Schedule NEC Form 1040 NR SP Tax on Income Not Effectively Connected with a U S Trade or Business Spanish Version 2024-2026

Understanding the Schedule NEC Form 1040 NR SP

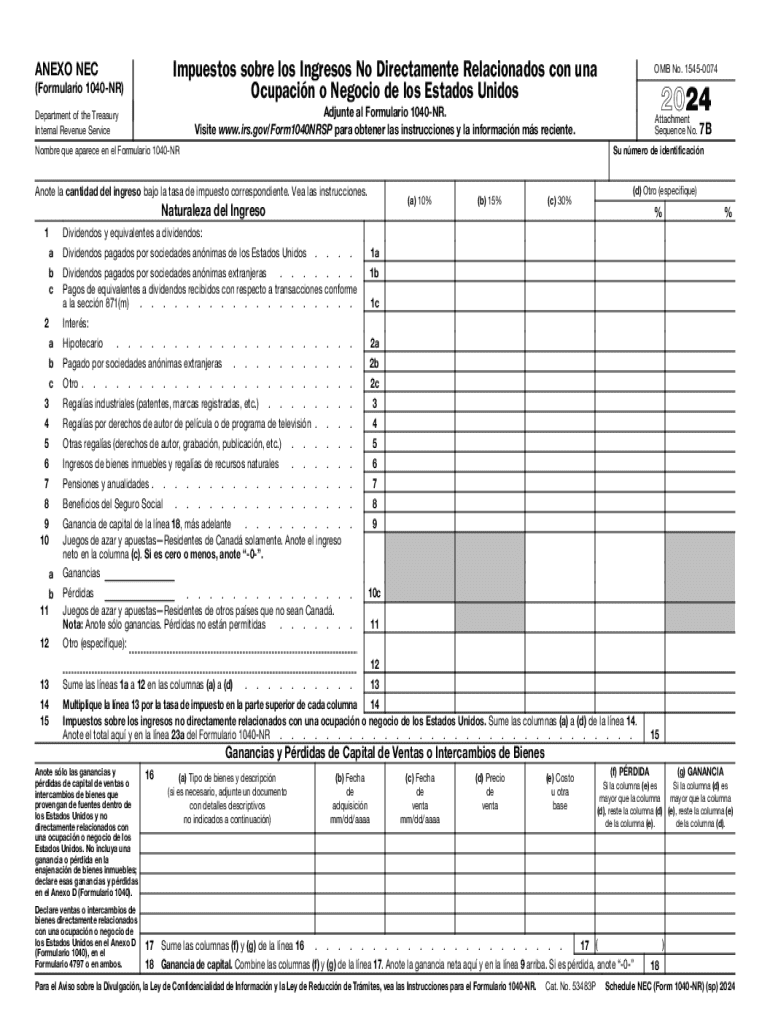

The Schedule NEC Form 1040 NR SP is a crucial document for non-resident aliens in the United States. It is specifically designed to report income that is not effectively connected with a U.S. trade or business. This form is essential for those who receive certain types of income, such as dividends, interest, or royalties, which are subject to U.S. tax withholding. Understanding this form helps ensure compliance with U.S. tax laws and proper reporting of income.

Steps to Complete the Schedule NEC Form 1040 NR SP

Completing the Schedule NEC Form 1040 NR SP involves several key steps:

- Gather necessary information: Collect all relevant income documents, including Form 1042-S, which reports U.S. source income.

- Fill out personal information: Provide your name, address, and taxpayer identification number (TIN) at the top of the form.

- Report income: List all applicable income types in the designated sections, ensuring accuracy in amounts and sources.

- Calculate tax: Apply the appropriate tax rates to the reported income to determine your tax liability.

- Sign and date: Ensure to sign and date the form before submission to validate your declaration.

Obtaining the Schedule NEC Form 1040 NR SP

The Schedule NEC Form 1040 NR SP can be obtained through the Internal Revenue Service (IRS) website. It is available for download in both English and Spanish versions. Additionally, tax professionals and certain financial institutions may provide copies of the form. It is advisable to ensure that you are using the most current version to comply with any updates in tax regulations.

Legal Use of the Schedule NEC Form 1040 NR SP

This form serves a legal purpose by allowing non-resident aliens to report income that is not effectively connected with a U.S. trade or business. Proper use of the Schedule NEC Form 1040 NR SP ensures compliance with U.S. tax laws, helping to avoid penalties and legal issues. Non-resident aliens must file this form if they have U.S. source income and are required to report it for tax purposes.

Key Elements of the Schedule NEC Form 1040 NR SP

Several key elements are essential when filling out the Schedule NEC Form 1040 NR SP:

- Identification Information: Includes personal details such as name, address, and TIN.

- Income Reporting: Sections for various types of income, including interest, dividends, and royalties.

- Tax Calculation: A section to compute the tax owed based on reported income.

- Signature Section: A requirement for the taxpayer to sign and date the form to confirm its accuracy.

Filing Deadlines for the Schedule NEC Form 1040 NR SP

Filing deadlines for the Schedule NEC Form 1040 NR SP typically align with the overall tax filing deadlines for non-resident aliens. Generally, the form must be filed by April fifteenth of the year following the tax year in question. However, if you are not required to file a tax return, you may still need to submit this form if you have U.S. source income. It is important to check the IRS website for any updates or changes to deadlines.

Create this form in 5 minutes or less

Find and fill out the correct schedule nec form 1040 nr sp tax on income not effectively connected with a u s trade or business spanish version 590041439

Create this form in 5 minutes!

How to create an eSignature for the schedule nec form 1040 nr sp tax on income not effectively connected with a u s trade or business spanish version 590041439

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version?

The Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version is a tax form used by non-resident aliens to report income that is not effectively connected with a U.S. trade or business. This form is essential for ensuring compliance with U.S. tax laws while catering to Spanish-speaking individuals.

-

How can airSlate SignNow help me with the Schedule NEC Form 1040 NR SP?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version. Our solution streamlines the document management process, making it efficient and secure for users.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while ensuring you can efficiently manage the Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version.

-

Is airSlate SignNow compliant with U.S. tax regulations?

Yes, airSlate SignNow is designed to comply with U.S. tax regulations, including those related to the Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version. Our platform ensures that all documents are handled securely and in accordance with legal standards.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow. This means you can easily manage the Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version alongside your existing tools.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as eSigning, document templates, and real-time tracking. These features make it easier to manage the Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version efficiently and effectively.

-

How secure is my information when using airSlate SignNow?

Your information is highly secure with airSlate SignNow. We implement advanced security measures to protect your data while you manage the Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version, ensuring confidentiality and compliance.

Get more for Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version

- Sf 2818 pdf form

- Department of health and human services interview questions form

- Ntuc co pay assist plan form

- Cvma patch agreement form

- Mybmv similar pdf documents jessicatalbot net form

- State form 37135 fill online printable fillable blank

- Security interest mvd use only processing new form

- Newfor official use onlysecurity interest processi form

Find out other Schedule NEC Form 1040 NR SP Tax On Income Not Effectively Connected With A U S Trade Or Business Spanish Version

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now