Accounts Form

What is the Accounts Form

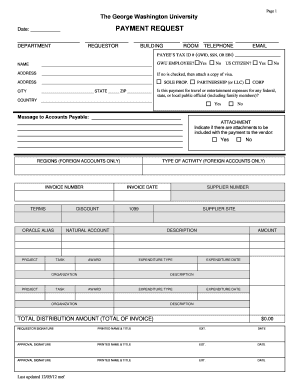

The accounts form is a crucial document used by individuals and businesses to report financial information for various purposes, such as tax filings, loan applications, or regulatory compliance. This form typically includes details about income, expenses, assets, and liabilities, ensuring that all relevant financial data is accurately captured. Understanding the purpose and structure of the accounts form is essential for effective completion and submission.

How to Use the Accounts Form

Using the accounts form involves several steps to ensure that all required information is accurately provided. Begin by gathering all necessary financial documents, such as bank statements, receipts, and previous tax returns. Carefully read the instructions accompanying the form to understand what information is required. Fill out the form methodically, ensuring that all sections are completed and that figures are accurate. Once completed, review the form for any errors or omissions before submission.

Steps to Complete the Accounts Form

Completing the accounts form can be broken down into a series of straightforward steps:

- Gather all relevant financial documents.

- Read the instructions carefully to understand the requirements.

- Fill out each section of the form, ensuring accuracy.

- Double-check all figures and calculations.

- Sign and date the form as required.

- Submit the form through the preferred method, whether online, by mail, or in person.

Legal Use of the Accounts Form

The accounts form must be completed in compliance with applicable laws and regulations to be considered valid. This includes ensuring that all information is truthful and accurate, as providing false information can lead to legal penalties. Additionally, the form must be signed by the appropriate parties, and if submitted electronically, it must comply with eSignature laws such as ESIGN and UETA, which govern the legality of electronic signatures in the United States.

Required Documents

When completing the accounts form, certain documents are typically required to support the information provided. These may include:

- Bank statements

- Receipts for expenses

- Previous tax returns

- Financial statements

- Proof of income

Having these documents readily available will streamline the completion process and help ensure accuracy in reporting.

Form Submission Methods

The accounts form can be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission through a secure portal

- Mailing a physical copy to the designated address

- In-person submission at a local office or agency

Each method has its own advantages, and it is essential to choose the one that best fits your needs and the requirements of the form.

Quick guide on how to complete accounts form

Complete Accounts Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the features necessary to create, modify, and eSign your documents quickly and without hassle. Manage Accounts Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Accounts Form with ease

- Obtain Accounts Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

No more worries about lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Accounts Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the accounts form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an accounts form in airSlate SignNow?

An accounts form in airSlate SignNow is a critical component that allows users to collect necessary information from clients before sending documents for e-signature. This feature simplifies the onboarding process, making it seamless for both parties. By utilizing an accounts form, businesses can ensure that they gather all relevant details to proceed with their transactions efficiently.

-

How does airSlate SignNow enhance the accounts form process?

airSlate SignNow streamlines the accounts form process with customizable templates that allow businesses to tailor forms to their specific needs. You can add fields, adjust layouts, and include branding to create a professional appearance. This efficiency not only improves user experience but also accelerates the document signing workflow.

-

Is there a pricing plan for using accounts forms in airSlate SignNow?

Yes, airSlate SignNow offers multiple pricing plans to suit different business needs, including options that feature accounts form functionality. Pricing is flexible, allowing companies to select a plan that fits their scale and requirements. Each plan includes essential features and can be scaled as your business grows.

-

Can I integrate accounts forms with other tools?

Absolutely! airSlate SignNow allows seamless integration of accounts forms with various third-party applications like CRMs, project management tools, and payment gateways. This connectivity helps automate workflows and ensures that all information collected through accounts forms is efficiently utilized across your business tools.

-

What are the benefits of using accounts forms with airSlate SignNow?

Using accounts forms with airSlate SignNow offers several advantages, including increased efficiency, enhanced data accuracy, and better client management. This feature automates information gathering, reducing the chances of errors that can occur with manual entry. Additionally, it fosters a more organized process that is beneficial for both businesses and customers.

-

How secure are the accounts forms created with airSlate SignNow?

Security is a top priority for airSlate SignNow. The accounts forms you create are protected with industry-standard encryption and comply with regulations like GDPR and HIPAA. This ensures that all data collected through accounts forms is safe, giving both you and your clients peace of mind.

-

Can I customize my accounts form in airSlate SignNow?

Yes, you can fully customize your accounts form in airSlate SignNow to meet your business requirements. Users can modify field types, set conditional logic, and add branding elements such as logos and colors. This level of customization helps ensure that your accounts forms reflect your company’s identity and gather the necessary information effectively.

Get more for Accounts Form

- Sexual assault evidence certification form

- Zahlungsauftrag im auslandsverkehr netbank ag form

- Land division application latah county latah id form

- Orthocarolina online forms

- Condominiumpud questionnaire not to be used for nyshcr form

- Sepa lastschriftmandat hdi boss assekuranz vertriebsservice hdi gerling form

- Attorneys relationship form

- Act 247 referral application chester county form

Find out other Accounts Form

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile