Promise to Pay Letter Form

What is the promise to pay letter?

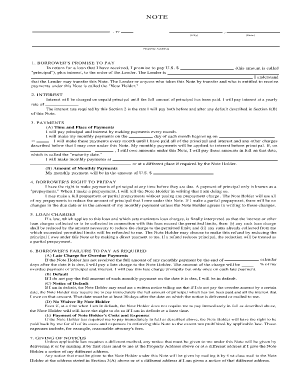

A promise to pay letter is a formal document that outlines an individual's or business's commitment to repay a debt. This letter serves as a written acknowledgment of the obligation and specifies the terms of repayment, including the amount owed, payment schedule, and any interest rates applicable. It is often used in various financial transactions, such as loans, services rendered, or credit agreements. By creating a clear record of the agreement, both parties can refer to the letter in case of disputes or misunderstandings.

Key elements of the promise to pay letter

When drafting a promise to pay letter, certain key elements must be included to ensure its effectiveness and legal validity. These elements typically consist of:

- Borrower's Information: Full name, address, and contact details of the person or entity making the promise.

- Lender's Information: Full name, address, and contact details of the person or entity to whom the debt is owed.

- Debt Amount: The total amount of money owed, clearly stated.

- Payment Terms: Specific details about how and when payments will be made, including due dates and any applicable interest rates.

- Signatures: Signatures of both parties to confirm their agreement to the terms outlined in the letter.

How to use the promise to pay letter

The promise to pay letter can be utilized in various scenarios where a financial obligation exists. To effectively use this letter, follow these steps:

- Draft the letter, ensuring all key elements are included.

- Review the terms with the other party to ensure mutual understanding.

- Sign the document in the presence of a witness, if necessary, to enhance its validity.

- Provide a copy to the lender and retain one for your records.

This letter not only serves as a reminder of the debt but also provides legal protection for both parties involved.

Steps to complete the promise to pay letter

Completing a promise to pay letter involves several important steps to ensure clarity and legal compliance. Here’s a straightforward guide:

- Identify the parties: Clearly state who is borrowing and who is lending.

- Specify the debt: Clearly outline the amount owed and the purpose of the debt.

- Outline repayment terms: Include the payment schedule, methods of payment, and any interest rates.

- Include legal language: Add any necessary legal disclaimers or conditions that apply.

- Sign and date: Ensure both parties sign and date the letter to validate the agreement.

Legal use of the promise to pay letter

The promise to pay letter is legally binding when executed properly. To ensure its legal standing, it must comply with relevant laws governing contracts. This includes:

- Both parties must have the legal capacity to enter into a contract.

- The terms of the agreement must be clear and specific.

- Consideration must be present, meaning something of value is exchanged.

- The agreement must not violate any laws or public policy.

When these conditions are met, the promise to pay letter can be enforced in a court of law if necessary.

Examples of using the promise to pay letter

There are various scenarios where a promise to pay letter can be effectively used. Common examples include:

- A business owner borrowing funds from a bank to finance operations.

- A service provider issuing a promise to pay letter after delivering services to a client.

- A family member lending money to another family member with a clear repayment plan.

These examples illustrate the versatility of the promise to pay letter in both personal and professional contexts.

Quick guide on how to complete promise to pay letter

Complete Promise To Pay Letter effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the right form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Promise To Pay Letter on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and electronically sign Promise To Pay Letter without hassle

- Find Promise To Pay Letter and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize essential sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to store your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors necessitating new printed copies. airSlate SignNow fulfills your document management requirements in a few clicks from any preferred device. Alter and electronically sign Promise To Pay Letter and ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the promise to pay letter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a promise to pay letter?

A promise to pay letter is a formal document that outlines an agreement where one party commits to repay a debt or obligation. This letter serves as a legal record of the agreement and can be used in situations involving loans or payment plans. Utilizing airSlate SignNow to create and eSign your promise to pay letter simplifies the document process, ensuring clarity and security.

-

How can airSlate SignNow help with a promise to pay letter?

airSlate SignNow provides a user-friendly platform for creating and managing your promise to pay letter. The tool allows you to easily input the necessary details, customize templates, and eSign the document directly online. This streamlines the process, making it accessible and efficient for both you and the recipient.

-

Is there a cost associated with generating a promise to pay letter?

Yes, there is a cost for using airSlate SignNow's services, but it is designed to be cost-effective for businesses of all sizes. Pricing plans are available that cater to different needs, providing essential features for document management, including the promise to pay letter. You can choose a plan that best fits your usage and budget.

-

What features does airSlate SignNow offer for promise to pay letters?

airSlate SignNow offers various features that enhance the creation of a promise to pay letter, including customizable templates, eSignature capabilities, and document storage. Additionally, it provides audit trails for legal compliance, ensuring your agreements are protected and verifiable. These features make managing your documents easier and more efficient.

-

What are the benefits of using airSlate SignNow for a promise to pay letter?

Using airSlate SignNow for your promise to pay letter offers several benefits, including faster processing and improved record-keeping. The ease of eSigning allows both parties to complete the agreement from anywhere, streamlining communication. Furthermore, it helps ensure accuracy and reduces the chance of disputes arising from misunderstandings.

-

Can I integrate airSlate SignNow with other tools for managing promise to pay letters?

Absolutely! airSlate SignNow integrates seamlessly with a variety of third-party applications that can assist with managing your promise to pay letter and other business processes. This includes tools for accounting, CRM, and project management. These integrations help streamline workflows, ensuring that your documents are well-organized and easily accessible.

-

Are promise to pay letters legally binding when created with airSlate SignNow?

Yes, promise to pay letters created and signed through airSlate SignNow are legally binding, as long as they adhere to relevant laws and regulations. The platform complies with eSignature laws, ensuring that your signed documents hold up in court. Always consult with a legal professional to ensure full compliance for your specific situation.

Get more for Promise To Pay Letter

- Lab protein synthesis transcription and translation answer key form

- Asme v suggested format

- This sample form is not intended to be used for entry into any

- Master promissory note federal perkins loan biola form

- Imm 892es spanish form

- 20 essential tools for real estate investors form

- Midwest special needs trust form

- Commercial clean service contract template form

Find out other Promise To Pay Letter

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online