Switzerland Insurance Check Form

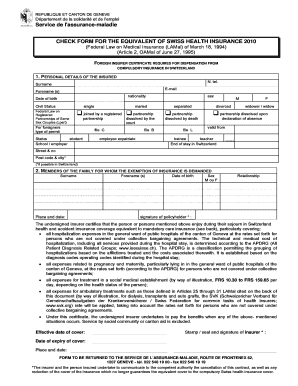

What is the Switzerland Insurance Check Form

The Switzerland Insurance Check Form is a document used to verify insurance coverage and compliance with specific regulations related to insurance policies in Switzerland. This form is essential for individuals and businesses seeking to ensure they meet the necessary insurance requirements while engaging in various activities, such as travel or business operations. The form typically captures details about the insurance provider, policy number, coverage limits, and the insured party's information.

How to use the Switzerland Insurance Check Form

Using the Switzerland Insurance Check Form involves several straightforward steps. First, gather all necessary information, including your insurance policy details and personal identification. Next, fill out the form accurately, ensuring that all required fields are completed. Once filled, the form can be submitted electronically or printed for physical submission, depending on the requirements of the institution requesting it. It is crucial to review the completed form for accuracy before submission to avoid any delays or issues.

Steps to complete the Switzerland Insurance Check Form

Completing the Switzerland Insurance Check Form requires careful attention to detail. Follow these steps for successful completion:

- Gather your insurance documents and personal information.

- Access the form through a reliable digital platform.

- Fill in your details, including your name, address, and policy information.

- Review the form for any errors or omissions.

- Sign the form electronically if submitting online, or print and sign if submitting by mail.

- Submit the form according to the instructions provided by the requesting entity.

Legal use of the Switzerland Insurance Check Form

The Switzerland Insurance Check Form is legally binding when completed correctly and submitted to the appropriate authorities. To ensure its legality, it must comply with relevant regulations, including those governing electronic signatures and data protection. Utilizing a trusted digital platform that adheres to these legal standards enhances the form's validity and security, providing peace of mind that the information submitted will be recognized by legal and regulatory bodies.

Key elements of the Switzerland Insurance Check Form

Several key elements are essential for the Switzerland Insurance Check Form to be complete and effective. These include:

- Insured Party Information: Name, address, and contact details of the individual or entity covered by the insurance.

- Insurance Provider Details: Name and contact information of the insurance company.

- Policy Information: Policy number, coverage limits, and expiration date.

- Signature: An electronic or handwritten signature to validate the form.

Form Submission Methods

The Switzerland Insurance Check Form can be submitted through various methods, depending on the preferences of the requesting organization. Common submission methods include:

- Online Submission: Many organizations accept forms submitted electronically via secure platforms.

- Mail: Physical copies of the form can be mailed to the designated address.

- In-Person: Some entities may require the form to be submitted in person for verification.

Quick guide on how to complete switzerland insurance check form

Complete Switzerland Insurance Check Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It presents an excellent eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents promptly without delays. Handle Switzerland Insurance Check Form on any device using airSlate SignNow's Android or iOS applications and improve any document-related process today.

The easiest way to modify and electronically sign Switzerland Insurance Check Form with ease

- Search for Switzerland Insurance Check Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools provided specifically for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information thoroughly and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from the device of your choice. Edit and eSign Switzerland Insurance Check Form to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the switzerland insurance check form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Switzerland Insurance Check Form?

A Switzerland Insurance Check Form is a document that allows individuals and businesses in Switzerland to verify their insurance information efficiently. With airSlate SignNow, you can easily create and manage these forms, ensuring that you have all the necessary information at your fingertips.

-

How does airSlate SignNow simplify the use of Switzerland Insurance Check Forms?

airSlate SignNow provides a user-friendly platform that simplifies the creation, distribution, and signing of Switzerland Insurance Check Forms. Users can quickly generate and send forms for eSignature, which reduces processing time and enhances efficiency in obtaining necessary insurance confirmations.

-

Are there any costs associated with using the Switzerland Insurance Check Form in airSlate SignNow?

Yes, using the Switzerland Insurance Check Form through airSlate SignNow involves a subscription fee, but the pricing is competitive and designed to accommodate various business needs. This cost-effective solution allows businesses of all sizes to manage their documents without incurring excessive expenses.

-

What features are included with the Switzerland Insurance Check Form in airSlate SignNow?

The Switzerland Insurance Check Form includes several features such as customizable templates, eSigning capabilities, and automated workflows. These features streamline the entire process, ensuring that all parties can access and sign documents quickly and securely.

-

Can I integrate the Switzerland Insurance Check Form with other software?

Yes, airSlate SignNow offers seamless integrations with various software platforms, enhancing the functionality of your Switzerland Insurance Check Form. This allows you to connect with CRM systems, document management tools, and more, ensuring a smooth workflow in managing your insurance documents.

-

What are the benefits of using the Switzerland Insurance Check Form?

Using the Switzerland Insurance Check Form can signNowly reduce paperwork, speed up the process of insurance verification, and ensure compliance with legal standards. Additionally, it enhances collaboration between stakeholders by providing a centralized platform for document management.

-

Is the Switzerland Insurance Check Form secure?

Absolutely! AirSlate SignNow prioritizes security with every document processed, including the Switzerland Insurance Check Form. The platform uses encryption and secure data storage, ensuring that your sensitive insurance information remains safe and confidential.

Get more for Switzerland Insurance Check Form

Find out other Switzerland Insurance Check Form

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement