Independent Contractor Analysis Florida Department of Revenue 2013

What is the Independent Contractor Analysis Florida Department Of Revenue

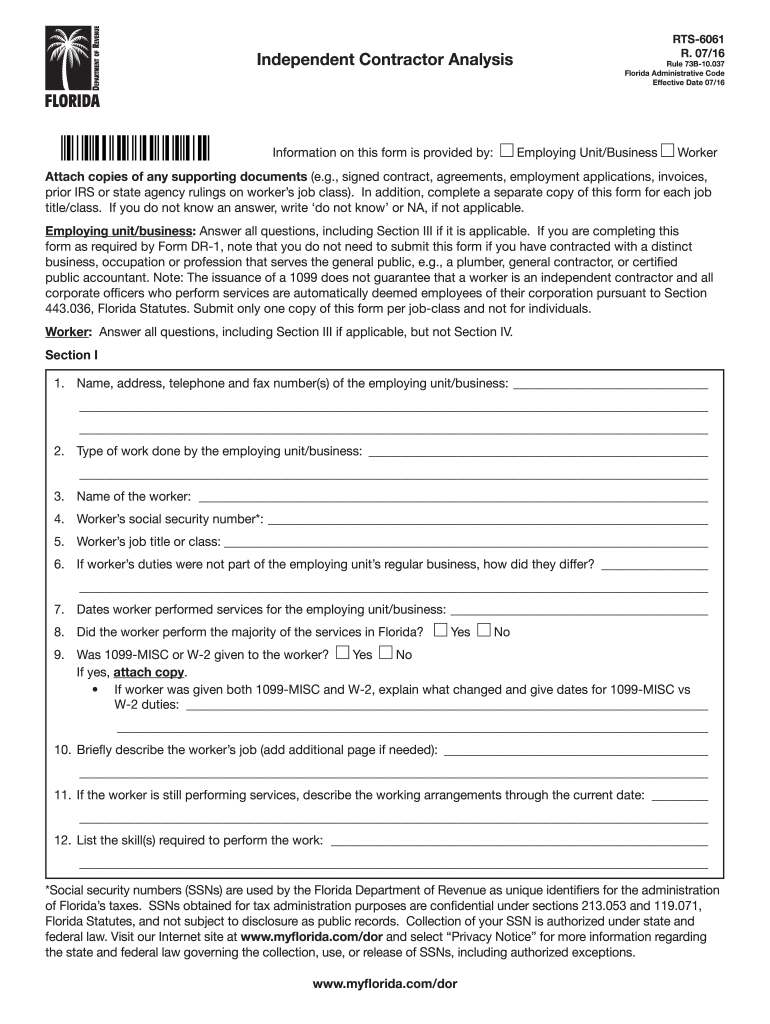

The Independent Contractor Analysis Florida Department Of Revenue is a specific form used to determine the classification of workers as independent contractors or employees. This classification is crucial for tax purposes, as it affects how income is reported and taxed. The form helps businesses comply with state regulations and ensures proper tax reporting. It provides a structured way to analyze the relationship between the worker and the business, considering factors such as control, independence, and the nature of the work performed.

Steps to complete the Independent Contractor Analysis Florida Department Of Revenue

Completing the Independent Contractor Analysis Florida Department Of Revenue involves several key steps:

- Gather necessary information about the worker and the work arrangement.

- Review the criteria for classification set by the Florida Department of Revenue.

- Fill out the form accurately, ensuring all relevant fields are completed.

- Sign the form using a legally recognized eSignature solution, such as signNow.

- Submit the form electronically or via mail, depending on your preference.

By following these steps, businesses can ensure they meet compliance requirements while simplifying the process of worker classification.

Legal use of the Independent Contractor Analysis Florida Department Of Revenue

The Independent Contractor Analysis Florida Department Of Revenue is legally recognized as a tool for determining worker classification. Proper use of this form helps businesses avoid misclassification, which can lead to penalties and back taxes. It is essential to adhere to the guidelines provided by the Florida Department of Revenue to ensure the form is valid. This includes understanding the legal implications of worker classification and maintaining accurate records to support the classification decision.

Key elements of the Independent Contractor Analysis Florida Department Of Revenue

Several key elements are essential when completing the Independent Contractor Analysis Florida Department Of Revenue:

- Worker Information: Details about the worker, including name, address, and Social Security number.

- Business Information: The business's name, address, and employer identification number.

- Nature of Work: A description of the services provided by the worker.

- Control Factors: Information regarding the level of control the business has over the worker.

- Payment Terms: Details about how and when the worker will be compensated.

These elements are crucial for accurately assessing the worker's classification and ensuring compliance with state regulations.

Filing Deadlines / Important Dates

When dealing with the Independent Contractor Analysis Florida Department Of Revenue, it is important to be aware of relevant deadlines. Filing deadlines may vary based on the specific tax year and the business's reporting schedule. Generally, businesses should aim to complete and submit the form as soon as the worker's classification is determined. This proactive approach helps avoid potential penalties associated with late filings and ensures compliance with state regulations.

Form Submission Methods (Online / Mail / In-Person)

The Independent Contractor Analysis Florida Department Of Revenue can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Completing and submitting the form electronically through a secure platform.

- Mail: Printing the completed form and sending it to the appropriate Florida Department of Revenue address.

- In-Person: Delivering the form directly to a local Florida Department of Revenue office.

Choosing the right submission method can enhance efficiency and ensure timely processing of the form.

Quick guide on how to complete independent contractor analysis florida department of revenue

Your assistance manual on how to prepare your Independent Contractor Analysis Florida Department Of Revenue

If you are wondering how to create and submit your Independent Contractor Analysis Florida Department Of Revenue, here are some straightforward guidelines to simplify the tax submission process.

To begin, you just need to register your airSlate SignNow account to transform your online document management. airSlate SignNow is an extremely user-friendly and powerful document platform that enables you to modify, create, and finalize your tax forms effortlessly. With its editor, you can switch between text, checkboxes, and eSignatures, and return to edit information as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and intuitive sharing options.

Follow the instructions below to complete your Independent Contractor Analysis Florida Department Of Revenue within minutes:

- Set up your account and start processing PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Select Get form to launch your Independent Contractor Analysis Florida Department Of Revenue in our editor.

- Complete the required fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and amend any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper may lead to return errors and delays in refunds. Additionally, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct independent contractor analysis florida department of revenue

FAQs

-

How do you fill out a W2 tax form if I'm an independent contractor?

Thanks for asking.If you are asking how to report your income as an independent contractor, then you do not fill out a W-2. You will report your income on your federal tax return on Schedule C which will have on which you list all of your non-employee income and associated expenses. The resulting net income, transferred to Schedule A is what you will pay self-employment and federal income tax on. If this too confusing, either get some good tax reporting software or get a tax professional to help you with it.If you are asking how to fill out a W-2 for someone that worked for you, either get some good tax reporting software or get a tax professional to help you with it.This is not tax advice, it is only my opinion on how to answer this question.

-

Does a NAFTA TN Management consultant in the U.S. still need to fill out an i-9 form even though they are an independent contractor?

Yes.You must still prove work authorization even though you are a contractor. You will fill out the I9 and indicate that you are an alien authorized to work, and provide the relevant details of your TN visa in support of your application.Hope this helps.

-

When you start working as an independent contractor for companies like Leapforce/Appen, how do you file for taxes? Do you fill out the W-8BEN form?

Austin Martin’s answer is spot on. When you are an independent contractor, you are in business for yourself. In other words, you are the business! That means you must pay taxes, and since you aren’t an employee of someone else, you have to make estimated tax payments, which will be “squared up” at year end when you file your tax return

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the independent contractor analysis florida department of revenue

How to generate an eSignature for the Independent Contractor Analysis Florida Department Of Revenue online

How to make an eSignature for the Independent Contractor Analysis Florida Department Of Revenue in Google Chrome

How to make an electronic signature for signing the Independent Contractor Analysis Florida Department Of Revenue in Gmail

How to generate an eSignature for the Independent Contractor Analysis Florida Department Of Revenue right from your smartphone

How to make an electronic signature for the Independent Contractor Analysis Florida Department Of Revenue on iOS devices

How to create an electronic signature for the Independent Contractor Analysis Florida Department Of Revenue on Android OS

People also ask

-

What is the Independent Contractor Analysis Florida Department Of Revenue?

The Independent Contractor Analysis Florida Department Of Revenue is a process used to determine whether a worker is classified as an independent contractor or an employee. This classification is crucial for tax purposes and regulatory compliance. Understanding this analysis helps businesses avoid potential penalties and ensure accurate tax reporting.

-

How can airSlate SignNow assist with the Independent Contractor Analysis Florida Department Of Revenue?

airSlate SignNow streamlines the document management process required for the Independent Contractor Analysis Florida Department Of Revenue. Our platform enables you to create, send, and securely eSign essential forms and agreements efficiently. This simplifies compliance and provides a clear record of your contractor agreements.

-

What features does airSlate SignNow offer for managing independent contractor documentation?

airSlate SignNow offers a variety of features including customizable templates, real-time tracking, and automated reminders for eSigning. These features help you manage all documents related to the Independent Contractor Analysis Florida Department Of Revenue seamlessly. This not only saves time but ensures you remain compliant with state regulations.

-

Is airSlate SignNow a cost-effective solution for small businesses?

Yes, airSlate SignNow provides a cost-effective solution ideal for small businesses looking to streamline their document processes. By utilizing our tools for the Independent Contractor Analysis Florida Department Of Revenue, businesses can save money on paper, ink, and postage. Our competitive pricing plans reflect our commitment to affordability and accessibility.

-

What are the benefits of using airSlate SignNow for independent contractor management?

Using airSlate SignNow for independent contractor management offers multiple benefits, including improved efficiency and enhanced compliance with the Independent Contractor Analysis Florida Department Of Revenue. The platform's user-friendly interface allows quick document access and management. Additionally, it mitigates errors often associated with manual documentation.

-

Can airSlate SignNow integrate with other business tools for better workflow?

Absolutely! airSlate SignNow integrates with popular business tools like Google Drive, Dropbox, and various CRM systems. These integrations enhance your workflow and simplify the process of managing documentation related to the Independent Contractor Analysis Florida Department Of Revenue. This ensures that all your relevant documents are organized and easily accessible.

-

What security features does airSlate SignNow provide for sensitive documents?

AirSlate SignNow incorporates industry-leading security measures to protect your sensitive documents during the Independent Contractor Analysis Florida Department Of Revenue process. Features like encrypted data transmission, secure cloud storage, and user authentication ensure that your information remains safe and confidential. Trust in our technology to keep your documents secure.

Get more for Independent Contractor Analysis Florida Department Of Revenue

Find out other Independent Contractor Analysis Florida Department Of Revenue

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent