Asset Acquisition Statement under Section 1060PDF 2024-2026

IRS Guidelines on Funeral Expenses

The Internal Revenue Service (IRS) provides specific guidelines regarding the deductibility of funeral expenses. Generally, funeral expenses are not deductible for personal income tax purposes. However, if the deceased's estate is responsible for these expenses, they may be deductible on the estate's tax return, specifically on Form 1041. It is essential to keep detailed records of all expenses incurred, as this documentation will support any claims made on the tax return.

Eligibility Criteria for Deducting Funeral Expenses

To determine if funeral expenses can be deducted, several eligibility criteria must be met. First, the expenses must be paid from the estate of the deceased, not from personal funds. Additionally, the expenses should be necessary and reasonable, reflecting the standard costs associated with funerals in the area. It is vital to ensure that the estate has sufficient assets to cover these expenses, as this can influence the deductibility.

Steps to Complete Form 1041 for Funeral Expenses

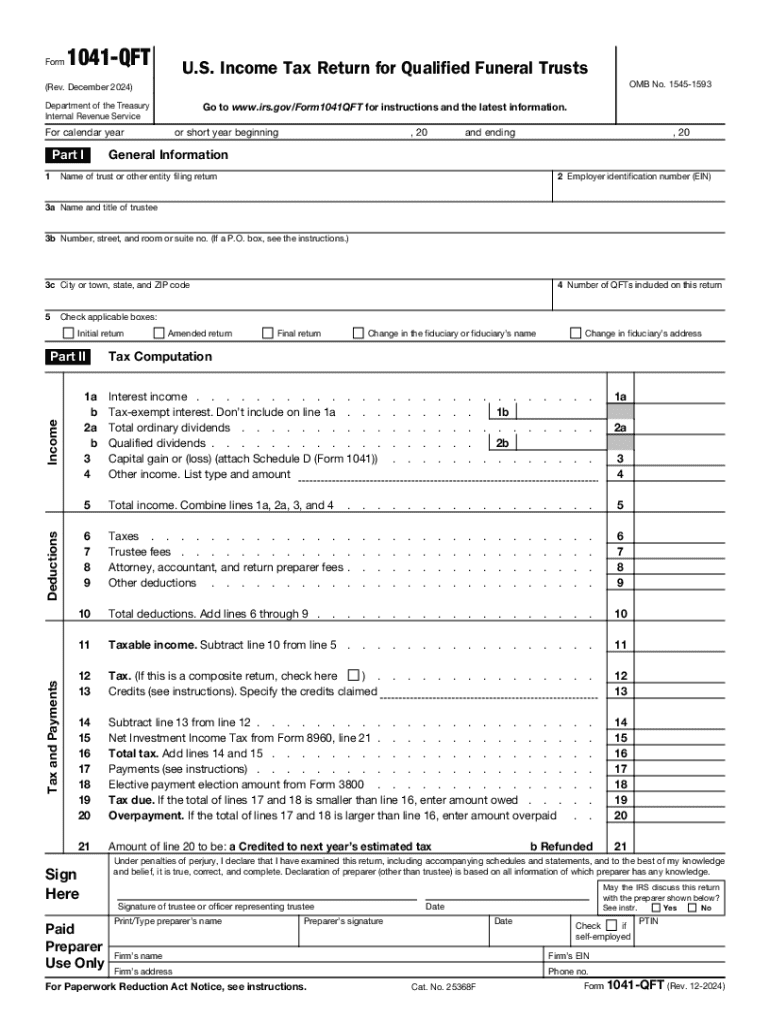

When filing Form 1041 for the estate, follow these steps to include funeral expenses:

- Gather all receipts and documentation related to funeral expenses.

- Complete the necessary sections of Form 1041, ensuring to report funeral expenses under the appropriate deductions.

- Attach any supporting documents that validate the expenses incurred.

- Review the completed form for accuracy before submission.

- Submit the form to the IRS by the designated deadline for estate tax returns.

Required Documents for Filing

When filing for the deduction of funeral expenses, certain documents are necessary to support the claim. These include:

- Receipts for all funeral-related expenses.

- A copy of the death certificate.

- Documentation showing the payment of expenses from the estate's funds.

- Any relevant estate planning documents that outline the responsibilities of the estate.

Filing Deadlines for Form 1041

Filing deadlines for Form 1041 are crucial for ensuring compliance and avoiding penalties. Generally, the form is due on the fifteenth day of the fourth month following the close of the estate’s tax year. For estates that operate on a calendar year, this typically means the deadline is April 15. If this date falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable to file as early as possible to ensure all deductions, including funeral expenses, are accounted for.

Taxpayer Scenarios Involving Funeral Expenses

Different taxpayer scenarios can influence the deductibility of funeral expenses. For example:

- If the deceased had a trust, funeral expenses may be deducted from the trust's income tax return.

- For estates with insufficient funds, beneficiaries may need to cover costs upfront, which may not be deductible.

- In cases where a funeral is prepaid through an irrevocable funeral contract, the expenses may be handled differently for tax purposes.

Create this form in 5 minutes or less

Find and fill out the correct asset acquisition statement under section 1060pdf

Create this form in 5 minutes!

How to create an eSignature for the asset acquisition statement under section 1060pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Can funeral expenses be deducted on my tax return?

Yes, in certain circumstances, funeral expenses can be deducted on your tax return. However, these deductions are typically limited to specific situations, such as when the expenses are incurred as part of a business or estate. It's important to consult with a tax professional to understand how and when funeral expenses can be deducted.

-

What types of funeral expenses can be deducted?

Generally, only certain funeral expenses can be deducted, such as costs related to the burial or cremation of the deceased. Additionally, if the funeral expenses are paid from an estate, they may be deductible. Always check with a tax advisor to confirm which specific expenses can be deducted.

-

How does airSlate SignNow help with managing funeral expense documentation?

airSlate SignNow provides an easy-to-use platform for managing and eSigning important documents related to funeral expenses. By streamlining the documentation process, users can ensure that all necessary paperwork is completed accurately and efficiently. This can be particularly beneficial when dealing with sensitive matters like funeral expenses.

-

Are there any features in airSlate SignNow that assist with funeral expense tracking?

Yes, airSlate SignNow offers features that allow users to track and manage their documents related to funeral expenses. With customizable templates and secure storage, users can keep all relevant information organized and accessible. This can help ensure that all potential deductions are accounted for.

-

Can I integrate airSlate SignNow with other financial tools for managing funeral expenses?

Absolutely! airSlate SignNow can be integrated with various financial tools to help manage funeral expenses more effectively. This integration allows for seamless data transfer and better tracking of expenses, making it easier to determine if funeral expenses can be deducted.

-

What are the benefits of using airSlate SignNow for funeral-related documents?

Using airSlate SignNow for funeral-related documents offers several benefits, including ease of use, cost-effectiveness, and enhanced security. The platform allows users to quickly eSign and send documents, ensuring that all necessary paperwork is handled promptly. This can be particularly important when dealing with time-sensitive matters like funeral expenses.

-

Is there a cost associated with using airSlate SignNow for managing funeral expenses?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for managing documents. The pricing structure is flexible, allowing users to choose a plan that best fits their needs. This can be especially beneficial for those looking to manage funeral expenses without incurring signNow costs.

Get more for Asset Acquisition Statement Under Section 1060PDF

Find out other Asset Acquisition Statement Under Section 1060PDF

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors