SHORT SALE ADDENDUM to MULTI BOARD RESIDENTIAL Irela Form

Understanding the short sale addendum

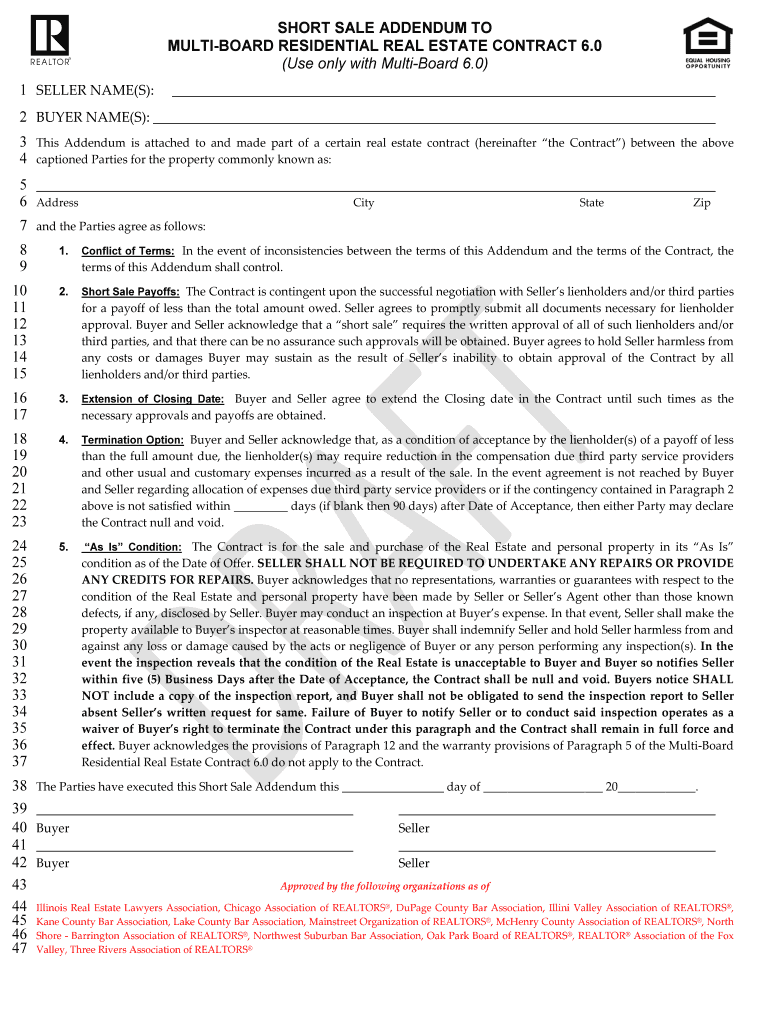

The short sale addendum to multi board residential Irela is a crucial document in real estate transactions, particularly when dealing with properties that are sold for less than the outstanding mortgage balance. This addendum outlines the terms and conditions under which the sale will occur, ensuring that all parties involved are aware of their rights and obligations. It serves as a formal agreement that helps facilitate the short sale process, protecting both the seller and the buyer.

How to complete the short sale addendum

Completing the short sale addendum involves several key steps. First, gather all necessary information, including property details, seller and buyer information, and any relevant financial data. Next, fill out each section of the addendum carefully, ensuring accuracy in all entries. It is advisable to review the document thoroughly for completeness and clarity. Once completed, all parties must sign the addendum to make it legally binding. Utilizing a digital signing platform can streamline this process, ensuring that signatures are captured securely and efficiently.

Key elements of the short sale addendum

The short sale addendum includes several essential components that must be addressed to ensure its effectiveness. Key elements typically include:

- Property Information: Details about the property being sold, including the address and legal description.

- Seller and Buyer Details: Full names and contact information of all parties involved in the transaction.

- Terms of Sale: Specific conditions under which the sale will occur, including any contingencies related to financing or inspections.

- Approval Conditions: Requirements for obtaining lender approval for the short sale.

- Disclosure of Liens: Information about any existing liens or encumbrances on the property.

Legal considerations for the short sale addendum

When using the short sale addendum, it is crucial to understand the legal implications involved. The addendum must comply with state and federal regulations governing real estate transactions. This includes ensuring that all disclosures are made and that the document is executed in accordance with applicable laws. Additionally, it is advisable to consult with a legal professional to ensure that the addendum adequately protects the interests of all parties and meets the necessary legal standards.

Obtaining the short sale addendum

The short sale addendum can typically be obtained through real estate professionals, such as agents or brokers, who are familiar with the short sale process. It may also be available through legal resources or real estate associations. For convenience, many users opt to access templates online, ensuring that they have the most current version of the addendum. When using a template, it is essential to customize the document to fit the specific details of the transaction.

Examples of using the short sale addendum

Examples of scenarios where the short sale addendum is utilized include:

- A homeowner facing foreclosure who needs to sell their property quickly to avoid further financial loss.

- A buyer interested in purchasing a property at a reduced price due to the seller's financial difficulties.

- Real estate investors looking to acquire properties below market value through short sales.

In each case, the short sale addendum serves to clarify the terms of the sale and protect the interests of all parties involved.

Quick guide on how to complete short sale addendum to multi board residential irela

Complete SHORT SALE ADDENDUM TO MULTI BOARD RESIDENTIAL Irela smoothly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and safely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly and without delays. Manage SHORT SALE ADDENDUM TO MULTI BOARD RESIDENTIAL Irela on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign SHORT SALE ADDENDUM TO MULTI BOARD RESIDENTIAL Irela effortlessly

- Obtain SHORT SALE ADDENDUM TO MULTI BOARD RESIDENTIAL Irela and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Choose your preferred method of delivering your form, whether it be via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow efficiently meets your document management needs in just a few clicks from any device you prefer. Modify and eSign SHORT SALE ADDENDUM TO MULTI BOARD RESIDENTIAL Irela and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I declare a short term capital gain tax in the ITR in India? I want to know about the ITR form number and where and what to fill in the details. This is my first time to pay a short term capital gain tax on an equity sale.

The selection of ITR form will depend upon the type of one's income.For Income from salary, house property, capital gains for ITR2 is suggestedHowever for income from above heads and business/profession ITR4 is suggestedIn both the forms under head CG, revenue from sale of equity shares are required to be mentioned along with purchase amount and expenses incurred on sale are also required to be mentioned.For short term and long term separate rows are there.Just fill up and it will take the net capital gain to respective cell in computation if income.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the short sale addendum to multi board residential irela

How to generate an electronic signature for the Short Sale Addendum To Multi Board Residential Irela online

How to create an eSignature for the Short Sale Addendum To Multi Board Residential Irela in Chrome

How to generate an electronic signature for putting it on the Short Sale Addendum To Multi Board Residential Irela in Gmail

How to generate an electronic signature for the Short Sale Addendum To Multi Board Residential Irela right from your mobile device

How to make an electronic signature for the Short Sale Addendum To Multi Board Residential Irela on iOS devices

How to make an eSignature for the Short Sale Addendum To Multi Board Residential Irela on Android devices

People also ask

-

What is an addendum short form and how is it used?

An addendum short form is a concise document used to modify or add to a contract or agreement. It efficiently outlines the changes in a clear manner that all parties can understand, making it essential for legal clarity. Businesses can utilize an addendum short form to ensure all adjustments are documented without rewriting an entire contract.

-

How does airSlate SignNow streamline the process of creating an addendum short form?

airSlate SignNow simplifies the creation of an addendum short form by offering customizable templates and an easy-to-use interface. Users can quickly edit existing documents or create new addenda in minutes, ensuring rapid turnaround times. This user-friendly approach minimizes the hassle often associated with legal documentation.

-

Is there a cost associated with using airSlate SignNow for addendum short forms?

Yes, airSlate SignNow offers affordable pricing plans catering to various business needs, including those focused on creating addendum short forms. You can choose a plan that suits your budget while still accessing powerful features for document management and eSigning. Consider taking advantage of the free trial to explore all available features.

-

What features make airSlate SignNow ideal for managing addendum short forms?

airSlate SignNow provides features such as document templates, customizable workflows, and secure eSigning to enhance the management of addendum short forms. Additionally, audit trails and compliance functionalities help ensure that all changes are tracked and legally binding. These features make it a comprehensive solution for all your document needs.

-

Can I integrate airSlate SignNow with other software for addendum short forms?

Absolutely! airSlate SignNow seamlessly integrates with a variety of software tools, enhancing your ability to handle addendum short forms alongside other business applications. This integration capability ensures that you can streamline your workflow and connect with platforms such as CRM systems and cloud storage solutions for optimal efficiency.

-

What are the benefits of using an addendum short form in business transactions?

Using an addendum short form in business transactions allows for clear and precise modifications to existing agreements, reducing the potential for misunderstandings. This document aids in maintaining legal compliance while saving time and resources compared to fully rewriting contracts. It's a practical tool for effective communication within and outside your organization.

-

How secure is the process of signing an addendum short form with airSlate SignNow?

The security of signing an addendum short form with airSlate SignNow is a top priority, as the platform employs advanced encryption and secure storage practices. All electronic signatures are legally compliant and verifiable, ensuring your documents are protected. Additionally, the platform provides user authentication features to safeguard sensitive information.

Get more for SHORT SALE ADDENDUM TO MULTI BOARD RESIDENTIAL Irela

- Agreement between contractor form

- Condominium 497329953 form

- Instruction to jury that unauthorized sale of personal property can constitute conversion 497329954 form

- Instruction to jury regarding compensatory damages for conversion form

- Instruction to jury regarding damages for conversion by lienholder form

- Interrogatories template 497329957 form

- Instruction to jury regarding damages for wrongful foreclosure 497329958 form

- Claimants first set of requests for production form

Find out other SHORT SALE ADDENDUM TO MULTI BOARD RESIDENTIAL Irela

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple