Vat623 Form

What is the Vat623

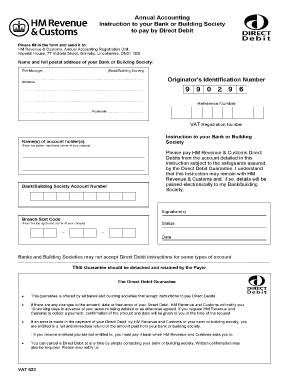

The Vat623 form is a specific document used for reporting and documenting certain tax-related information. It is essential for individuals and businesses to understand its purpose and the information it requires. The form is typically utilized in various financial and tax reporting contexts, ensuring compliance with federal regulations. Understanding the Vat623 is crucial for accurate reporting and avoiding potential penalties.

How to use the Vat623

Using the Vat623 form involves several steps to ensure that all necessary information is accurately captured. First, gather all relevant documentation that pertains to the information required on the form. This may include financial records, identification details, and any other supporting documents. Next, carefully fill out the form, ensuring that all entries are clear and precise. Once completed, review the form for accuracy before submission to avoid any issues with processing.

Steps to complete the Vat623

Completing the Vat623 form involves a systematic approach to ensure all necessary information is included. Follow these steps:

- Gather required documents, such as financial statements and identification.

- Begin filling out the form, starting with your personal or business information.

- Provide detailed financial information as required by the form.

- Review each section for accuracy and completeness.

- Sign and date the form, ensuring all required signatures are included.

- Submit the completed form through the appropriate method, whether online, by mail, or in person.

Legal use of the Vat623

The Vat623 form is legally binding when completed correctly and submitted according to federal regulations. It is important to ensure that all information provided is truthful and accurate, as discrepancies can lead to legal repercussions. Utilizing a reliable platform for eSigning, such as airSlate SignNow, can enhance the legal validity of your submission by providing secure digital signatures and maintaining compliance with relevant laws.

Key elements of the Vat623

Several key elements must be included when filling out the Vat623 form. These elements typically consist of:

- Personal or business identification details.

- Financial information relevant to the reporting period.

- Signatures of authorized individuals.

- Date of completion and submission.

Ensuring that these elements are accurately represented is vital for the form's acceptance and processing.

Filing Deadlines / Important Dates

Timely submission of the Vat623 form is critical to avoid penalties. It is essential to be aware of specific filing deadlines, which can vary based on the reporting period. Generally, these deadlines align with the annual tax filing schedule. Keeping a calendar of important dates can help ensure that the form is submitted on time, thereby maintaining compliance with tax regulations.

Who Issues the Form

The Vat623 form is typically issued by the Internal Revenue Service (IRS) or relevant state tax authorities. It is important to obtain the most current version of the form from official sources to ensure compliance with any updates or changes in regulations. Understanding the issuing authority can also provide clarity on where to direct any inquiries regarding the form.

Quick guide on how to complete vat623

Effortlessly Prepare Vat623 on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the right format and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Vat623 across any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and eSign Vat623 with Ease

- Obtain Vat623 and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets all your document management needs within a few clicks from any device you choose. Edit and eSign Vat623 and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat623

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is VAT 623 and how does it relate to airSlate SignNow?

VAT 623 is a specific value-added tax form that businesses may need to manage. airSlate SignNow simplifies the process of obtaining necessary signatures on documents related to VAT 623, enabling quick and efficient compliance with tax regulations.

-

How can airSlate SignNow help with VAT 623 document management?

With airSlate SignNow, you can easily create, send, and eSign VAT 623 documents. The platform allows you to store and organize these documents securely, ensuring that you can access them swiftly when required for compliance or audits.

-

What features does airSlate SignNow offer for handling VAT 623?

airSlate SignNow provides robust features for VAT 623, including customizable templates, automatic notifications, and a user-friendly interface. These features help streamline the eSignature process, reducing the time it takes to manage your VAT documents effectively.

-

Is airSlate SignNow cost-effective for managing VAT 623 documents?

Yes, airSlate SignNow is a cost-effective solution for managing VAT 623 and other related documents. With flexible pricing plans, businesses can choose the option that best suits their needs while benefiting from enhanced efficiency and reduced paper usage.

-

Can I integrate airSlate SignNow with other software for VAT 623 purposes?

Absolutely! airSlate SignNow offers integrations with popular software and business applications, allowing you to streamline your workflow for managing VAT 623 documents. This compatibility enhances productivity by connecting your existing tools with our eSigning platform.

-

How secure is my information with airSlate SignNow when dealing with VAT 623?

Security is a top priority at airSlate SignNow. All data, including important VAT 623 documents, is encrypted and stored securely, ensuring that your information remains confidential and compliant with industry standards.

-

What are the benefits of using airSlate SignNow for VAT 623?

Using airSlate SignNow for VAT 623 offers numerous benefits, including speed, convenience, and reduced administrative burden. By digitizing your document processes, you can ensure timely submissions and focus more on your core business activities.

Get more for Vat623

- Annual performance review form manager to complete hroi

- Employee purchase form

- Agt quotcardholder application formquot gb

- Fit testing form frank phillips college fpctx

- This form is required only of those with a history of positive ppd or other positive tb test result

- Www bankofthewest comcustomer servicecustomer servicebank of the west form

- East central community college transcript request form

- Global animal health certificate application globalhealth wsu form

Find out other Vat623

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT