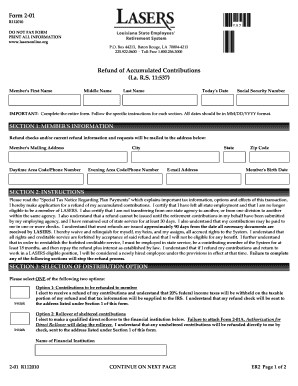

Lasersonline Refund of Accumulated Contributions Form

What is the Lasersonline Refund Of Accumulated Contributions Form

The Lasersonline Refund Of Accumulated Contributions Form is a specific document used by individuals to request the return of their accumulated contributions to a retirement or pension plan. This form is essential for those who have ceased participation in a plan and wish to withdraw their funds. It ensures that the process is documented and compliant with relevant regulations, allowing for a smooth transition of funds back to the individual.

How to use the Lasersonline Refund Of Accumulated Contributions Form

Using the Lasersonline Refund Of Accumulated Contributions Form involves several straightforward steps. First, obtain the form from the appropriate source, typically the website of the retirement or pension plan administrator. Next, fill out the required fields, ensuring that all personal information is accurate and complete. Once filled, the form can be submitted electronically or printed for mailing, depending on the submission options provided by the plan administrator.

Steps to complete the Lasersonline Refund Of Accumulated Contributions Form

Completing the Lasersonline Refund Of Accumulated Contributions Form requires attention to detail. Follow these steps for successful completion:

- Gather necessary personal information, including your Social Security number and account details.

- Access the form online or through your plan administrator.

- Fill in your personal information accurately, ensuring no errors.

- Review the form for completeness and accuracy.

- Submit the form electronically or print it for mailing, based on the submission guidelines.

Key elements of the Lasersonline Refund Of Accumulated Contributions Form

Key elements of the Lasersonline Refund Of Accumulated Contributions Form include personal identification details, the amount of contributions to be refunded, and the method of payment preferred by the individual. Additionally, the form may require a signature to validate the request and confirm that the individual understands the implications of withdrawing their contributions.

Legal use of the Lasersonline Refund Of Accumulated Contributions Form

The Lasersonline Refund Of Accumulated Contributions Form is legally binding when completed and submitted in accordance with applicable laws and regulations. To ensure its legality, it must be signed and dated by the individual requesting the refund. Compliance with federal and state laws regarding retirement funds is crucial, as improper handling of the form may lead to penalties or delays in processing the refund.

Required Documents

When submitting the Lasersonline Refund Of Accumulated Contributions Form, individuals may need to provide supporting documents. Commonly required documents include proof of identity, such as a government-issued ID, and any relevant account statements that detail the contributions made. These documents help verify the individual's identity and ensure that the refund request is processed accurately and efficiently.

Quick guide on how to complete lasersonline refund of accumulated contributions form

Complete Lasersonline Refund Of Accumulated Contributions Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without any delays. Manage Lasersonline Refund Of Accumulated Contributions Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to alter and eSign Lasersonline Refund Of Accumulated Contributions Form seamlessly

- Find Lasersonline Refund Of Accumulated Contributions Form and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or black out sensitive information with tools that airSlate SignNow specifically offers for these purposes.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form hunting, or mistakes that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Lasersonline Refund Of Accumulated Contributions Form to ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lasersonline refund of accumulated contributions form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Lasersonline Refund Of Accumulated Contributions Form?

The Lasersonline Refund Of Accumulated Contributions Form is a document that allows users to request a refund of their accumulated contributions effectively. This form is essential for individuals looking to recover funds they have previously contributed. With airSlate SignNow, you can easily complete and eSign this form online.

-

How does airSlate SignNow facilitate the completion of the Lasersonline Refund Of Accumulated Contributions Form?

airSlate SignNow offers a user-friendly platform that simplifies the process of completing the Lasersonline Refund Of Accumulated Contributions Form. Users can fill out the necessary details, involve multiple signers, and eSign the document securely all in one place. This efficiency saves time and ensures accurate submissions.

-

Is there a cost associated with using airSlate SignNow for the Lasersonline Refund Of Accumulated Contributions Form?

Yes, while airSlate SignNow is a cost-effective solution, pricing may vary depending on the plan chosen. Users can access various features that aid in the completion of the Lasersonline Refund Of Accumulated Contributions Form at competitive rates. It’s advisable to visit the pricing page for detailed information on available plans.

-

What features does airSlate SignNow provide for the Lasersonline Refund Of Accumulated Contributions Form?

airSlate SignNow provides several features to enhance the experience of completing the Lasersonline Refund Of Accumulated Contributions Form. These features include custom templates, automated workflows, and secure electronic signing, ensuring that users can handle their documents efficiently and securely.

-

Can I integrate other tools with airSlate SignNow for the Lasersonline Refund Of Accumulated Contributions Form?

Absolutely! airSlate SignNow offers integrations with numerous third-party applications, allowing for seamless workflows. Users can easily integrate with tools like Google Drive and Dropbox when handling the Lasersonline Refund Of Accumulated Contributions Form, making document management more streamlined.

-

What benefits do I gain from using airSlate SignNow for the Lasersonline Refund Of Accumulated Contributions Form?

Using airSlate SignNow for the Lasersonline Refund Of Accumulated Contributions Form provides signNow benefits, such as enhanced efficiency and better document security. Users can fill out, eSign, and track their forms in real-time, ensuring that the refund process is easy and convenient.

-

Is eSigning the Lasersonline Refund Of Accumulated Contributions Form legally binding?

Yes, eSigning the Lasersonline Refund Of Accumulated Contributions Form through airSlate SignNow is legally binding. The platform complies with eSignature laws and regulations, ensuring that your electronically signed documents hold the same legal weight as traditional signatures.

Get more for Lasersonline Refund Of Accumulated Contributions Form

- Application for a sale health certificate list of ingestible form

- For ada use only form

- Killian l director form

- Biofuel registration form

- Burning permit sonoita form

- Cottonseed sampler certification application aac r3 5 102 form

- Az at your service office of the arizona governor doug ducey form

- Livestock inspectionsarizona department of agriculture form

Find out other Lasersonline Refund Of Accumulated Contributions Form

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later