Where Do I Submit Form 50 114 Application for Residence Homestead Exemption Harris County 2008

What is the Form 50-114 Application for Residence Homestead Exemption in Harris County?

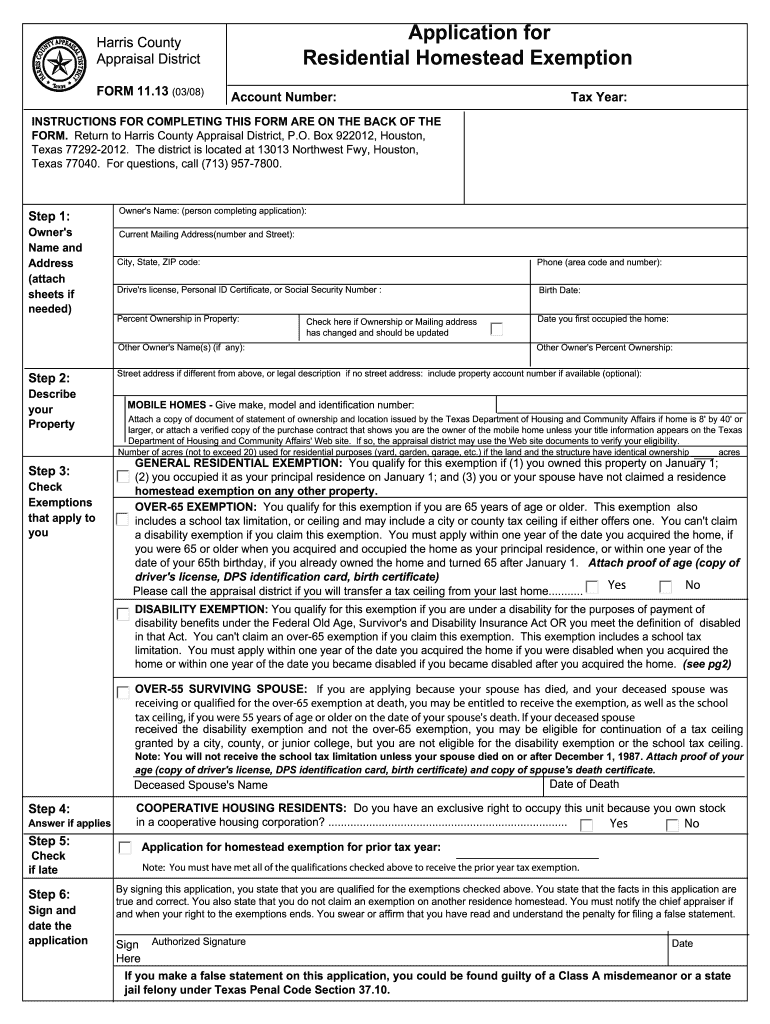

The Form 50-114 is an application used to request a Residence Homestead Exemption in Harris County, Texas. This exemption is designed to provide property tax relief to homeowners by reducing the taxable value of their primary residence. By submitting this form, eligible homeowners can benefit from a decrease in the amount of property taxes owed, making homeownership more affordable. The exemption applies to various taxes, including school district taxes, and is available to individuals who meet specific eligibility criteria set by the state.

Eligibility Criteria for the Form 50-114 Application

To qualify for the Residence Homestead Exemption in Harris County, applicants must meet certain criteria. Homeowners must occupy the property as their principal residence on January 1 of the tax year for which they are applying. Additionally, applicants must be individuals, not corporations or other business entities. Other factors, such as age, disability status, and ownership of the property, may also influence eligibility. It is essential to review these criteria carefully to ensure that the application is valid and that the homeowner qualifies for the exemption.

Steps to Complete the Form 50-114 Application

Completing the Form 50-114 involves several key steps. First, homeowners should gather necessary documentation, including proof of identity and ownership of the property. Next, the form must be filled out accurately, providing details such as the property address and the applicant's information. After completing the form, applicants should review it for accuracy before submission. Finally, the form can be submitted to the Harris County Appraisal District either online, by mail, or in person, depending on the preferred method of submission.

Form Submission Methods for Form 50-114

Homeowners in Harris County have multiple options for submitting the Form 50-114. The application can be submitted online through the Harris County Appraisal District's website, which offers a convenient and efficient way to complete the process. Alternatively, applicants may choose to mail the completed form to the appropriate address or deliver it in person to the local appraisal district office. Each method has its own advantages, and homeowners should select the one that best suits their needs.

Required Documents for the Form 50-114 Application

When applying for the Residence Homestead Exemption using Form 50-114, homeowners must provide specific documentation to support their application. Required documents typically include proof of identity, such as a driver's license or state ID, and evidence of property ownership, like a deed or mortgage statement. Additionally, if applicable, documentation related to age or disability status may be necessary to qualify for certain exemptions. Ensuring that all required documents are included will help prevent delays in the processing of the application.

Legal Use of the Form 50-114 Application

The Form 50-114 is legally binding once submitted and accepted by the Harris County Appraisal District. Homeowners must ensure that the information provided is accurate and truthful, as any misrepresentation can lead to penalties or denial of the exemption. It is important for applicants to understand their responsibilities regarding the use of this form and to comply with all relevant laws and regulations governing property tax exemptions in Texas.

Quick guide on how to complete where do i submit form 50 114 application for residence homestead exemption harris county 2008

Ensure Your Details Are Accurate on Where to Submit Form 50 114 Application For Residence Homestead Exemption in Harris County

Making deals, managing listings, coordinating calls, and property viewings—real estate agents and professionals juggle a variety of responsibilities each day. A signNow portion of these tasks entails numerous forms, such as Where Do I Submit Form 50 114 Application For Residence Homestead Exemption Harris County, that require completion in a timely and accurate manner.

airSlate SignNow is a comprehensive solution that assists professionals in the real estate sector in alleviating the paperwork load, enabling them to concentrate more on their clients’ needs throughout the entire negotiation phase and helping them secure the best possible terms for the agreement.

Steps to fill out Where Do I Submit Form 50 114 Application For Residence Homestead Exemption Harris County using airSlate SignNow:

- Go to the Where Do I Submit Form 50 114 Application For Residence Homestead Exemption Harris County page or utilize our library’s search features to find the necessary document.

- Click on Get form—you will be swiftly redirected to the editor.

- Begin completing the form by selecting fillable fields and inputting your information.

- Add additional text and adjust its properties if required.

- Select the Sign option in the upper toolbar to create your eSignature.

- Explore additional features designed to annotate and optimize your document, including drawing, highlighting, adding shapes, and more.

- Open the comment section and add notes regarding your document.

- Conclude the process by downloading, sharing, or emailing your document to your intended recipients or organizations.

Eliminate paper for good and enhance the home purchasing experience with our user-friendly and robust platform. Experience greater ease when completing Where Do I Submit Form 50 114 Application For Residence Homestead Exemption Harris County and other real estate documentation online. Try our solution today!

Create this form in 5 minutes or less

Find and fill out the correct where do i submit form 50 114 application for residence homestead exemption harris county 2008

FAQs

-

What forms do I need to fill out to sue a police officer for civil rights violations? Where do I collect these forms, which court do I submit them to, and how do I actually submit those forms? If relevant, the state is Virginia.

What is relevant, is that you need a lawyer to do this successfully. Civil rights is an area of law that for practical purposes cannot be understood without training. The police officer will have several experts defending if you sue. Unless you have a lawyer you will be out of luck. If you post details on line, the LEO's lawyers will be able to use this for their purpose. You need a lawyer who knows civil rights in your jurisdiction.Don't try this by yourself.Get a lawyer. Most of the time initial consultations are free.

-

When and how are the assignments for IGNOU CHR to be submitted for the December 2018 TEE? How and when to fill out the examination form? Where do I look for the datasheet?

First download the assignments from IGNOU - The People's University website and write them with A4 size paper then submitted it in your study center.check the above website you will find a link that TEE from fill up for dec 2018 after got the link you will fill your tee from online.Remember while filling your TEE you should put tick mark on the box like this;Are you submitted assignments: yes[ ] No[ ]

Create this form in 5 minutes!

How to create an eSignature for the where do i submit form 50 114 application for residence homestead exemption harris county 2008

How to generate an electronic signature for your Where Do I Submit Form 50 114 Application For Residence Homestead Exemption Harris County 2008 in the online mode

How to make an electronic signature for the Where Do I Submit Form 50 114 Application For Residence Homestead Exemption Harris County 2008 in Google Chrome

How to make an electronic signature for putting it on the Where Do I Submit Form 50 114 Application For Residence Homestead Exemption Harris County 2008 in Gmail

How to generate an electronic signature for the Where Do I Submit Form 50 114 Application For Residence Homestead Exemption Harris County 2008 from your smartphone

How to create an electronic signature for the Where Do I Submit Form 50 114 Application For Residence Homestead Exemption Harris County 2008 on iOS

How to create an eSignature for the Where Do I Submit Form 50 114 Application For Residence Homestead Exemption Harris County 2008 on Android OS

People also ask

-

Where Do I Submit Form 50 114 Application For Residence Homestead Exemption Harris County?

You can submit the Form 50-114 Application for Residence Homestead Exemption in Harris County by mailing it to the Harris County Appraisal District or submitting it in person at their office. It is important to ensure that your application is submitted by the deadline to qualify for the exemption. Additionally, keep proof of submission for your records.

-

What are the benefits of using airSlate SignNow for submitting the Form 50 114?

Using airSlate SignNow for submitting Form 50 114 offers various benefits, such as the ability to eSign documents quickly and securely. This makes it easier to manage and track your submissions to the Harris County Appraisal District. The service streamlines your workflow and reduces the need for physical paperwork.

-

Is there a cost involved with using airSlate SignNow to submit Form 50 114?

airSlate SignNow offers competitive pricing plans that can fit various budgets. Additionally, it provides a free trial for new users to explore its features before committing. The cost of using the platform is often offset by the time saved in managing your Form 50 114 submissions.

-

What features does airSlate SignNow offer for application submissions?

airSlate SignNow offers features such as customizable templates, real-time collaboration, and document tracking to enhance your application submissions. These tools help ensure that your Form 50 114 is filled out correctly and submitted on time. You can easily access your documents from any device, making the process more efficient.

-

Can airSlate SignNow help with tracking the status of my Form 50 114 submission?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your Form 50 114 submission. This transparency helps you stay informed about the progress of your application with the Harris County Appraisal District. You can receive notifications and updates directly to your email, ensuring you never miss important information.

-

What integrations does airSlate SignNow offer to assist with Form 50 114 submissions?

airSlate SignNow integrates with popular applications like Google Drive, Dropbox, and Microsoft Office, making it easier to manage documents related to your Form 50 114. These integrations enable seamless access and sharing of your files, enhancing efficiency in the submission process. This broad compatibility allows you to work within your existing workflow.

-

Is airSlate SignNow secure for submitting sensitive documents like Form 50 114?

Absolutely, airSlate SignNow prioritizes security with advanced encryption protocols to protect your sensitive documents, including the Form 50 114 submission. Your data is safeguarded during transmission and storage, ensuring compliance with privacy regulations. This commitment to security provides peace of mind for users handling important submissions.

Get more for Where Do I Submit Form 50 114 Application For Residence Homestead Exemption Harris County

- Prevention of injuries california childcare health form

- Closing and distributing the estate county of alameda form

- Snow removal contract template get free sample form

- Sales contract template free sample docsketch form

- Fundraising for a year abroad student form

- Sample update letter to boss form

- Security protection services contract organization of form

- Assignment of pending application by sole inventor form

Find out other Where Do I Submit Form 50 114 Application For Residence Homestead Exemption Harris County

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document