State of Tennessee Limited Liability Partnership Foreign Form

What is the State of Tennessee Limited Liability Partnership Foreign Form

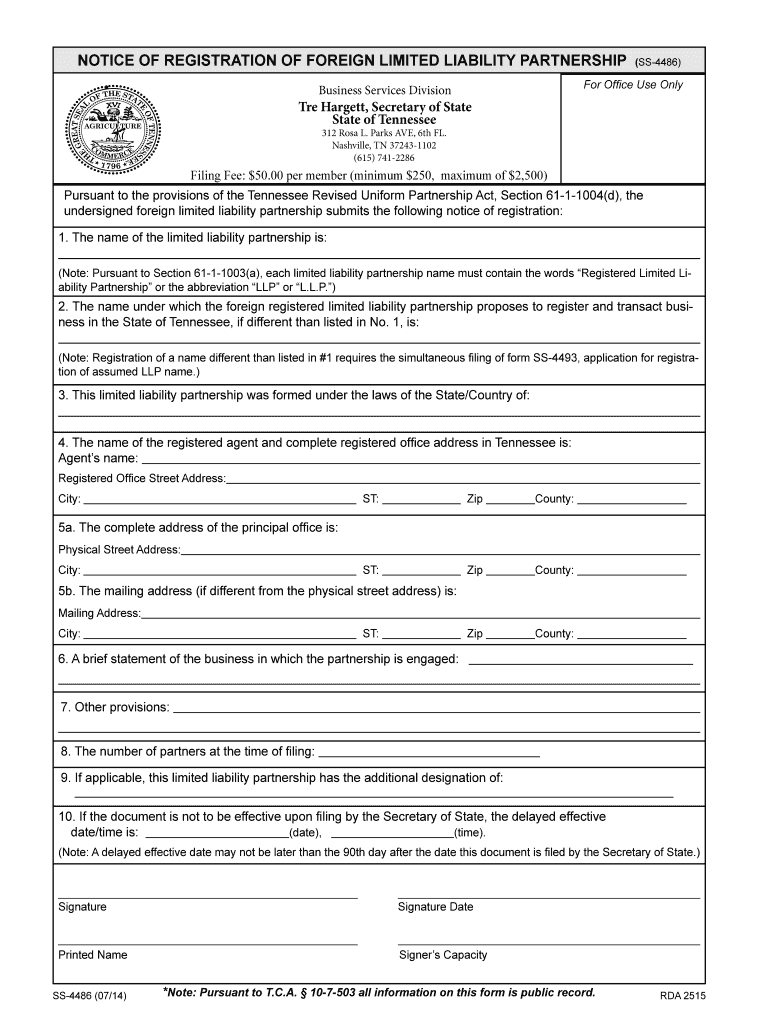

The State of Tennessee Limited Liability Partnership Foreign Form is a legal document required for businesses that are organized in another state but wish to operate in Tennessee as a foreign limited liability partnership (LLP). This form ensures that the business complies with Tennessee laws and regulations while establishing its presence in the state. Filing this form is essential for foreign entities to gain the legal authority to conduct business activities in Tennessee.

Required Documents

To successfully complete the State of Tennessee Limited Liability Partnership Foreign Form, several documents are necessary. These typically include:

- Certificate of Good Standing or Existence from the home state

- Copy of the partnership agreement

- Application for registration

- Payment for the filing fee

Gathering these documents beforehand can streamline the registration process and ensure compliance with state requirements.

Steps to Complete the State of Tennessee Limited Liability Partnership Foreign Form

Completing the State of Tennessee Limited Liability Partnership Foreign Form involves several key steps:

- Obtain the required documents, including the Certificate of Good Standing.

- Fill out the application form accurately, providing all necessary information about the partnership.

- Submit the application along with the required documents and payment for the filing fee.

- Await confirmation from the state, which will indicate whether the registration was successful.

Following these steps carefully can help ensure a smooth registration process for your foreign LLC in Tennessee.

Legal Use of the State of Tennessee Limited Liability Partnership Foreign Form

The legal use of the State of Tennessee Limited Liability Partnership Foreign Form is critical for businesses looking to operate legally within the state. This form not only registers the business but also provides it with certain legal protections and rights under Tennessee law. It is important to ensure that the information provided is accurate and that all required documents are submitted to avoid any legal complications.

Eligibility Criteria

To qualify for filing the State of Tennessee Limited Liability Partnership Foreign Form, certain eligibility criteria must be met. The business must be a limited liability partnership formed under the laws of another state. Additionally, the partnership must be in good standing in its home state, as evidenced by the Certificate of Good Standing. Meeting these criteria is essential for successful registration and operation in Tennessee.

Form Submission Methods

The State of Tennessee Limited Liability Partnership Foreign Form can be submitted through various methods, including:

- Online submission via the Tennessee Secretary of State’s website

- Mailing the completed form and documents to the appropriate state office

- In-person submission at designated state offices

Choosing the right submission method can depend on the urgency and convenience for the business.

Quick guide on how to complete state of tennessee limited liability partnership foreign form

Finalize State Of Tennessee Limited Liability Partnership Foreign Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle State Of Tennessee Limited Liability Partnership Foreign Form on any platform with airSlate SignNow Android or iOS applications and streamline any document-related processes today.

The easiest way to alter and eSign State Of Tennessee Limited Liability Partnership Foreign Form with ease

- Obtain State Of Tennessee Limited Liability Partnership Foreign Form and then click Get Form to begin.

- Utilize the tools we provide to finish your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign State Of Tennessee Limited Liability Partnership Foreign Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can a foreigner (a non-citizen living outside the U.S.) form a limited liability company (LLC) in the United States?

Yes, anyone in the world can create an LLC in the United States. You never need the visit the United States to do so, it can be done by fax in many states, by mail in the rest, and by lawyer in all of them.Merely holding an ownership interest in an LLC (a passive member) is unlikely the violate the terms of any visa, despite generating self-employment income; but you'll want to consult an immigration attorney. Being an active member while present in the United States can, as you would require work authorization.The tax implications of owning an LLC depends upon the nature of the income. Unless the only income is from passive investments and/or personal services performed outside of the United States; it would otherwise likely give rise to income effectively connected to a trade or business in the United States, and thus be taxable even for a non-resident alien.

-

Is it legal for a limited liability partnership (LLP) to raise money in India in the form of donations?

Disclaimer : I'm not a lawyerAs long as I know, you can not use an LLP for not-for-profit activity. It has to be for-profit only. Donations generally mean that you are going ahead for not-profit which in this case would make it illegal. Make sure you prove your entity to be a commercial for-profit entity and then do business. For donations I may suggest you form a trust(making the LLP a trustee) to raise donations.You may want to go and talk to a lawyer before you proceed.

-

Is it legal for a limited liability partnership (LLP) to raise money in India in the form of investments?

An LLP is a hybrid business structure which offers the operational flexibility of a partnership vis-à-vis the advantages of limited liability and separate identity of a company. Thus, an LLP is a blend of the advantages of both a general partnership as well as an incorporated company. The compliance requirements of an LLP, although is slightly more than that of a general partnership, is still much less than what is required for an LLC. An LLP is more suited to small businesses that are not looking forward to getting burdened by the tax compliance requirements of a corporation.An LLP, much like a corporation can continue to exist despite the outgo and incoming of any partner. In that, an LLP has perpetual succession like a company. An LLP has a legal entity separate from its partners and is liable to the full extent of its assets. However, unlike a general partnership, any liability of the partnership in case of an LLP cannot signNow its hands to the throats of the partners to any more than the extent to which the partners have agreed to contribute in the LLP. Thus, in case of an LLP, partners have what may be looked upon as some kind of protection, unlike in general partnerships where partners are personally liable and creditors can have claim to even the personal assets of the partners.Reasons Why VCs Don’t Invest in LLPsNew WatersInvestors like to invest in business structures which are tried and tested. While the corporation has been there for decades, the Limited Liability Partnership structure is one which is of recent origin. Even in India, the act that governs LLPs, the Limited Liability Partnership Act, 2008 was only notified on March 30, 2009. Hence, because investors have spent relatively much lesser time with this structure, they tend to go with more trusted business structures and end up favoring the corporation over anything else most of the time. As we know, it takes a lot of time and effort to make a decision regarding whether or not to invest in a particular venture, after analyzing its growth potential, associated risks etc. Thus, no investor would like their position and money to be put on stake by enhancing the risks by investing in an unknown business structure.Particular VentureIt is a fact that LLPs are governed by their LLP agreements. This makes it possible and possible for LLPs to bring in clauses in the agreement order to fix time limits for the duration of the business. Thus, if there is such a provision in the agreement that allows an LLP to come to an end, LLPs can choose to get wound up or have their names struck off from the name of the LLPs after the fixed time limit in the agreement has elapsed or the purpose or objective with which the LLP was formed has been realized. Since gaining returns on an investment can be a lengthy and time taking thing, investors are more often particular to not invest in ventures which might cease to exist soon.Limited Legal RecourseIt is known for a fact that in LLPs, unlike general partnerships, any claim on the venture cannot signNow its hand on the partners’ neck beyond what they have agreed to contribute in the business. For instance, if a partner has agreed to contribute Rs. 10 lakhs and has paid Rs. 7 lakhs, on a claim on the LLP, the partner cannot be compelled to pay a penny beyond Rs. 3 lakhs (the remaining amount). And if the claimant’s claim is still not satisfied, he cannot compel the partner to pay beyond the remaining amount. The immediate implication of this fact is that there is less security of the money invested by a VC in an LLP because the money that they will be investing might up end in the managing partner’s own pockets and the investors shall not be left with much legal recourse to contest. For this reason too, VCs prefer private limited companies where the only mechanisms to extract capital from a company is either dividend or liquidation of the company and in each case, an approval from the Board of Directors is required. And it is a known fact that investors usually have much control on the Board, so this means that there is sufficient security for their money.ScalabilityInvestors do not only invest for quick money making. They are interested in seeing the business grow over the years while maintaining a stake in the same. On the other hand, LLPs are known to be a model unsuited for large businesses and is rather advised for professional service providers such as lawyers, accountants etc. Companies that have high growth potentials such as those working in the fields of technology or life sciences etc. are expected to be organized and structured as corporations and not as LLPs. Since such opportunities are capable of providing the financial returns VCs look forward to, they like to invest in corporations and not in LLPs. Businesses structured as LLPs can be a little disadvantageous for an investor who wants to see the business grow.No concept of shares like corporationsLLPs do not have any concept of shares, unlike the corporations. Investors usually like to look at an employee stock pool before they invest. While VCs are not forbidden from investing in LLPs and can secure an interest in the same, the safety as well as the return of their investment can be cleanly scoped out in the form of shares the concept of which only exists for corporations and not for LLPs.Shareholders are PartnersIn an LLP it is a must for all shareholders to be partners, while the same does not hold good in case of corporations. The outlook of VCs towards investment is usually that against the money they put in, they would like to have more control in the venture rather than getting burdened with more responsibilities. In an LLP, since every shareholder must be a partner, for a VC it means that they too will have to be a partner if they are willing to hold interests in the LLP. On the other hand, this is not a requirement in case of corporations where shareholders exercise much control on the Board of Directors and don’t have to essentially get burdened with responsibilities. In case of companies, VCs have more a sort of commanding position without much responsibility and this affects their interests in the long run.Rights of PartnersIt is possible to structure an LLP in a manner where one partner has more rights than another. Thus, unlike in corporations, the one vote per share system does not exist in case of LLPs. This means that despite having a majority share in an LLP, the position of the VCs can be compromised if they have less rights than the other partners.Exit OptionWhile a VC can buy an interest in an LLP, the fact remains that LLPs cannot be listed on a stock exchange for the mere reason that they are not the same as public companies. What this means for VCs is one of their exit routs is cut off, condemning any deal with an LLP of any size. Companies are capable of providing successful exit events within the required time frame which VCs expect. Since VCs usually want to have a planned exit event (usually in the form of an IPO or an acquisition) within three to seven years, LLPs are not what they prefer.

-

Why Indians don't prefer to come under organised form of business like one person company or limited liability partnership (LLP)?

The first LLP was registered on the 2nd of April, 2009As of 3rd June, 2017 a Total of 96020 LLP’s have been registered in India.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the state of tennessee limited liability partnership foreign form

How to create an electronic signature for your State Of Tennessee Limited Liability Partnership Foreign Form in the online mode

How to generate an electronic signature for the State Of Tennessee Limited Liability Partnership Foreign Form in Google Chrome

How to make an eSignature for signing the State Of Tennessee Limited Liability Partnership Foreign Form in Gmail

How to make an eSignature for the State Of Tennessee Limited Liability Partnership Foreign Form straight from your mobile device

How to make an electronic signature for the State Of Tennessee Limited Liability Partnership Foreign Form on iOS

How to create an eSignature for the State Of Tennessee Limited Liability Partnership Foreign Form on Android devices

People also ask

-

What is the State Of Tennessee Limited Liability Partnership Foreign Form?

The State Of Tennessee Limited Liability Partnership Foreign Form is a legal document required for foreign entities wishing to conduct business in Tennessee. It allows these entities to register as a limited liability partnership within the state, ensuring compliance with Tennessee laws and regulations.

-

How do I file the State Of Tennessee Limited Liability Partnership Foreign Form?

To file the State Of Tennessee Limited Liability Partnership Foreign Form, you must complete the necessary application and submit it to the Tennessee Secretary of State's office. This process can often be streamlined using airSlate SignNow, which provides an easy-to-use platform for signing and sending documents electronically.

-

What are the benefits of using airSlate SignNow for the State Of Tennessee Limited Liability Partnership Foreign Form?

Using airSlate SignNow for the State Of Tennessee Limited Liability Partnership Foreign Form offers several benefits, including a user-friendly interface, the ability to eSign documents quickly, and secure storage of your files. Additionally, it can save you time and reduce paperwork, making the filing process more efficient.

-

Is there a cost associated with the State Of Tennessee Limited Liability Partnership Foreign Form?

Yes, there is typically a filing fee associated with the State Of Tennessee Limited Liability Partnership Foreign Form, which can vary depending on the specifics of your application. Using airSlate SignNow can help you manage these costs effectively with its affordable pricing plans for document management.

-

Can airSlate SignNow integrate with other software for managing the State Of Tennessee Limited Liability Partnership Foreign Form?

Absolutely! airSlate SignNow can integrate with various software solutions, allowing for seamless management of the State Of Tennessee Limited Liability Partnership Foreign Form. This enables you to streamline your workflow and keep all your business documents organized in one place.

-

What features does airSlate SignNow offer for the State Of Tennessee Limited Liability Partnership Foreign Form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking for the State Of Tennessee Limited Liability Partnership Foreign Form. These features enhance your ability to manage your forms efficiently and ensure that all documents are completed accurately and on time.

-

How can I ensure my State Of Tennessee Limited Liability Partnership Foreign Form is completed accurately?

To ensure your State Of Tennessee Limited Liability Partnership Foreign Form is completed accurately, you can utilize airSlate SignNow's built-in validation tools and templates. Additionally, our platform allows for multiple users to review and sign documents, which helps minimize errors and ensures compliance.

Get more for State Of Tennessee Limited Liability Partnership Foreign Form

- Short sale addendum to multi board residential irela form

- 509 fha va addendum to buy and sell agreement form

- Team medical release form

- Soccer waiver form

- The markov process model of labor force activity extended tables bb form

- Independent contractor analysis florida department of revenue form

- Kma sacco loan application form

- Fsm social security form

Find out other State Of Tennessee Limited Liability Partnership Foreign Form

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer