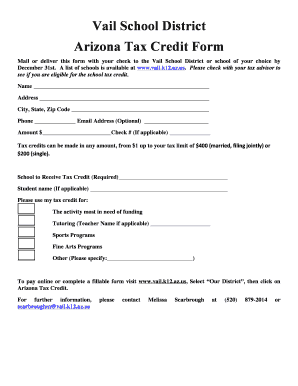

Vail School District Tax Credit Form

What is the daycare tax form?

The daycare tax form is a crucial document for parents and guardians seeking to claim tax credits for childcare expenses. This form allows individuals to report their daycare costs, which may qualify for deductions or credits on their federal tax returns. By accurately completing this form, taxpayers can potentially reduce their taxable income, leading to significant savings. The form typically requires details about the care provider, the amount spent on daycare, and the taxpayer's personal information.

Steps to complete the daycare tax form

Completing the daycare tax form involves several important steps to ensure accuracy and compliance with IRS regulations. Begin by gathering all necessary documentation, including receipts from the daycare provider and any relevant tax identification numbers. Next, fill out the form with precise information regarding your childcare expenses, ensuring that you include the correct amounts and provider details. After completing the form, review it thoroughly for any errors before submitting it with your tax return. It is advisable to keep a copy of the completed form and all supporting documents for your records.

Required documents for the daycare tax form

When preparing to fill out the daycare tax form, certain documents are essential for accurate reporting. These typically include:

- Receipts or invoices from the daycare provider, detailing the services rendered and amounts charged.

- The provider's tax identification number (TIN) or Social Security number.

- Your personal identification information, including Social Security numbers for both the taxpayer and the child receiving care.

- Any other relevant tax documents that may support your claim for childcare expenses.

IRS guidelines for daycare tax form

The IRS has established specific guidelines regarding the daycare tax form to ensure that taxpayers accurately report their childcare expenses. It is important to familiarize yourself with these guidelines, which include eligibility criteria for claiming the Child and Dependent Care Credit. Taxpayers must provide valid documentation of expenses and ensure that the care provider meets IRS requirements. Additionally, understanding the income limits and how the credit is calculated can help maximize potential tax benefits.

Form submission methods for the daycare tax form

Submitting the daycare tax form can be done through various methods, depending on your preference and convenience. Taxpayers can choose to file their forms electronically using tax software, which often simplifies the process and ensures accuracy. Alternatively, you can print the completed form and submit it via mail along with your tax return. In some cases, in-person submission at designated tax offices may also be an option. Each method has its own advantages, so consider which one best suits your needs.

Eligibility criteria for the daycare tax form

To qualify for the benefits associated with the daycare tax form, taxpayers must meet specific eligibility criteria set forth by the IRS. Generally, the taxpayer must have earned income and must be paying for childcare services that enable them to work or look for work. The care must be provided for children under the age of thirteen or for dependents who are unable to care for themselves. Additionally, the daycare provider must meet IRS requirements, such as being licensed or registered. Understanding these criteria is essential for successfully claiming credits or deductions.

Quick guide on how to complete vail school district tax credit

Complete Vail School District Tax Credit effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Vail School District Tax Credit on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign Vail School District Tax Credit seamlessly

- Locate Vail School District Tax Credit and click Get Form to begin.

- Use the tools available to complete your form.

- Highlight signNow sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal authority as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form retrieval, or errors requiring the printing of new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any preferred device. Edit and eSign Vail School District Tax Credit to ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vail school district tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a daycare tax form?

A daycare tax form is a document that parents can use to claim childcare tax credits on their tax returns. By using airSlate SignNow, you can easily create, sign, and store your daycare tax form securely, ensuring that all necessary information is accurately documented.

-

How can airSlate SignNow help with daycare tax forms?

airSlate SignNow streamlines the process of preparing and signing daycare tax forms. Our platform allows you to quickly fill out the necessary fields, gather signatures, and share the completed document effortlessly, making tax season much simpler for parents.

-

Is airSlate SignNow cost-effective for managing daycare tax forms?

Yes, airSlate SignNow offers a variety of pricing plans that make it a cost-effective solution for managing daycare tax forms. With our subscription options, you can access essential features without breaking the bank, ensuring a budget-friendly approach to document management.

-

Can I integrate airSlate SignNow with other software for daycare tax forms?

Absolutely! airSlate SignNow provides integrations with various software solutions, enabling seamless data transfer when working with daycare tax forms. Whether you use accounting software or child care management systems, our platform can connect to enhance your workflow.

-

Are there any features in airSlate SignNow specifically for daycare providers?

Yes, airSlate SignNow includes features tailored for daycare providers that help simplify the signing process for daycare tax forms. Features like templates, reminders, and mobile access ensure you can manage your documents efficiently and focus on providing quality care for children.

-

Can I use airSlate SignNow on my mobile device for daycare tax forms?

Yes, airSlate SignNow is mobile-friendly, allowing you to access and manage daycare tax forms on your smartphone or tablet. This enables daycare providers and parents to sign documents anytime and anywhere, enhancing convenience and flexibility.

-

What security measures does airSlate SignNow employ for daycare tax forms?

airSlate SignNow prioritizes the security of your daycare tax forms by utilizing industry-standard encryption and compliance measures. Your documents are stored securely to prevent unauthorized access, ensuring that sensitive information related to your daycare operation is protected.

Get more for Vail School District Tax Credit

- Tick identification and testing form state of michigan michigan

- Dma 5008 form

- Rada home parties order taker form

- Mo healthnet applicationeligibility statement form

- 401k enrollment form 2 13 ai 401k network

- Sec wb app form

- Inspection and copying okla stat tit 5124a 7 form

- Patient registration insurance integris health form

Find out other Vail School District Tax Credit

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer