Form 8829 Expenses for Business Use of Your Home Irs

What is the Form 8829 Expenses For Business Use Of Your Home IRS

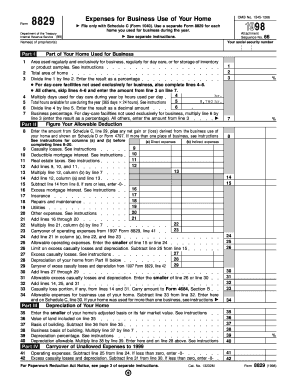

The Form 8829 is a tax form used by self-employed individuals to calculate and report expenses related to the business use of their home. This form allows taxpayers to deduct certain expenses associated with maintaining a home office, which can include mortgage interest, utilities, repairs, and depreciation. It is essential for individuals who operate a business from their residence to accurately complete this form to ensure they receive the appropriate tax benefits.

How to use the Form 8829 Expenses For Business Use Of Your Home IRS

To use the Form 8829, taxpayers must first determine the portion of their home that is used exclusively for business purposes. This involves measuring the square footage of the home office and dividing it by the total square footage of the home. Once this percentage is established, it can be applied to eligible expenses to calculate the total deduction. The form guides users through various sections, including direct and indirect expenses, ensuring all relevant costs are accounted for.

Steps to complete the Form 8829 Expenses For Business Use Of Your Home IRS

Completing the Form 8829 involves several key steps:

- Gather necessary documentation, including receipts and records for all expenses related to the home office.

- Determine the percentage of your home used for business by measuring the office space.

- Fill out the form by entering direct expenses, such as repairs specific to the office, and indirect expenses, like utilities.

- Calculate the total deduction based on the information provided.

- Review the completed form for accuracy before submission.

Legal use of the Form 8829 Expenses For Business Use Of Your Home IRS

The Form 8829 is legally recognized by the IRS as a valid means for reporting home office expenses. To ensure compliance, taxpayers must adhere to IRS guidelines regarding the exclusive use of the home office and maintain accurate records of all expenses claimed. Failure to comply with these legal requirements may result in penalties or disallowed deductions during tax audits.

Eligibility Criteria

To be eligible to use the Form 8829, taxpayers must meet specific criteria set by the IRS. Primarily, the space claimed as a home office must be used regularly and exclusively for business activities. Additionally, the taxpayer must be self-employed or a partner in a business. Homeowners and renters alike can qualify, provided they meet the usage requirements and maintain the necessary documentation to support their claims.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8829 typically align with the general tax filing deadlines. For most taxpayers, this means the form must be submitted by April 15 of the following tax year. If additional time is needed, taxpayers can file for an extension, but it is crucial to ensure that any taxes owed are paid by the original deadline to avoid penalties and interest.

Quick guide on how to complete form 8829 expenses for business use of your home irs

Effortlessly prepare Form 8829 Expenses For Business Use Of Your Home Irs on any device

Managing documents online has gained popularity among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow offers all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle Form 8829 Expenses For Business Use Of Your Home Irs across any platform using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest method to modify and electronically sign Form 8829 Expenses For Business Use Of Your Home Irs with ease

- Obtain Form 8829 Expenses For Business Use Of Your Home Irs and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or obscure confidential information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 8829 Expenses For Business Use Of Your Home Irs to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8829 expenses for business use of your home irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8829 and how do I use it?

Form 8829 is used for claiming expenses for the business use of your home. With airSlate SignNow, you can easily prepare and eSign form 8829, ensuring that you maximize your deductions with a simple and effective solution. Our platform streamlines the process, making it user-friendly even for those unfamiliar with tax forms.

-

How can airSlate SignNow help me with my form 8829?

airSlate SignNow provides a powerful platform to complete and eSign your form 8829 efficiently. Our features allow for easy document management and signing, which can signNowly reduce the time and effort spent on tax-related paperwork. You'll benefit from a clear and efficient workflow when preparing your form 8829.

-

Is there a cost to use airSlate SignNow for form 8829?

Yes, airSlate SignNow offers competitive pricing plans tailored for individuals and businesses that need to handle documents like form 8829. We provide various subscriptions that fit your budget, ensuring you receive a reliable and cost-effective solution for your signing needs without compromising on features.

-

What features does airSlate SignNow offer for managing form 8829?

With airSlate SignNow, you gain access to features such as automated document workflows, customizable templates, and easy tracking of your form 8829 submissions. These tools enhance your efficiency and organization, allowing you to focus more on your business rather than paperwork. Our platform integrates seamlessly with commonly used applications to further streamline your processes.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow can be integrated with various accounting and tax preparation software to enhance your experience while filling out form 8829. This integration helps to sync data automatically, reducing the chances of errors and saving you time. You can enjoy a streamlined workflow when preparing your tax documents.

-

What are the benefits of using airSlate SignNow for my form 8829?

Using airSlate SignNow to handle your form 8829 offers several benefits, including increased efficiency, user-friendly navigation, and time savings. Our platform allows for secure document signing and sharing, ensuring your sensitive information remains protected. With our reliable solution, you can focus on running your business rather than dealing with cumbersome paperwork.

-

Is airSlate SignNow suitable for small businesses needing to submit form 8829?

Yes, airSlate SignNow is an excellent choice for small businesses needing to submit form 8829. Our platform offers affordability and scalability, allowing small businesses to manage their document signing effectively. Whether you're a sole proprietor or aiming to grow, our tools provide the support you need for smooth tax filing.

Get more for Form 8829 Expenses For Business Use Of Your Home Irs

- Skmc25823012710000 form

- New brunswick lease agreement official form

- Spermatogene form

- Ifa master lease of agricultural land form

- Student handbook fayetteville state university form

- Fca2 211291226 form

- Fill fillable 113ci hr113 critical illness form pdf

- Crown land tenure application authorization guidance form

Find out other Form 8829 Expenses For Business Use Of Your Home Irs

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure