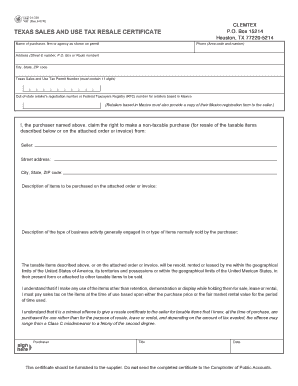

TEXAS SALES and USE TAX RESALE CERTIFICATE Form

What is the Texas Sales and Use Tax Resale Certificate?

The Texas Sales and Use Tax Resale Certificate is a legal document that allows a buyer to purchase goods without paying sales tax if those goods are intended for resale. This certificate is crucial for businesses that buy products to sell them to consumers. By using this form, businesses can avoid paying sales tax on inventory they plan to sell, which helps in maintaining cash flow and reducing costs.

Steps to Complete the Texas Sales and Use Tax Resale Certificate

Filling out the Texas Sales and Use Tax Resale Certificate involves several key steps:

- Obtain the Form: The resale certificate can be accessed online or through the Texas Comptroller's office.

- Provide Business Information: Fill in your business name, address, and Texas sales tax permit number. This information verifies your eligibility to use the certificate.

- Describe the Property: Clearly describe the items you are purchasing for resale. This ensures that the certificate is used correctly.

- Sign and Date: The certificate must be signed by an authorized representative of the business, along with the date of signing.

Legal Use of the Texas Sales and Use Tax Resale Certificate

To legally use the Texas Sales and Use Tax Resale Certificate, it must be presented to the seller at the time of purchase. The seller must retain a copy of this certificate for their records. Misuse of the certificate, such as using it for personal purchases or items not intended for resale, can lead to penalties, including fines and back taxes owed.

Key Elements of the Texas Sales and Use Tax Resale Certificate

Important elements that must be included in the Texas Sales and Use Tax Resale Certificate are:

- Purchaser's Information: Complete name and address of the buyer.

- Seller's Information: Name and address of the seller.

- Sales Tax Permit Number: The buyer's Texas sales tax permit number is essential for validation.

- Description of Items: A detailed description of the items being purchased for resale.

Examples of Using the Texas Sales and Use Tax Resale Certificate

Common scenarios for using the Texas Sales and Use Tax Resale Certificate include:

- A retail store purchasing clothing from a wholesaler to sell in their shop.

- A restaurant buying food supplies from a distributor for meal preparation.

- A contractor acquiring materials for a construction project that will be billed to clients.

Eligibility Criteria for the Texas Sales and Use Tax Resale Certificate

To be eligible to use the Texas Sales and Use Tax Resale Certificate, a business must:

- Hold a valid Texas sales tax permit.

- Purchase items intended for resale in the regular course of business.

- Provide accurate information on the certificate to avoid penalties.

Quick guide on how to complete texas sales and use tax resale certificate

Effortlessly prepare TEXAS SALES AND USE TAX RESALE CERTIFICATE on any device

Digital document management has gained traction among companies and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the required form and securely store it online. airSlate SignNow equips you with all the resources needed to create, adjust, and electronically sign your documents swiftly without any hold-ups. Manage TEXAS SALES AND USE TAX RESALE CERTIFICATE across any platform using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to adjust and electronically sign TEXAS SALES AND USE TAX RESALE CERTIFICATE with ease

- Find TEXAS SALES AND USE TAX RESALE CERTIFICATE and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize key sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether it be via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, time-consuming form navigation, or mistakes that require new copies to be printed. airSlate SignNow meets your document management requirements seamlessly from any device of your choice. Adjust and electronically sign TEXAS SALES AND USE TAX RESALE CERTIFICATE to ensure outstanding communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the texas sales and use tax resale certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Texas sales and use tax resale certificate instructions?

The Texas sales and use tax resale certificate instructions outline the necessary steps for Texas businesses to purchase items tax-free for resale. This certificate must be properly filled out and provided to vendors at the time of purchase. Understanding these instructions is crucial for compliance and to avoid unnecessary tax liabilities.

-

How do I obtain a Texas sales and use tax resale certificate?

To obtain a Texas sales and use tax resale certificate, you need to complete the form available on the Texas Comptroller's website. Ensure that you provide all required information accurately to avoid delays. Following the Texas sales and use tax resale certificate instructions will streamline the process.

-

How does airSlate SignNow help in managing resale certificate documents?

airSlate SignNow offers a straightforward platform for sending and eSigning resale certificate documents digitally. This feature ensures that you can manage your Texas sales and use tax resale certificate instructions effortlessly. With secure storage and easy access, your business can stay organized and compliant.

-

Are there any costs associated with using airSlate SignNow for resale certificates?

airSlate SignNow provides a cost-effective solution for managing your documents, including resale certificates. Pricing plans offer a variety of features tailored to your business needs, ensuring you can efficiently follow Texas sales and use tax resale certificate instructions without breaking the bank. Review our pricing page for detailed information.

-

What features does airSlate SignNow offer for resale certificate management?

AirSlate SignNow equips you with essential features like customizable templates, eSigning capabilities, and secure document storage. These features enhance your ability to follow the Texas sales and use tax resale certificate instructions effectively. Plus, the user-friendly interface allows for quick navigation and document handling.

-

Can airSlate SignNow integrate with other applications for resale certificate processing?

Yes, airSlate SignNow offers integrations with popular applications such as CRMs and accounting software to facilitate the process of managing resale certificates. This ensures that all your documents, including those following Texas sales and use tax resale certificate instructions, are synchronized across platforms. Check our integrations page for more details.

-

What are the benefits of using a digital solution for resale certificates?

Using airSlate SignNow for resale certificates provides multiple benefits, including increased efficiency and reduced paper clutter. Digital solutions allow for quicker access, easier revisions, and the ability to track document status. This supports your adherence to Texas sales and use tax resale certificate instructions seamlessly.

Get more for TEXAS SALES AND USE TAX RESALE CERTIFICATE

- Op 407 confidential medical report uft form

- Board resolution format yes bank yesbank

- Blank alphabet chart form

- Six big ideas in the constitution handout 3 answer key pdf 100968866 form

- Ride along application lehi city police department b580b west state bb lehi ut form

- Business loan contract template form

- Business management contract template form

Find out other TEXAS SALES AND USE TAX RESALE CERTIFICATE

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document