Arizona Tax Withholding Form

What is the Arizona Tax Withholding Form

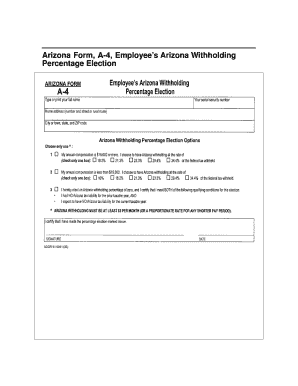

The Arizona Tax Withholding Form, also known as the A-4 form, is a crucial document used by employers in Arizona to determine the amount of state income tax to withhold from employees' paychecks. This form allows employees to specify their withholding preferences based on their individual tax situations. Understanding this form is essential for both employers and employees to ensure compliance with Arizona state tax regulations.

How to use the Arizona Tax Withholding Form

To use the Arizona Tax Withholding Form effectively, employees must complete it accurately and submit it to their employer. The form requires personal information such as name, address, and Social Security number, along with details about the withholding allowances. Employers use this information to calculate the correct withholding amount from each paycheck, which directly impacts an employee's take-home pay and tax obligations.

Steps to complete the Arizona Tax Withholding Form

Completing the Arizona Tax Withholding Form involves several straightforward steps:

- Provide your personal information, including your name, address, and Social Security number.

- Indicate your filing status, such as single or married.

- Claim any allowances based on your tax situation, which can reduce the amount withheld.

- Sign and date the form to certify the accuracy of the information provided.

- Submit the completed form to your employer for processing.

Legal use of the Arizona Tax Withholding Form

The Arizona Tax Withholding Form is legally binding when completed and submitted according to state regulations. Employers are required to use the information provided on this form to ensure proper withholding of state income tax. Failure to comply with these regulations can result in penalties for both employers and employees, making it essential to handle this form with care.

Form Submission Methods

Employees can submit the Arizona Tax Withholding Form to their employer through various methods. The most common submission methods include:

- In-person delivery at the workplace.

- Mailing the completed form to the employer's payroll department.

- Submitting electronically, if the employer offers a digital submission option.

Who Issues the Form

The Arizona Department of Revenue is responsible for issuing the Arizona Tax Withholding Form. Employers can obtain the form directly from the department's website or through authorized tax professionals. It is important to ensure that the most current version of the form is used to comply with state tax laws.

Penalties for Non-Compliance

Non-compliance with the Arizona Tax Withholding Form requirements can lead to significant penalties. Employers who fail to withhold the correct amount of state income tax may face fines and interest on unpaid taxes. Employees may also be subject to underpayment penalties if they do not have enough tax withheld throughout the year, which can affect their overall tax liability.

Quick guide on how to complete arizona tax withholding form

Complete Arizona Tax Withholding Form effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents quickly and efficiently. Manage Arizona Tax Withholding Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Arizona Tax Withholding Form with ease

- Obtain Arizona Tax Withholding Form and click on Get Form to initiate the process.

- Utilize the available tools to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your device of choice. Edit and eSign Arizona Tax Withholding Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona tax withholding form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Arizona income tax?

airSlate SignNow is an innovative platform that enables businesses to send and eSign documents efficiently. For those managing Arizona income tax documents, it offers a streamlined solution to ensure timely submissions and compliance with state regulations.

-

How can airSlate SignNow help with the preparation of Arizona income tax documents?

With airSlate SignNow, you can easily create, send, and sign Arizona income tax forms. The platform supports various document formats, ensuring you have everything needed to prepare your taxes without the hassle of paper documents.

-

What are the pricing plans for airSlate SignNow for Arizona income tax services?

airSlate SignNow offers competitive pricing plans tailored to fit the needs of businesses submitting Arizona income tax documents. These plans provide access to essential features, ensuring you get the best value while managing your tax documents.

-

What features does airSlate SignNow offer that are beneficial for managing Arizona income tax?

airSlate SignNow includes features like customizable templates, bulk sending, and real-time tracking, which are particularly useful for managing Arizona income tax paperwork. These tools simplify the signing process, helping you stay organized and compliant.

-

Is airSlate SignNow compliant with Arizona income tax regulations?

Yes, airSlate SignNow is designed to comply with various state regulations including those for Arizona income tax. By using this platform, you can be confident that your electronic signatures and documents meet the legal requirements for tax submissions.

-

Can I integrate airSlate SignNow with accounting software for Arizona income tax?

Absolutely! airSlate SignNow integrates seamlessly with many accounting software solutions, making it easier to handle Arizona income tax-related documents. This integration enhances workflow efficiency and ensures accurate records for your tax filings.

-

What are the benefits of using airSlate SignNow for Arizona income tax e-signatures?

Using airSlate SignNow for Arizona income tax e-signatures ensures faster processing and enhanced security. Electronic signatures are legally binding and provide an automated way to manage documentation, which can signNowly reduce the time needed for tax preparation.

Get more for Arizona Tax Withholding Form

- Guaranteed loan report of loss forms sc egov usda

- Compliance review rcac form

- Fha case number cancellation form

- Housing urban development management form

- You must make a choice on getting a home inspection form

- District vi juvenile detention center bannock county idaho form

- Empower form

- Ira beneficiary claim request wells fargo advantage funds form

Find out other Arizona Tax Withholding Form

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT