Navajo Nation Tax Commission Form 100

What is the Navajo Nation Tax Commission Form 100

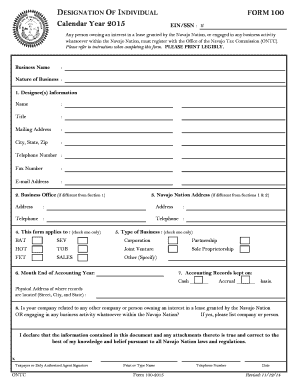

The Navajo Nation Tax Commission Form 100 is a critical document used for tax purposes within the Navajo Nation. This form is specifically designed to report income and calculate tax liabilities for individuals and businesses operating within the jurisdiction of the Navajo Nation. It plays a vital role in ensuring compliance with local tax laws and regulations, helping to support the economic framework of the community.

How to use the Navajo Nation Tax Commission Form 100

Using the Navajo Nation Tax Commission Form 100 involves several steps. First, individuals or businesses must gather all necessary financial information, including income statements and expense records. Once the required information is collected, the form can be completed either electronically or on paper. It is essential to ensure that all sections are filled out accurately to avoid delays in processing. After completion, the form must be submitted to the appropriate tax authority within the Navajo Nation.

Steps to complete the Navajo Nation Tax Commission Form 100

Completing the Navajo Nation Tax Commission Form 100 requires careful attention to detail. Follow these steps:

- Gather all financial documents, including W-2s, 1099s, and other income statements.

- Fill out personal identification information at the top of the form.

- Report all sources of income in the designated sections.

- Deduct any eligible expenses to determine taxable income.

- Review the completed form for accuracy before submission.

Legal use of the Navajo Nation Tax Commission Form 100

The legal use of the Navajo Nation Tax Commission Form 100 is governed by the tax laws of the Navajo Nation. To be considered valid, the form must be filled out completely and accurately. Additionally, it must be submitted by the specified deadlines to avoid penalties. Utilizing electronic signatures through a secure platform can enhance the legal standing of the document, ensuring compliance with eSignature regulations.

Required Documents

When filling out the Navajo Nation Tax Commission Form 100, certain documents are required to support the information provided. These include:

- Income statements (W-2s, 1099s).

- Records of any deductions or credits claimed.

- Proof of residency within the Navajo Nation.

- Any additional documentation requested by the tax authority.

Form Submission Methods

The Navajo Nation Tax Commission Form 100 can be submitted through various methods, ensuring convenience for taxpayers. These methods include:

- Online submission via the Navajo Nation Tax Commission's official portal.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices within the Navajo Nation.

Quick guide on how to complete navajo tax commission form 100

Complete navajo tax commission form 100 seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage form 100 navajo nation on any platform with airSlate SignNow Android or iOS applications and enhance any document-related operation today.

How to modify and eSign navajo nation tax commission effortlessly

- Find navajo nation form 100 and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Select relevant sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you prefer to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors requiring new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign navajo nation form 100 2018 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to navajo nation form 100

Create this form in 5 minutes!

How to create an eSignature for the navajo nation form 100 2018

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask navajo nation tax commission form 100

-

What is the form 100 Navajo Nation and why is it important?

The form 100 Navajo Nation is a crucial document for businesses operating within the Navajo Nation's jurisdiction. It is primarily used for tax purposes and regulatory compliance. Understanding how to properly complete and submit this form is essential for any business looking to operate seamlessly on Navajo Nation lands.

-

How does airSlate SignNow help with the form 100 Navajo Nation?

airSlate SignNow provides an efficient way to eSign and send the form 100 Navajo Nation electronically. With its user-friendly interface, businesses can quickly complete the form and ensure all necessary signatures are captured. This streamlines the process and reduces the risk of errors, making compliance easier.

-

Are there any costs associated with using airSlate SignNow for the form 100 Navajo Nation?

Yes, while airSlate SignNow offers competitive pricing, the exact costs can vary based on the plan you choose. Many plans include features that simplify the completion and signing of important documents like the form 100 Navajo Nation. Reviewing the pricing page will provide a clear understanding of the available options.

-

Can I integrate airSlate SignNow with other software for managing the form 100 Navajo Nation?

Absolutely! airSlate SignNow offers integrations with various software tools that can further streamline your workflow. This means you can easily combine data from your existing systems with the functionality of airSlate SignNow when completing the form 100 Navajo Nation.

-

What features does airSlate SignNow offer for the form 100 Navajo Nation?

airSlate SignNow includes features such as eSignature tools, document templates, and automated workflows that are particularly beneficial for processing the form 100 Navajo Nation. Its robust functionality allows users to save time and enhance accuracy in document handling. These features are designed to support efficient document management.

-

Is it easy for multiple users to collaborate on the form 100 Navajo Nation with airSlate SignNow?

Yes, airSlate SignNow facilitates seamless collaboration among multiple users when working on the form 100 Navajo Nation. You can invite team members to review and sign the document, ensuring everyone has access to the latest information. This collaborative approach enhances transparency and efficiency.

-

How secure is airSlate SignNow when managing sensitive documents like the form 100 Navajo Nation?

Security is a top priority for airSlate SignNow, which employs advanced encryption protocols to protect sensitive documents, including the form 100 Navajo Nation. You can rest assured that your data is safe during transmission and storage. Compliance with industry standards further enhances the security of your document management process.

Get more for form 100 navajo nation

Find out other navajo nation tax commission

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien