AD 19 Indiana Department of Revenue Af? Davit for Form

What is the AD 19 Indiana Department Of Revenue Affidavit For

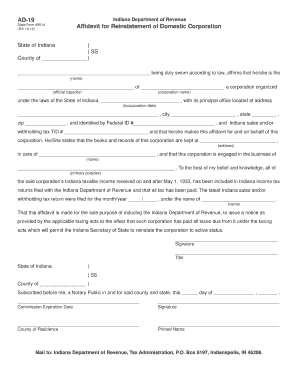

The AD 19 Indiana Department Of Revenue Affidavit For is a legal document used primarily for tax-related matters within the state of Indiana. This form is essential for individuals or entities that need to declare specific information regarding their tax obligations or status. It serves as a formal declaration that can be utilized in various tax scenarios, ensuring compliance with state regulations. The affidavit may be required in situations such as claiming tax exemptions, verifying residency, or providing proof of income.

Steps to complete the AD 19 Indiana Department Of Revenue Affidavit For

Completing the AD 19 Indiana Department Of Revenue Affidavit For involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information, including personal identification details, tax identification numbers, and any relevant financial documentation. Next, carefully fill out the form, ensuring that all sections are completed accurately. It's important to review the affidavit for any errors or omissions before signing. Finally, submit the completed form to the appropriate department, either online or via mail, as specified by the Indiana Department of Revenue.

Legal use of the AD 19 Indiana Department Of Revenue Affidavit For

The AD 19 Indiana Department Of Revenue Affidavit For holds legal significance, as it is recognized by the state as a valid declaration of information related to tax matters. To be legally binding, it must be signed and dated by the individual or entity submitting it. Additionally, it is crucial to ensure that the affidavit complies with all applicable state laws and regulations. Failure to provide accurate information or to submit the affidavit correctly may result in penalties or legal repercussions.

How to obtain the AD 19 Indiana Department Of Revenue Affidavit For

The AD 19 Indiana Department Of Revenue Affidavit For can be obtained directly from the Indiana Department of Revenue's official website or by visiting their office in person. It is typically available as a downloadable PDF document, which can be printed and filled out manually. Alternatively, individuals may also request a physical copy of the form by contacting the department directly. Ensuring you have the most current version of the form is essential, as updates may occur periodically.

Form Submission Methods

Submitting the AD 19 Indiana Department Of Revenue Affidavit For can be done through various methods. Individuals have the option to submit the form online via the Indiana Department of Revenue's electronic filing system, which provides a convenient and efficient way to complete the process. Alternatively, the completed affidavit can be mailed to the designated address provided on the form. In some cases, individuals may also choose to deliver the form in person at their local revenue office. It is important to check the submission guidelines to ensure compliance with state requirements.

Key elements of the AD 19 Indiana Department Of Revenue Affidavit For

Several key elements must be included in the AD 19 Indiana Department Of Revenue Affidavit For to ensure its validity. These include the full name and contact information of the individual or entity submitting the affidavit, the specific purpose of the affidavit, and a detailed declaration of the information being provided. Additionally, the form must include a signature and date to verify the authenticity of the submission. Ensuring that all required elements are present is crucial for the affidavit's acceptance by the Indiana Department of Revenue.

Quick guide on how to complete ad 19 indiana department of revenue af davit for

Complete AD 19 Indiana Department Of Revenue Af? Davit For seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to access the appropriate forms and securely save them online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage AD 19 Indiana Department Of Revenue Af? Davit For across any platform with airSlate SignNow's Android or iOS applications and streamline any document-driven process today.

How to modify and eSign AD 19 Indiana Department Of Revenue Af? Davit For effortlessly

- Find AD 19 Indiana Department Of Revenue Af? Davit For and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign AD 19 Indiana Department Of Revenue Af? Davit For and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ad 19 indiana department of revenue af davit for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AD 19 Indiana Department Of Revenue Af? Davit For?

The AD 19 Indiana Department Of Revenue Af? Davit For is a specific form used for tax filings in Indiana. It helps individuals and businesses report their income and deductions accurately. Utilizing airSlate SignNow allows users to complete and eSign this document efficiently.

-

How can airSlate SignNow streamline the AD 19 Indiana Department Of Revenue Af? Davit For process?

airSlate SignNow offers an intuitive interface that simplifies the completion of the AD 19 Indiana Department Of Revenue Af? Davit For form. Users can easily fill in the required fields and send documents for eSigning, reducing the time spent on paperwork. This ensures timely submission and compliance with tax deadlines.

-

What pricing plans are available for using airSlate SignNow for AD 19 Indiana Department Of Revenue Af? Davit For?

airSlate SignNow provides several pricing plans to fit various business needs. These plans include features tailored for individual users to larger teams needing to manage forms such as the AD 19 Indiana Department Of Revenue Af? Davit For. You can choose a plan based on the number of users and the features required.

-

Are there any integrations available with airSlate SignNow for the AD 19 Indiana Department Of Revenue Af? Davit For?

Yes, airSlate SignNow seamlessly integrates with various applications and platforms to enhance the eSigning process for the AD 19 Indiana Department Of Revenue Af? Davit For. This includes integrations with cloud storage services, CRMs, and other document management systems, which help in automating workflows and improving efficiency.

-

What are the benefits of using airSlate SignNow for tax documents like the AD 19 Indiana Department Of Revenue Af? Davit For?

Using airSlate SignNow for your tax documents provides several benefits, including improved accuracy, faster turnaround times, and enhanced security. It eliminates paper-based processes, allowing you to manage the AD 19 Indiana Department Of Revenue Af? Davit For digitally. This results in a more organized and stress-free tax preparation experience.

-

How secure is my information when using airSlate SignNow for the AD 19 Indiana Department Of Revenue Af? Davit For?

airSlate SignNow prioritizes your security with top-notch encryption and compliance with industry standards. When you use airSlate SignNow for your AD 19 Indiana Department Of Revenue Af? Davit For, you can be confident that your personal and financial information is protected. Regular security audits and updates ensure that the platform remains secure against threats.

-

Can I access the AD 19 Indiana Department Of Revenue Af? Davit For on mobile devices with airSlate SignNow?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing you to access and eSign the AD 19 Indiana Department Of Revenue Af? Davit For from your smartphone or tablet. This flexibility ensures that you can manage your tax documents on the go, making it convenient and efficient.

Get more for AD 19 Indiana Department Of Revenue Af? Davit For

- Fillable online form dvat 35a dnhctdgovin fax email

- Jsu eduregistrarincomplete grade completionincomplete grade completion plan form office of the registrar

- Report writing manual sacramento state form

- Lesson plans amp course syllabus form

- Gba student mentoring report form monthly gracechatt

- Personnel requisition form shasta college

- Official name change request fort hays state university fhsu form

- Registration form cecil college cecil

Find out other AD 19 Indiana Department Of Revenue Af? Davit For

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure