Consequences of Not Following a Budget Worksheet Answers Form

Understanding the Consequences of Not Following a Budget

Not adhering to a budget can lead to significant financial consequences. Individuals may experience increased debt levels, which can result in higher interest payments and a negative impact on credit scores. This situation can make it challenging to secure loans or mortgages in the future. Additionally, without a budget, individuals may struggle to save for emergencies or retirement, leaving them vulnerable to unexpected expenses.

Moreover, failing to follow a budget can create stress and anxiety, affecting overall well-being. It may also lead to impulsive spending, further exacerbating financial instability. Understanding these consequences is essential for anyone looking to maintain control over their finances.

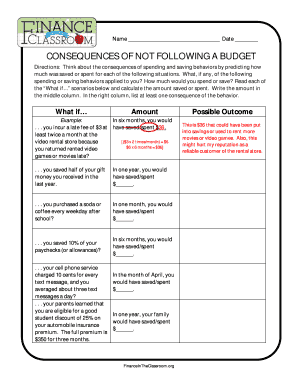

Steps to Complete the Consequences of Not Following a Budget Worksheet

Completing the worksheet requires a systematic approach. Start by gathering all financial documents, including income statements, bills, and previous budget records. Next, list all sources of income and categorize expenses into fixed and variable costs. This categorization helps in identifying areas where spending can be reduced.

Once the information is organized, analyze the data to understand spending patterns and identify the consequences of not adhering to a budget. This may include noting instances of overspending or missed savings goals. Finally, reflect on the findings and set realistic financial goals to improve budgeting practices.

Key Elements of the Consequences of Not Following a Budget Worksheet

The worksheet should include several key elements to be effective. First, it should have sections for income, fixed expenses (like rent and utilities), and variable expenses (such as groceries and entertainment). Additionally, it should allow space for users to reflect on their financial goals and the potential consequences of overspending.

Another crucial element is a summary section, where users can note the overall impact of their budgeting habits. This summary can help in recognizing patterns and making informed decisions moving forward.

Examples of Using the Consequences of Not Following a Budget Worksheet

Utilizing the worksheet can provide clarity on financial habits. For instance, a user may realize that frequent dining out contributes significantly to overspending. By documenting this in the worksheet, they can set a goal to reduce dining expenses and allocate those funds towards savings.

Another example could involve a user identifying that they consistently underestimate monthly utility costs. By tracking these expenses over several months, they can adjust their budget to reflect more accurate figures, preventing future financial strain.

Legal Use of the Consequences of Not Following a Budget Worksheet

While the worksheet itself is primarily a personal finance tool, its legal implications can arise in situations involving financial disputes or bankruptcy. Accurate records can serve as evidence of financial management practices. In legal contexts, demonstrating responsible budgeting can impact negotiations or court decisions related to debt repayment or asset division.

It's essential to ensure that the information recorded is truthful and comprehensive, as inaccuracies could lead to legal repercussions in financial matters.

State-Specific Rules for the Consequences of Not Following a Budget Worksheet

Different states may have specific regulations regarding financial management, especially in cases of bankruptcy or debt collection. Users should be aware of their state’s laws concerning budgeting and financial disclosures. For instance, certain states may require more detailed financial reporting during bankruptcy proceedings.

Consulting local financial advisors or legal experts can provide guidance on how state laws may affect personal budgeting practices and the use of related worksheets.

Quick guide on how to complete consequences of not following a budget worksheet answers

Complete Consequences Of Not Following A Budget Worksheet Answers effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the applicable form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your files promptly without delays. Manage Consequences Of Not Following A Budget Worksheet Answers on any device using the airSlate SignNow apps for Android or iOS and enhance any document-oriented task today.

The easiest method to edit and eSign Consequences Of Not Following A Budget Worksheet Answers with minimal hassle

- Locate Consequences Of Not Following A Budget Worksheet Answers and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you wish to distribute your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and eSign Consequences Of Not Following A Budget Worksheet Answers and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the consequences of not following a budget worksheet answers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the consequences of not following a budget answer key?

The consequences of not following a budget can lead to overspending and financial instability. Businesses may find it difficult to manage expenses effectively, resulting in unexpected costs. Understanding these consequences is crucial for maintaining a healthy financial outlook.

-

How can airSlate SignNow help in managing budget adherence?

AirSlate SignNow streamlines document management, which aids in budget adherence by simplifying approval processes. By digitizing workflows, businesses can reduce delays and minimize errors related to budgetary constraints. Understanding these features can help mitigate the consequences of not following a budget answer key.

-

What features does airSlate SignNow offer for budget planning?

AirSlate SignNow provides features such as electronic signatures, document tracking, and customizable templates. These tools enable better planning and management of budgets. Accessing a comprehensive budget-related workflow can reduce the risk of facing the consequences of not following a budget answer key.

-

Is airSlate SignNow cost-effective for budget-conscious businesses?

Yes, airSlate SignNow offers several pricing plans tailored to fit various business needs, making it a cost-effective solution. By utilizing digital solutions, businesses can save on resources and reduce the financial repercussions of not sticking to a budget. Analyzing the investment can prevent the consequences of not following a budget answer key.

-

Does airSlate SignNow integrate with other budgeting tools?

Yes, airSlate SignNow integrates seamlessly with popular budgeting tools and accounting software. This integration helps standardize processes and ensures that budget-related documents are accessible and organized. Effective integration can help avoid the consequences of not following a budget answer key.

-

What benefits does digitizing documents have on budgeting?

Digitizing documents through airSlate SignNow streamlines workflows and improves accountability, which is essential for effective budgeting. Enhanced visibility into document statuses helps businesses avoid costs that can arise from mismanagement. Not understanding these benefits may lead to the consequences of not following a budget answer key.

-

How can I get started with airSlate SignNow for budgeting purposes?

Getting started with airSlate SignNow is simple; you can sign up for a free trial to explore its features. This trial allows businesses to assess how the platform can assist in budget management. By familiarizing yourself with the tool, you can better navigate the consequences of not following a budget answer key.

Get more for Consequences Of Not Following A Budget Worksheet Answers

- Unimproved property tar form

- Texas real estate contract pdf form

- Release of authorization form nameaccount number

- For official use onlyname last first miarmy c form

- Dme certification and receipt form certificaci n

- Authority executive order 10450 and public law 99 474 the computer fraud and abuse act form

- Form cms 1763 request for termination of premium part a part b or part b immunosuppressive drug coverage

- Discharge applicationtotal and permanent disability form

Find out other Consequences Of Not Following A Budget Worksheet Answers

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors