F8812 Form

What is the F8812 Form

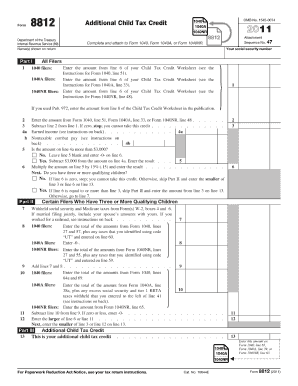

The F8812 form, officially known as the "Additional Child Tax Credit," is a tax form used by eligible taxpayers to claim a refundable credit for qualifying children. This form is particularly relevant for individuals who do not receive the full amount of the Child Tax Credit due to insufficient tax liability. By completing the F8812, taxpayers can potentially receive a refund even if they owe no taxes. Understanding the nuances of this form is essential for maximizing tax benefits.

How to use the F8812 Form

Using the F8812 form involves several steps to ensure accurate completion and submission. First, gather necessary information about your qualifying children, including their Social Security numbers and details about your income. Next, complete the form by following the instructions provided, ensuring that you accurately report your eligibility for the Additional Child Tax Credit. Once completed, the form should be submitted along with your tax return to the IRS.

Steps to complete the F8812 Form

Completing the F8812 form requires careful attention to detail. Begin by entering your personal information at the top of the form. Then, list your qualifying children, providing their names, Social Security numbers, and other required details. Calculate your credit by following the worksheet included with the form. Finally, review your entries for accuracy before submitting the form with your tax return. Ensuring that all information is correct will help avoid delays in processing your claim.

Legal use of the F8812 Form

The F8812 form is legally binding when completed accurately and submitted according to IRS guidelines. To ensure its legal standing, it is important to comply with all requirements set forth by the IRS, including providing truthful information and retaining documentation that supports your claims. Misrepresentation or failure to comply with tax laws can lead to penalties or delays in processing your refund.

Filing Deadlines / Important Dates

Filing deadlines for the F8812 form align with the general tax return deadlines set by the IRS. Typically, individual tax returns are due on April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about any changes to deadlines or extensions to ensure timely submission of your tax return and the F8812 form.

Eligibility Criteria

To qualify for the Additional Child Tax Credit using the F8812 form, certain eligibility criteria must be met. Taxpayers must have a qualifying child who is under the age of 17 at the end of the tax year. Additionally, the taxpayer's income must fall within specific limits set by the IRS. It is important to review these criteria carefully to determine eligibility and maximize potential credits.

Quick guide on how to complete f8812 form

Complete F8812 Form effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it on the internet. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any holdups. Handle F8812 Form on any platform with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign F8812 Form with ease

- Find F8812 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Produce your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you would like to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign F8812 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f8812 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is f8812 in relation to airSlate SignNow?

The f8812 refers to a specific feature of airSlate SignNow that streamlines document signing processes. This feature allows businesses to easily send and eSign documents, enhancing efficiency and productivity. By implementing f8812, users can simplify their workflows and reduce turnaround times.

-

How does airSlate SignNow's pricing model work for f8812?

AirSlate SignNow offers flexible pricing plans that cater to various business needs for utilizing the f8812 feature. Customers can choose from monthly or annual subscriptions, with cost-effective options available for different team sizes. This ensures businesses can access the f8812 capabilities without overspending.

-

What are the main benefits of using f8812 with airSlate SignNow?

Using f8812 within airSlate SignNow provides several benefits, including increased efficiency, enhanced security for document handling, and improved compliance with legal standards. It allows users to track document statuses in real-time and receive notifications when signatures are completed, making it an indispensable tool for businesses.

-

Can f8812 integrate with other tools and platforms?

Yes, f8812 seamlessly integrates with a variety of tools and platforms, allowing businesses to optimize their workflows. Whether you're using CRM systems, project management tools, or cloud storage solutions, airSlate SignNow ensures that f8812 can connect and work harmoniously with your existing software. This integration simplifies processes and improves productivity.

-

Is there a free trial available for f8812 on airSlate SignNow?

Absolutely! AirSlate SignNow offers a free trial that allows users to explore the capabilities of f8812 without any commitment. This trial period provides businesses with full access to the features, helping them understand how f8812 can enhance their document processes before making a purchase.

-

What types of documents can I send using f8812?

AirSlate SignNow allows users to send a wide variety of documents using f8812, including contracts, agreements, and consent forms. This flexibility ensures that businesses in different industries can utilize f8812 for their specific document needs. The platform supports various file formats, making it easy to send and receive documents.

-

How secure are documents signed with f8812 in airSlate SignNow?

Documents signed with f8812 in airSlate SignNow are highly secure, employing advanced encryption and authentication measures. The platform adheres to industry standards for data protection, ensuring that your sensitive information is safeguarded throughout the signing process. This commitment to security makes airSlate SignNow a trusted choice for businesses.

Get more for F8812 Form

- Team professionalism rating report form

- Liability waiver and release parade doc form

- The tom and betty cloyd scholarship deadline for form

- Preservation program kcha form

- Outdoor bazaar information rules ampamp application

- Www psd1 orgcmslibc l booth education service center 1215 w lewis street form

- Rzp application form

- Columbia fire fire sprinkler systemsfire protection service form

Find out other F8812 Form

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF