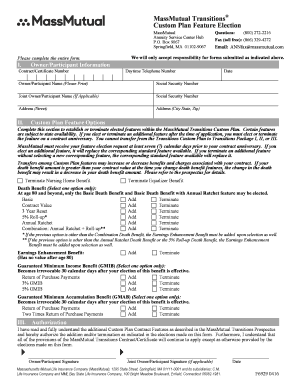

MassMutual Transitions Form

Understanding the MassMutual Full Surrender Form

The MassMutual full surrender form is a crucial document for policyholders wishing to completely withdraw their funds from a MassMutual annuity or insurance policy. This form essentially allows individuals to request the full surrender of their policy, which may include cash value or investment returns. It is important to understand the implications of surrendering a policy, including potential tax consequences and loss of coverage.

Steps to Complete the MassMutual Full Surrender Form

Filling out the MassMutual full surrender form involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including your policy number and personal identification details.

- Clearly indicate the amount you wish to surrender, ensuring it aligns with your policy's terms.

- Review any applicable fees or penalties associated with the surrender.

- Sign and date the form, confirming your request for full surrender.

Double-check all entries for accuracy before submission to avoid delays in processing.

Required Documents for Submission

When submitting the MassMutual full surrender form, certain documents may be required to verify your identity and policy details. Commonly required documents include:

- A copy of your government-issued identification, such as a driver's license or passport.

- Any additional forms or documentation specified by MassMutual, which may vary based on the type of policy.

Ensure all documents are current and legible to facilitate a smooth surrender process.

Form Submission Methods

The MassMutual full surrender form can typically be submitted through various methods, providing flexibility for policyholders:

- Online Submission: Many users prefer to complete the form digitally through MassMutual's online portal.

- Mail: You can print and send the completed form to the designated address provided by MassMutual.

- In-Person: Some policyholders may choose to submit the form in person at a local MassMutual office.

Choose the method that best suits your needs and ensure you keep a copy of the submitted form for your records.

Legal Considerations for Full Surrender

Understanding the legal implications of surrendering a policy is essential. When you submit the MassMutual full surrender form, you are essentially terminating your contract with the insurer. This action may have legal ramifications, such as:

- Potential tax liabilities on any gains received from the surrender.

- Loss of any death benefits associated with the policy.

- Impact on any future insurance coverage you may require.

Consulting with a financial advisor or tax professional can help clarify these legal aspects before proceeding with the surrender.

Eligibility Criteria for Full Surrender

Not all policies may be eligible for full surrender. It is important to check the specific terms of your MassMutual policy. Common eligibility criteria include:

- The policy must have accumulated cash value.

- The policyholder must be the individual requesting the surrender.

- All premiums must be paid up to date.

Review your policy documents or contact MassMutual for specific eligibility requirements related to your situation.

Quick guide on how to complete massmutual transitions

Complete MassMutual Transitions effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle MassMutual Transitions on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to alter and eSign MassMutual Transitions without any hassle

- Obtain MassMutual Transitions and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, endless form searching, or errors that require printing additional document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign MassMutual Transitions and guarantee outstanding communication at any point during your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the massmutual transitions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Who owns MassMutual insurance?

Mutual ownership As a mutual company, with no shareholders, MassMutual is managed with the long-term interests of its policyowners and members in mind. Policyowners and members may benefit directly from the Company's mutual ownership structure.

-

Who bought out MassMutual?

On December 31, 2020, Empower Retirement (“Empower”) acquired the retirement plan and group insurance business of Massachusetts Mutual Life Insurance Company (“MassMutual”).

-

Where did my MassMutual 401k go?

Empower Retirement acquired MassMutual's retirement plan business in January 2021. Log in to your Empower Retirement account. Who can I contact about my workplace retirement plan? Empower Retirement has acquired your MassMutual workplace retirement plan.

-

Who replaced MassMutual?

As a result of the acquisition, MassMutual's retirement plan business transitions to Empower in a reinsurance transaction for a ceding commission of $2.35 billion.

-

Who did MassMutual merge with?

GREENWOOD VILLAGE, Colo., Jan. 4, 2021 - Empower Retirement today announced the completion of the previously announced acquisition of Massachusetts Mutual Life Insurance Company's (MassMutual) retirement plan business, following the receipt of regulatory approval required by the agreement.

-

What is the new name for MassMutual?

Why are you changing your name? Great American Life was acquired by MassMutual on May 28, 2021. As part of this transition, we are required to establish a new company name, MassMutual Ascend Life Insurance Company. To 'Ascend' is to move, go upward, rise and succeed, which is what we intend to do with your partnership!

-

Who did MassMutual Ascend merge with?

CINCINNATI – October 3, 2022 – Great American Life Insurance Company announced today that it will now do business as MassMutual Ascend Life Insurance Company (MassMutual Ascend). The rebrand comes as a result of the company's acquisition by Massachusetts Mutual Life Insurance Company (MassMutual) in May 2021.

-

What is the name of MassMutual?

The Massachusetts Mutual Life Insurance Company, also known as MassMutual, is a Springfield, Massachusetts-based life insurance company. MassMutual provides financial products such as life insurance, disability income insurance, long term care insurance, and annuities. Major affiliate includes Barings LLC.

Get more for MassMutual Transitions

- Bird beak lab answer key form

- Sfusd transcript form

- Authorization to discloseobtain health information hartford hospital english 571559 hartford hospital consent forms rehab

- Anugya patra form

- Atto di notoriet esempio form

- Pythagorean theorem worksheet five pack math worksheets land form

- Building departmentcity of richmond form

- Customer move out request form 2 3 xlsx

Find out other MassMutual Transitions

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors