Form is a crucial document used by individuals seeking to obtain a mortgage from Natwest. This form collects essential information about the applicant's financial status, employment details, and the property being purchased. It serves as the foundation for the mortgage approval process, allowing the lender to assess the applicant's eligibility and determine the terms of the mortgage. Completing this form accurately is vital, as it influences the decision-making process regarding loan approval and the interest rates offered.

Steps to complete the Natwest Mortgage Application Form

Completing the Natwest Mortgage Application Form involves several important steps:

- Gather Necessary Information: Collect personal details, financial statements, and property information.

- Fill Out the Form: Input all required information accurately, ensuring there are no errors or omissions.

- Review Your Application: Double-check all entries for accuracy and completeness before submission.

- Submit the Form: Send the completed application through the preferred method, whether online or by mail.

Following these steps can help streamline the application process and increase the chances of approval.

How to use the Natwest Mortgage Application Form

Using the Natwest Mortgage Application Form is straightforward. Applicants can access the form online or request a physical copy. Once obtained, the form should be filled out with accurate and up-to-date information. It's important to provide thorough details about income, expenses, and any existing debts. After completing the form, applicants can submit it electronically or via traditional mail, depending on their preference. Ensuring that all information is clear and precise will facilitate a smoother review process by the lender.

Legal use of the Natwest Mortgage Application Form

The legal use of the Natwest Mortgage Application Form is governed by various regulations that ensure the information provided is accurate and truthful. Applicants must understand that submitting false information can lead to legal consequences, including denial of the mortgage application or potential fraud charges. The form must be completed in compliance with applicable laws, including those related to consumer protection and lending practices. This legal framework helps maintain the integrity of the mortgage process and protects both lenders and borrowers.

Eligibility Criteria

Eligibility for a Natwest mortgage is determined by several factors outlined in the application form. These criteria typically include:

- Minimum credit score requirements

- Stable income and employment history

- Debt-to-income ratio

- Property type and value

Applicants should ensure they meet these criteria before submitting their application to enhance their chances of approval.

Required Documents

When completing the Natwest Mortgage Application Form, applicants must provide several supporting documents to verify the information submitted. Commonly required documents include:

- Proof of identity (e.g., driver's license or passport)

- Recent pay stubs or tax returns

- Bank statements

- Details of existing debts and financial obligations

Having these documents ready can expedite the application process and ensure that the lender has all necessary information for assessment.

Quick guide on how to complete natwest mortgage application form

Easily Prepare Natwest Mortgage Application Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Handle Natwest Mortgage Application Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

An Effortless Way to Modify and eSign Natwest Mortgage Application Form

- Retrieve Natwest Mortgage Application Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal authority as a traditional handwritten signature.

- Verify all the information and click the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in a few clicks from your preferred device. Modify and eSign Natwest Mortgage Application Form and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the natwest mortgage application form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a NatWest mortgage advisor and how can they help me?

A NatWest mortgage advisor is a financial professional who specializes in helping clients navigate the mortgage process. They provide guidance on selecting the right mortgage products, prepare necessary documents, and assist in securing a mortgage tailored to your financial situation. Engaging a NatWest mortgage advisor can simplify the often complex mortgage journey.

-

What are the fees associated with hiring a NatWest mortgage advisor?

The fees for hiring a NatWest mortgage advisor can vary based on services provided and the complexity of your mortgage needs. Generally, some advisors charge a flat fee, while others may earn a commission from lenders upon closing. It's important to discuss and clarify any potential fees upfront to avoid surprises.

-

What features should I look for in a NatWest mortgage advisor?

When choosing a NatWest mortgage advisor, look for qualifications, experience, and reviews from previous clients. Additionally, they should offer personalized advice, transparency in their processes, and a thorough understanding of NatWest's mortgage products. Good advisors also support you through the entire mortgage application process.

-

What benefits can I expect from using a NatWest mortgage advisor?

Using a NatWest mortgage advisor can provide numerous benefits, such as expert knowledge of mortgage options, assistance with paperwork, and negotiating better rates. They can also save you time and reduce stress by handling communications with lenders and helping you stay organized. Overall, their expertise can lead to better financial outcomes.

-

Can a NatWest mortgage advisor help with adverse credit situations?

Yes, a NatWest mortgage advisor can assist clients with adverse credit situations by exploring niche mortgage products available for such circumstances. They have the expertise to help you understand your options and work towards improving your credit profile. With their guidance, you can navigate the challenges that come with securing a mortgage in these scenarios.

-

How do I choose the right NatWest mortgage advisor for my needs?

To choose the right NatWest mortgage advisor, consider their experience, area of specialization, and client reviews. It's beneficial to schedule an initial consultation to gauge their understanding of your unique financial situation and needs. This will help ensure that you select an advisor who aligns with your expectations and can deliver tailored advice.

-

Are there any integrations available when working with a NatWest mortgage advisor?

Many NatWest mortgage advisors may offer integrations with online tools and platforms for ease of document sharing and progress tracking. Depending on the advisor, you may have access to software that simplifies mortgage calculations or manages your application process effectively. It’s advisable to inquire about specific integrations during your initial meetings.

Get more for Natwest Mortgage Application Form

- Daisy exchange application form

- Rp 467 form

- Pta cash verification form 365791826

- Growth in a bacterial population worksheet answers 250177547 form

- Federalism division of power worksheet form

- Pnc deferment form

- E link automatic debit arrangement form

- Federal form 1120 reit u s income tax return for real

Find out other Natwest Mortgage Application Form

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter