Georgia Small Claims Court Forms

What is the Georgia Small Claims Court Forms

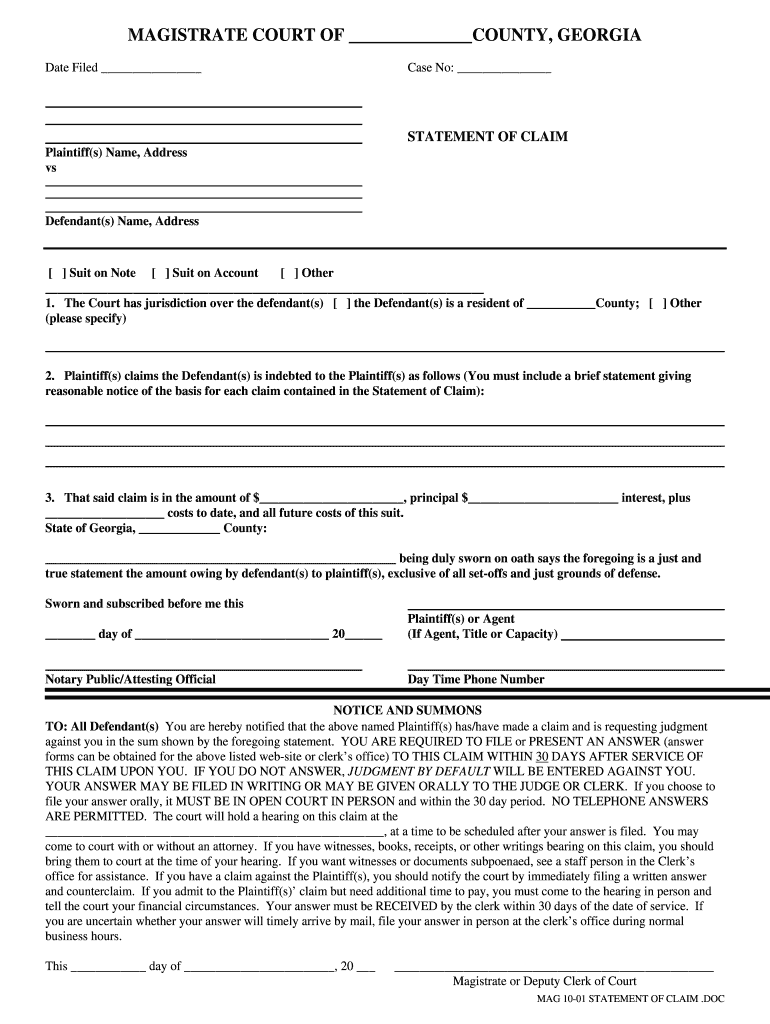

The Georgia Small Claims Court Forms are legal documents used to initiate a claim in small claims court within the state of Georgia. These forms allow individuals to seek monetary compensation for disputes involving relatively small amounts of money, typically up to five thousand dollars. The statement of claim form is a crucial part of this process, as it outlines the details of the claim, including the parties involved, the nature of the dispute, and the amount being sought. Understanding these forms is essential for anyone looking to navigate the small claims process effectively.

How to use the Georgia Small Claims Court Forms

Using the Georgia Small Claims Court Forms involves several key steps. First, you must accurately complete the statement of claim form, ensuring that all required information is provided. This includes your name, address, and a clear description of your claim. After filling out the form, you need to file it with the appropriate court, which may involve paying a filing fee. Once filed, you will receive a court date where you can present your case. It is important to keep copies of all documents for your records and to prepare any evidence or witnesses you may need for your hearing.

Steps to complete the Georgia Small Claims Court Forms

Completing the Georgia Small Claims Court Forms requires attention to detail. Follow these steps:

- Obtain the correct form, typically the statement of claim form, from the court or online resources.

- Fill in your personal information, including your name and contact details.

- Clearly describe the nature of your claim, including relevant dates and amounts.

- List the defendant's information accurately to ensure proper notification.

- Sign and date the form before submission.

After completing the form, review it for accuracy and completeness to avoid delays in processing.

Key elements of the Georgia Small Claims Court Forms

Key elements of the Georgia Small Claims Court Forms include specific information that must be included to ensure the claim is valid. These elements typically consist of:

- Parties involved: Names and addresses of both the plaintiff and the defendant.

- Claim description: A detailed account of the issue at hand, including the basis for the claim.

- Amount sought: The total monetary compensation being requested.

- Filing details: Information about where and when the form is being filed.

Including these elements accurately is essential for the court to process your claim effectively.

Legal use of the Georgia Small Claims Court Forms

The legal use of the Georgia Small Claims Court Forms is governed by specific rules and regulations. These forms are designed for disputes involving small amounts of money and are intended to provide a simplified process for individuals without the need for an attorney. It is important to understand that the small claims court has jurisdiction over certain types of cases, such as contract disputes and property damage claims. Proper use of these forms ensures that your claim is heard in the appropriate legal setting, adhering to the guidelines established by Georgia law.

Form Submission Methods

Submitting the Georgia Small Claims Court Forms can be done through various methods. You can file the forms:

- In-person: Visit the local small claims court to submit your forms directly.

- By mail: Send the completed forms to the court's mailing address, ensuring you include any required fees.

- Online: Some jurisdictions may offer online filing options for convenience.

Each method has its own requirements and timelines, so it is important to choose the one that best suits your needs and to confirm the specific procedures with your local court.

Quick guide on how to complete form statement claim

Complete and submit your Georgia Small Claims Court Forms swiftly

Comprehensive tools for electronic document exchange and approval are now vital for process enhancement and the ongoing improvement of your forms. When handling legal documents and signing a Georgia Small Claims Court Forms, an effective signature solution can conserve signNow time and resources with every submission.

Search, fill out, modify, endorse, and share your legal documents using airSlate SignNow. This platform provides everything necessary to create streamlined document submission workflows. Its extensive collection of legal forms and user-friendly interface can help you locate your Georgia Small Claims Court Forms immediately, and the editor featuring our signature capability will enable you to finalize and validate it on the spot.

Sign your Georgia Small Claims Court Forms in a few straightforward steps

- Access the Georgia Small Claims Court Forms you require in our library through search or catalog pages.

- Review the form details and preview it to ensure it meets your needs and state regulations.

- Click Get form to open it for modification.

- Complete the form utilizing the comprehensive toolbar.

- Inspect the information you've added and click the Sign tool to validate your file.

- Select one of three options to affix your signature.

- Finalize your edits and save the document in your files, then download it to your device or share it instantly.

Optimize each phase of your document preparation and endorsement with airSlate SignNow. Experience a more effective online solution that addresses all aspects of your paperwork management.

Create this form in 5 minutes or less

FAQs

-

I am a layman. What is Form 16, Income Tax return and the fuss about it?

The filing of Income Tax returns is a mandatory duty along with the payment of Income Tax to the Government of India . As the season closes by (last date of filing return - 5th August for 2014), many new tax-payers are in qualms as to how to go with the procedure as well as do away with the seemingly complicated mechanism behind it .Following are some of the pointers , which I acquired through self-learning (all are written considering the tax procedures for an Individual, and not Companies or other organizations). Here goes :1) Firstly , it is important to understand that Income Tax return is a document which is filed by you stating your Total Income in a Financial Year through various sources of income i.e Salary , business, house property, etc . (Financial Year is the year of your income , and Assessment Year is the year next to it in which the tax is due . Eg - Financial Year 2013-14, Assessment Year 2014-15)It also states the Taxable income on that salary and the Total tax payable with surcharges and Education Cess . The Taxable income has an exemption of upto 2 lakh rupees(For an individual, and not a senior citizen) for this assessment year , and 2.5 lakhs for the next (As per the new budget) . You also get tax exemptions on various other investments/allowances such as HRA , Fixed Deposits , Insurance Policies , Provident Funds , Children's Education , etc under various clauses of Section 80.People should know that return is filed to intimate the Government of your tax statements and it should not be confused with the Tax-refund one gets if there is a surplus tax paid by you to the Government . Return is not Refund .2) Government of India collects Income Tax through three modes :a) TDS - Tax Deduction at Source . TDS is the system in which any corporation/business as an Employer is supposed to deduct the Income tax of an Employee from his/her salary at source and submit it to the GOI before the end of Financial Year . The tax is deducted regularly from the employee's salary in certain percentage so as to overcome the liability of Total Tax to be paid by the employer for the Financial Year.The Employer issues a TDS Certificate in the form of Form 16 or Form 16A to the Employee which would be used to claim the TDS by the employee while filing his/her return . Form 16 is the certificate issued for the tax deducted under the head Salaries . Form 16A is issued for tax deducted for income through other sources such as interests on securities,dividends,winnings,etc.If the employee has some extra income through other sources , he/she should intimate the Employer about it before so as to include it for TDS . The total tax paid by you through TDS is also available online on the TRACES portal which is linked to your Bank Account and PAN No. for your convenience . You can also generate and validate your Form 16 / 16A from the website to file your return online .b) Advance Tax and Self Assessment Tax .Advance Tax may also be called 'Pay as you earn' Tax . In India one has to estimate his income during the financial year.If your projected tax liability of the current Financial year is more than Rs 10000, you are supposed to pay Advance tax !This has to be paid in three instalments. 30 % by 15th Sept,60% minus first instalment by 15th Dec and 100% minus 2nd instalment by 15th March.For individuals who are earning only through salaries , the Advance Tax is taken care of through TDS by the employers and there is hardly any Advance Tax to be paid . But for individuals who have other sources of income , they have to pay Advance Tax .If one forgets to pay he is liable to pay interest @ 1% p.m.Self-Assessment Tax - While filing your Return of Income, one does a computation of income and taxes to be filled in the Return. On computation, sometimes it is noted that the Taxes paid either as Advance Tax or by way of TDS fall short of the Actual Tax Payable . The shortfall so determined is called the Self Assessment Tax which is payable before filing the Return of Income. c) TCS - Tax Collection at Source .Tax Collected at Source (TCS) is income tax collected by a Seller from a Payer on sale of certain items. The seller has to collect tax at specified rates from the payer who has purchased these items : Alcoholic liquor for human consumption Tendu leaves Timber obtained under a forest lease Timber obtained by any mode other than under a forest lease Any other forest produce not being timber or tendu leaves Scrap Minerals being coal or lignite or iron ore Scrap BatteriesSalaried Individuals are not concerned with TCS .3) Online Procedure for Filing your Return , Payment of Tax , and viewing/generating your TDS certificate . a) Filing Income Tax Return :The procedure is as simple as it gets . You have to go to the E-filing homepage of the GOI , i.e https://incometaxindiaefiling.go... and login to your account . If you don't have an account yet , you can create it through the 'Register Yourself' link above it . All you need is a PAN No. (obviously) . After logging in , you have to go to the E-file tab and select the 'Prepare and Submit online ITR' option . Alternatively , you can select the 'Upload Return' option to upload your return through an XML file downloaded from the 'Downloads' tab and filled offline by you .You have to enter your PAN No, select ITR Form name 'ITR1' (Form ITR1 is for salaried individuals, income from house property and other income) , select Assessment year and submit .Now all you have to do is fill the form with the tabs Personal Information , Income Details , Tax Details , Tax Paid and Verification and 80G to complete your Return and submit it to the Income Tax Department .The 'Income Details' tab asks for your Total Income through various sources , and Tax exemptions claimed by you under various clauses of Section 80 . It also computes the Income tax liability of yours for that Financial Year . The 'Tax details' tab asks for the TAN (Tax Deduction Account Number) and Details of Form 16/16A issued by the employer/generated by you for TDS . It also asks for Advance Tax / Self Assessment Tax, if paid and the Challan no. of the payment receipt .The 'Tax Paid and Verification' Tab asks for your Bank Account Number and IFSC code . If there is a surplus tax paid by you in the form of TDS/Advance Tax , you will get its refund with interest in a 4 months period by the Income Tax Department . After submitting the Return , you get a link on your registered E-mail id . This link provides you the ITR-V document (an acknowledgement slip) which you have to download , print , put your signature , and send it to the Bangalore division of the Income Tax Department for completion of your Return Filing . The address is mentioned in the document . Alternatively , you can evade the ITR-V process and opt to digitally sign in the beginning of E-filing , but the process requires you to spend money and is to be renewed every year .b) Payment of Tax - You can pay the TDS (Not required for an individual, it is to be paid by the employer) , Advance Tax or Self Assessment Tax through the portal of Tax Information Network , i.e e-TAX Payment System After filling the required form (ITNS 280 for Income Tax) , you pay the tax through your Bank Account , and get a Challan receipt which will be used during filing your return .c) View/ Generate TDS Certificate online .You can do it by logging on to the TRACES portal of the Tax Deduction System , i.e , Page on tdscpc.gov.in You will have to register yourself before logging in through your PAN no.You can view the details of your TDS deducted by the Employer via From 26AS on the portal .Also , you can generate your TDS Certificate in the form of Form 16/16A by entering the TAN No. of your Employer .

-

How can I claim the VAT amount for items purchased in the UK? Do I need to fill out any online forms or formalities to claim?

Easy to follow instructions can be found here Tax on shopping and servicesThe process works like this.Get a VAT 407 form from the retailer - they might ask for proof that you’re eligible, for example your passport.Show the goods, the completed form and your receipts to customs at the point when you leave the EU (this might not be in the UK).Customs will approve your form if everything is in order. You then take the approved form to get paid.The best place to get the form is from a retailer on the airport when leaving.

-

In what cases do you have to fill out an insurance claim form?

Ah well let's see. An insurance claim form is used to make a claim against your insurance for financial, repair or replacement of something depending on your insurance. Not everything will qualify so you actually have to read the small print.

-

How do I fill out the disability forms so well that my claim is approved?

Contact Barbara Case, the founder of USA: Providing Free Advocacy & Support She's incredible!

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

Create this form in 5 minutes!

How to create an eSignature for the form statement claim

How to create an eSignature for your Form Statement Claim online

How to create an eSignature for your Form Statement Claim in Google Chrome

How to make an eSignature for putting it on the Form Statement Claim in Gmail

How to create an eSignature for the Form Statement Claim right from your mobile device

How to make an eSignature for the Form Statement Claim on iOS devices

How to generate an eSignature for the Form Statement Claim on Android

People also ask

-

What are Georgia Small Claims Court Forms?

Georgia Small Claims Court Forms are legal documents required for filing a small claims case in Georgia. These forms allow individuals to present their claims for disputes involving monetary amounts up to $15,000. Properly completing these forms is crucial for ensuring your case proceeds smoothly in court.

-

How can I obtain Georgia Small Claims Court Forms?

You can obtain Georgia Small Claims Court Forms online through the official Georgia court website or various legal document service providers. Additionally, airSlate SignNow offers an easy-to-use platform where you can access, complete, and eSign these forms quickly and securely.

-

Are there any fees associated with filing Georgia Small Claims Court Forms?

Yes, filing Georgia Small Claims Court Forms typically involves a filing fee, which varies by county. It's important to check with your local court for the exact fee amount and any additional costs that may apply, such as service fees for delivering the documents.

-

Can airSlate SignNow help me fill out Georgia Small Claims Court Forms?

Absolutely! airSlate SignNow provides templates for Georgia Small Claims Court Forms that simplify the filling process. With our user-friendly interface, you can easily input your information, ensuring that your forms are completed accurately and efficiently.

-

What features does airSlate SignNow offer for managing Georgia Small Claims Court Forms?

airSlate SignNow offers a range of features for managing Georgia Small Claims Court Forms, including document templates, electronic signatures, and cloud storage. These features ensure that your documents are organized, secure, and accessible from anywhere, making the filing process seamless.

-

Is airSlate SignNow suitable for businesses dealing with Georgia Small Claims Court Forms?

Yes, airSlate SignNow is an excellent solution for businesses that need to handle Georgia Small Claims Court Forms. Our platform streamlines the document management process, allowing businesses to send, eSign, and store forms easily, which is vital for maintaining compliance and efficiency.

-

What benefits does using airSlate SignNow provide for Georgia Small Claims Court Forms?

Using airSlate SignNow for Georgia Small Claims Court Forms offers numerous benefits, including time savings, reduced paperwork, and enhanced security. Our platform allows you to complete and eSign forms digitally, minimizing the hassle of physical document handling and ensuring your information is protected.

Get more for Georgia Small Claims Court Forms

- Kansas secure power of attorney form

- Solicitud de beneficio familiar declaracion jurada form

- Fill in the chart with purpose of the human body system form

- Kavi kulguru ramtek university ramtek 1 year realst form

- Cic imm 3907e form

- Navy reenlistment form

- Hipaa employee acknowledgement form

- Cbe results documantation form

Find out other Georgia Small Claims Court Forms

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document