14700SOV Indd Instructions for Form 4136, Credit for Federal Tax Paid on Fuels Maine

What is the 14700SOV indd Instructions For Form 4136, Credit For Federal Tax Paid On Fuels Maine

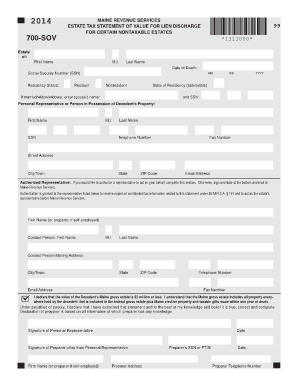

The 14700SOV indd instructions for Form 4136 provide detailed guidance for taxpayers in Maine seeking to claim a credit for federal tax paid on fuels. This form is essential for individuals and businesses that have incurred fuel taxes and wish to receive a refund or credit. Understanding the instructions is crucial for accurate completion and compliance with tax regulations.

Steps to complete the 14700SOV indd Instructions For Form 4136, Credit For Federal Tax Paid On Fuels Maine

Completing the 14700SOV indd instructions for Form 4136 involves several key steps:

- Gather all necessary documentation, including receipts for fuel purchases and proof of federal excise tax paid.

- Review the instructions carefully to understand eligibility criteria and required information.

- Fill out the form accurately, ensuring all sections are completed as per the guidelines.

- Double-check calculations and entries to avoid errors that could delay processing.

- Submit the completed form by the specified deadline, either electronically or by mail.

Key elements of the 14700SOV indd Instructions For Form 4136, Credit For Federal Tax Paid On Fuels Maine

Key elements of the 14700SOV indd instructions include:

- Eligibility criteria: Guidelines on who can claim the credit.

- Documentation requirements: List of documents needed to support the claim.

- Filing methods: Options for submitting the form, including online and mail.

- Deadline information: Important dates for filing to ensure timely processing.

Legal use of the 14700SOV indd Instructions For Form 4136, Credit For Federal Tax Paid On Fuels Maine

The legal use of the 14700SOV indd instructions for Form 4136 is governed by federal tax laws. To ensure compliance, taxpayers must adhere to the guidelines provided in the instructions. This includes the proper completion of the form, accurate reporting of fuel taxes, and submission within the designated time frame. Non-compliance may result in penalties or denial of the credit.

IRS Guidelines

IRS guidelines for the 14700SOV indd instructions for Form 4136 outline the federal requirements for claiming the credit for federal tax paid on fuels. Taxpayers should familiarize themselves with these guidelines to ensure they meet all necessary criteria and submit accurate information. These guidelines are designed to facilitate a smooth filing process and help taxpayers understand their rights and responsibilities.

Filing Deadlines / Important Dates

Filing deadlines for the 14700SOV indd instructions for Form 4136 are critical to ensure timely processing of claims. Taxpayers should be aware of the following important dates:

- The deadline for submitting the form for the current tax year.

- Any extensions available for filing.

- Dates for potential refunds or credits to be issued.

Quick guide on how to complete 14700sov indd instructions for form 4136 credit for federal tax paid on fuels maine

Complete 14700SOV indd Instructions For Form 4136, Credit For Federal Tax Paid On Fuels Maine effortlessly on any device

Online document management has become increasingly prevalent among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle 14700SOV indd Instructions For Form 4136, Credit For Federal Tax Paid On Fuels Maine on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to edit and eSign 14700SOV indd Instructions For Form 4136, Credit For Federal Tax Paid On Fuels Maine with ease

- Locate 14700SOV indd Instructions For Form 4136, Credit For Federal Tax Paid On Fuels Maine and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which only takes moments and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign 14700SOV indd Instructions For Form 4136, Credit For Federal Tax Paid On Fuels Maine and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 14700sov indd instructions for form 4136 credit for federal tax paid on fuels maine

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 14700SOV indd Instructions For Form 4136, Credit For Federal Tax Paid On Fuels Maine?

The 14700SOV indd Instructions For Form 4136, Credit For Federal Tax Paid On Fuels Maine provides detailed guidance on claiming the federal tax credit for fuels used in vehicles. This form is essential for businesses and individuals in Maine looking to maximize their tax benefits related to fuel purchases.

-

How can airSlate SignNow help with the 14700SOV indd Instructions For Form 4136?

airSlate SignNow streamlines the process of filling out the 14700SOV indd Instructions For Form 4136, Credit For Federal Tax Paid On Fuels Maine by allowing users to easily eSign and send documents. This makes it simple to prepare your forms while ensuring compliance with federal requirements.

-

Is there a cost associated with using airSlate SignNow for the 14700SOV indd Instructions For Form 4136?

Yes, airSlate SignNow offers various pricing plans designed to fit different business needs. By utilizing our affordable solutions, users can save time and improve efficiency when working on the 14700SOV indd Instructions For Form 4136, Credit For Federal Tax Paid On Fuels Maine.

-

What features does airSlate SignNow provide for managing the 14700SOV indd Instructions For Form 4136?

airSlate SignNow includes features such as document templates, customizable workflows, and secure eSigning options that enhance the management of the 14700SOV indd Instructions For Form 4136. These features help streamline the process and reduce the risk of errors.

-

Are there integration options with airSlate SignNow for handling the 14700SOV indd Instructions For Form 4136?

Yes, airSlate SignNow seamlessly integrates with various applications and software, making it easy to incorporate the 14700SOV indd Instructions For Form 4136, Credit For Federal Tax Paid On Fuels Maine into your existing workflows. This integration capability enhances accessibility and productivity.

-

How does airSlate SignNow ensure the security of documents related to the 14700SOV indd Instructions For Form 4136?

airSlate SignNow prioritizes document security through advanced encryption and secure storage solutions. This ensures that all documents, including the 14700SOV indd Instructions For Form 4136, Credit For Federal Tax Paid On Fuels Maine, are safely stored and protected from unauthorized access.

-

Can I track the status of the 14700SOV indd Instructions For Form 4136 with airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily track the signing status of the 14700SOV indd Instructions For Form 4136 in real-time. This feature allows users to stay updated on each step of the process, ensuring timely submissions.

Get more for 14700SOV indd Instructions For Form 4136, Credit For Federal Tax Paid On Fuels Maine

- Accordance with the applicable laws of the state of pennsylvania and form

- Control number pa 018 78 form

- Renunciation and discliamer of form

- Control number pa 021 77 form

- Complaint for custody pike county court of common pleas form

- Control number pa 022 78 form

- Pennsylvania quit claim deed form formswift

- Control number pa 023 78 form

Find out other 14700SOV indd Instructions For Form 4136, Credit For Federal Tax Paid On Fuels Maine

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast