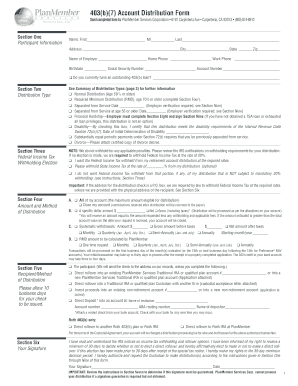

PlanMember Services 403b Distribution Form

What is the PlanMember Services 403b Distribution Form

The PlanMember Services 403b Distribution Form is a document used by participants in a 403(b) retirement plan to request a distribution of their funds. This form is essential for individuals looking to withdraw money from their retirement accounts due to various reasons, such as retirement, financial hardship, or changing employment. It outlines the necessary information required for processing the request and ensures compliance with federal regulations governing retirement distributions.

How to use the PlanMember Services 403b Distribution Form

Using the PlanMember Services 403b Distribution Form involves several steps to ensure that your request is processed smoothly. First, gather all necessary personal information, including your account number and the reason for the distribution. Next, fill out the form accurately, providing details such as your name, address, and the amount you wish to withdraw. After completing the form, review it for any errors before submitting it to the appropriate plan administrator. This process can often be completed electronically, streamlining the experience.

Steps to complete the PlanMember Services 403b Distribution Form

Completing the PlanMember Services 403b Distribution Form requires careful attention to detail. Follow these steps:

- Gather your personal information and account details.

- Indicate your reason for the distribution, such as retirement or hardship.

- Fill out the required fields, including your name, address, and the amount you wish to withdraw.

- Review the form for accuracy and completeness.

- Submit the form electronically or by mail, following the instructions provided by your plan administrator.

Legal use of the PlanMember Services 403b Distribution Form

The legal use of the PlanMember Services 403b Distribution Form is governed by federal regulations that dictate how and when distributions can be made. To ensure compliance, it is crucial to understand the eligibility criteria for taking a distribution, which may include age, employment status, and specific financial circumstances. Additionally, the form must be signed and dated by the participant to be considered valid. Utilizing a reliable electronic signature solution can enhance the legal standing of the document.

Required Documents

When completing the PlanMember Services 403b Distribution Form, certain documents may be required to support your request. These documents can include:

- Proof of identity, such as a driver's license or passport.

- Documentation supporting the reason for distribution, like a termination letter or medical bills.

- Any previous forms related to your 403(b) account that may be relevant.

Form Submission Methods

The PlanMember Services 403b Distribution Form can typically be submitted through various methods, depending on the plan administrator's guidelines. Common submission methods include:

- Online submission via the plan administrator's secure portal.

- Mailing the completed form to the designated address.

- In-person submission at the plan administrator's office, if applicable.

Quick guide on how to complete planmember services 403b distribution form

Effortlessly Prepare PlanMember Services 403b Distribution Form on Any Device

Digital document management has gained traction among organizations and individuals. It offers a superb environmentally-friendly substitute to traditional printed and signed forms, allowing you to find the appropriate template and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without hassles. Manage PlanMember Services 403b Distribution Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign PlanMember Services 403b Distribution Form with Ease

- Obtain PlanMember Services 403b Distribution Form and click on Access Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Finish button to save your modifications.

- Select your preferred method to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign PlanMember Services 403b Distribution Form and ensure effective communication at every stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the planmember services 403b distribution form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PlanMember Services 403b Distribution Form?

The PlanMember Services 403b Distribution Form is a document used to initiate the distribution of funds from a 403b retirement plan. This form is essential for employees looking to withdraw funds or roll over their accounts. Ensuring you fill it out correctly can streamline the process and prevent delays.

-

How do I access the PlanMember Services 403b Distribution Form?

You can access the PlanMember Services 403b Distribution Form directly from the airSlate SignNow platform. Simply log in to your account, navigate to the document library, and search for the form. This makes it convenient to find and complete the necessary paperwork anytime.

-

What features does the airSlate SignNow platform offer for the PlanMember Services 403b Distribution Form?

AirSlate SignNow provides features such as eSigning, document tracking, and customizable templates for the PlanMember Services 403b Distribution Form. These functionalities ensure that your form is completed quickly and securely while providing real-time updates on its status.

-

Are there any costs associated with using the PlanMember Services 403b Distribution Form on airSlate SignNow?

Using the PlanMember Services 403b Distribution Form on airSlate SignNow is part of our subscription-based model. Pricing is competitive, and we offer various plans to suit different needs, ensuring a cost-effective solution for eSigning and document management.

-

How can the PlanMember Services 403b Distribution Form benefit my business?

The PlanMember Services 403b Distribution Form helps your business by simplifying the withdrawal process for employees. This can enhance employee satisfaction due to faster processing times and fewer errors. Overall, it contributes to a more efficient workflow and improved productivity.

-

Is it easy to integrate the PlanMember Services 403b Distribution Form with other applications?

Yes, airSlate SignNow allows for easy integration of the PlanMember Services 403b Distribution Form with various applications. Our platform supports several third-party apps, enabling seamless document management and eSigning processes across different tools you may already be using.

-

What security measures are in place for the PlanMember Services 403b Distribution Form?

AirSlate SignNow prioritizes the security of all documents, including the PlanMember Services 403b Distribution Form. We utilize advanced encryption and secure cloud storage to protect sensitive information, ensuring that your data remains confidential throughout the signing process.

Get more for PlanMember Services 403b Distribution Form

- Ucr domestic violence form

- Child support guidelines sole parenting worksheet rule appendix ix c form

- Reciprocity information list of reciprocal states

- Glossary of termsdistrict of minnesota form

- Download notary application form

- Defense finance and accounting service8899 east 5 form

- Summer session catalog am7 regis university regis form

- 8 sickle cell waiver cal state stanislaus warriors form

Find out other PlanMember Services 403b Distribution Form

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement