Td Ameritrade Roth Conversion Form

What is the TD Ameritrade Roth Conversion Form

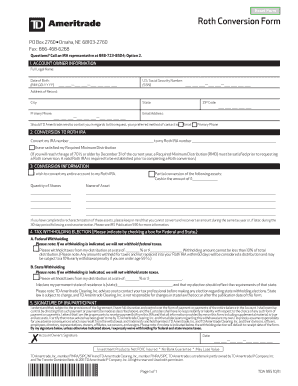

The TD Ameritrade Roth Conversion Form is a document used by individuals seeking to convert funds from a traditional IRA to a Roth IRA within the TD Ameritrade platform. This conversion allows individuals to benefit from tax-free growth and tax-free withdrawals in retirement, provided certain conditions are met. The form captures essential information, including account details, the amount to be converted, and the signature of the account holder, indicating their consent to the transaction.

How to Use the TD Ameritrade Roth Conversion Form

Using the TD Ameritrade Roth Conversion Form involves several straightforward steps. First, gather all necessary information, including your account number and the amount you wish to convert. Next, complete the form by filling in the required fields accurately. After completing the form, review it to ensure all information is correct. Finally, submit the form through the designated method, which may include online submission or mailing it to TD Ameritrade. It is crucial to keep a copy of the completed form for your records.

Steps to Complete the TD Ameritrade Roth Conversion Form

Completing the TD Ameritrade Roth Conversion Form requires careful attention to detail. Follow these steps:

- Access the form from the TD Ameritrade website or request a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide your TD Ameritrade account number and specify the amount to convert.

- Review the tax implications of the conversion, as this may affect your taxable income.

- Sign and date the form to validate your request.

- Submit the completed form as instructed.

Legal Use of the TD Ameritrade Roth Conversion Form

The legal use of the TD Ameritrade Roth Conversion Form is governed by IRS regulations regarding retirement accounts. To ensure compliance, the form must be filled out accurately and submitted within the specified timeframes. Electronic signatures are acceptable under the ESIGN Act, provided the signer is authenticated, and the document meets all legal requirements. It is essential to understand that improper use of the form or failure to comply with IRS guidelines can result in penalties.

Eligibility Criteria for Roth Conversion

Eligibility for converting a traditional IRA to a Roth IRA using the TD Ameritrade Roth Conversion Form is generally open to all account holders. However, there are specific considerations:

- Individuals must have a traditional IRA from which they wish to convert funds.

- There are no income limits for converting, but the converted amount will be subject to income tax in the year of conversion.

- Account holders should consider their current tax bracket and future tax implications before proceeding with the conversion.

Form Submission Methods

The TD Ameritrade Roth Conversion Form can be submitted through various methods to accommodate user preferences. Common submission methods include:

- Online submission via the TD Ameritrade website, where users can upload the completed form directly.

- Mailing a physical copy of the form to the address specified by TD Ameritrade.

- In-person submission at a local TD Ameritrade branch, if available.

Quick guide on how to complete td ameritrade roth conversion form

Complete Td Ameritrade Roth Conversion Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers a great eco-friendly substitute for traditional printed and signed forms, allowing you to access the necessary documents and securely store them online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your files swiftly and without delays. Manage Td Ameritrade Roth Conversion Form on any device using the airSlate SignNow apps for Android or iOS and enhance any document-driven workflow today.

How to alter and eSign Td Ameritrade Roth Conversion Form with ease

- Obtain Td Ameritrade Roth Conversion Form and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight essential portions of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form searches, or errors that necessitate printing out new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Td Ameritrade Roth Conversion Form to ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the td ameritrade roth conversion form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Roth IRA at TD Ameritrade?

A Roth IRA at TD Ameritrade is a retirement savings account that allows you to invest your money post-tax and grow it tax-free. With this type of account, your withdrawals during retirement are also tax-free, making it an attractive option for long-term financial planning.

-

How do I open a Roth IRA at TD Ameritrade?

To open a Roth IRA at TD Ameritrade, you need to fill out an online application. You'll provide personal information, financial details, and investment preferences. Once your account is set up, you can start funding your Roth IRA and choosing investments that align with your retirement goals.

-

What are the contribution limits for a Roth IRA at TD Ameritrade?

The contribution limits for a Roth IRA at TD Ameritrade align with IRS regulations. For 2023, individuals can contribute up to $6,500 annually, or $7,500 if you're age 50 or older. It's essential to stay within these limits to avoid penalties.

-

What investment options are available with a Roth IRA at TD Ameritrade?

A Roth IRA at TD Ameritrade offers a wide range of investment options including stocks, bonds, mutual funds, ETFs, and options. You can diversify your portfolio according to your risk tolerance and investment strategy, ensuring your retirement savings grow effectively.

-

What are the benefits of using a Roth IRA at TD Ameritrade?

The benefits of a Roth IRA at TD Ameritrade include tax-free growth on investments, flexible withdrawal options, and no required minimum distributions. This allows you to maximize your retirement savings and maintain control over your financial future.

-

Are there any fees associated with a Roth IRA at TD Ameritrade?

While TD Ameritrade does not charge annual account maintenance fees for a Roth IRA, there may be commissions on trades depending on your investment choices. It's important to review their fee schedule and understand how it impacts your long-term investment strategy.

-

Can I transfer my existing retirement account to a Roth IRA at TD Ameritrade?

Yes, you can transfer funds from another retirement account to a Roth IRA at TD Ameritrade through a process known as a Roth IRA conversion. Be mindful that you may have to pay taxes on the amount converted, so it's advisable to consult with a financial advisor before proceeding.

Get more for Td Ameritrade Roth Conversion Form

- Ri mc011 form

- Mad fcs 004 form

- Odont have to sue form

- Fy25 arts grants certification of assurances grant conditions form

- Issuance request form collincountytexas

- Request for issuance form

- Use this form to change personal data cancel coverage or remove a dependents

- Schedule pa 40 x amended pa personal income tax schedule pa 40 x formspublications 794932038

Find out other Td Ameritrade Roth Conversion Form

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter