Form it 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year 2022

Understanding the Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year

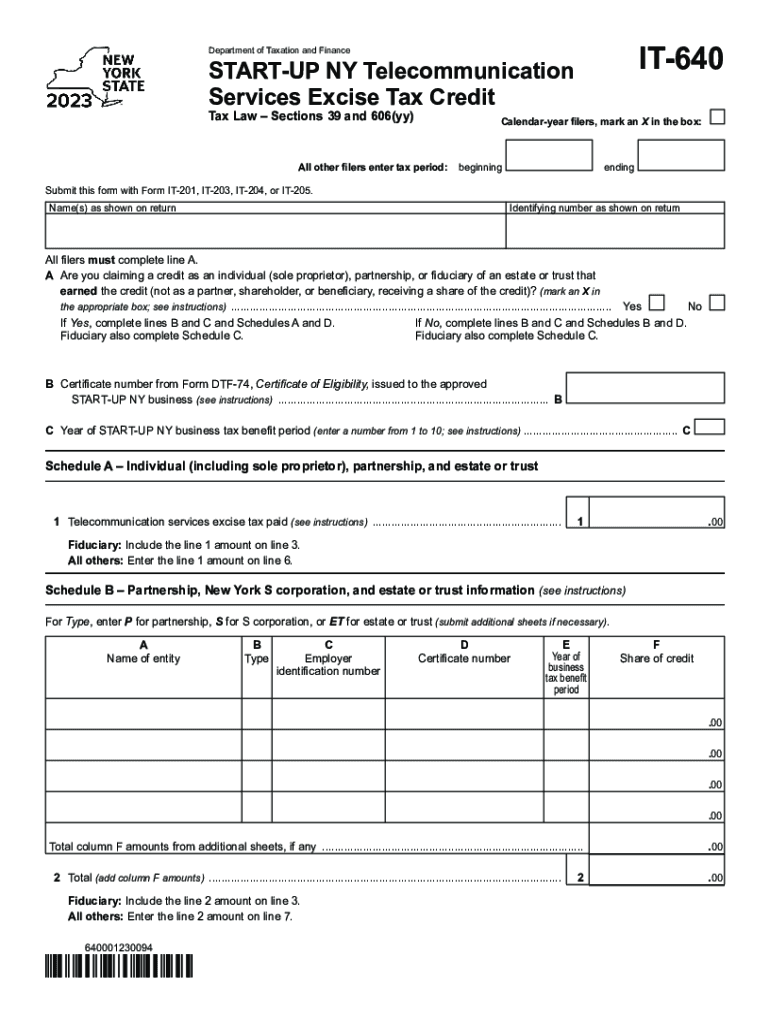

The Form IT 640 is specifically designed for businesses in New York that provide telecommunication services and seek to claim the START-UP NY Telecommunication Services Excise Tax Credit for a given tax year. This credit aims to encourage economic growth by providing tax relief to eligible businesses that meet specific criteria. The form requires detailed information about the business, including its structure, revenue from telecommunication services, and compliance with state regulations.

Steps to Complete the Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year

Completing the Form IT 640 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including financial records and proof of eligibility for the tax credit. Next, fill out the form by providing detailed information about your business operations, revenue, and any other required disclosures. Ensure that all calculations are correct, as inaccuracies can lead to delays or penalties. Finally, review the completed form thoroughly before submission to confirm that all information is accurate and complete.

Eligibility Criteria for the Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year

To qualify for the tax credit associated with Form IT 640, businesses must meet specific eligibility criteria. These criteria typically include being a registered telecommunication service provider in New York, demonstrating a certain level of investment in the state, and meeting revenue thresholds. Additionally, businesses must comply with all applicable state laws and regulations related to telecommunication services. It is essential to review the eligibility requirements carefully to ensure compliance before filing.

Required Documents for the Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year

When preparing to file Form IT 640, businesses should compile a set of required documents to support their application. This may include financial statements, proof of telecommunication service revenue, and documentation demonstrating compliance with state regulations. Additionally, any records related to investments made in New York and employment data may be necessary to substantiate claims for the tax credit. Having these documents ready will facilitate a smoother filing process.

Form Submission Methods for the Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year

Businesses can submit the Form IT 640 through various methods, including online submission, mailing a paper form, or delivering it in person to the appropriate state agency. Online submission is often the most efficient method, allowing for quicker processing times and confirmation of receipt. When submitting by mail, it is advisable to use a traceable delivery method to ensure the form arrives at the correct destination. In-person submissions may be suitable for businesses that require immediate assistance or have questions regarding their application.

Filing Deadlines for the Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year

Filing deadlines for Form IT 640 are critical to ensure that businesses do not miss out on claiming the tax credit. Generally, the form must be submitted by a specific date following the end of the tax year for which the credit is being claimed. It is important to stay informed about any changes to deadlines and to mark them on your calendar to avoid penalties or missed opportunities for tax relief.

Quick guide on how to complete form it 640 start up ny telecommunication services excise tax credit tax year

Easily Prepare Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and eSign your documents without any hassle. Manage Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year on any platform using airSlate SignNow's Android or iOS applications and streamline your document-based processes today.

How to Alter and eSign Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year effortlessly

- Obtain Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the document or redact sensitive information using tools specifically designed by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of delivery for your form—via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year to ensure clear communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 640 start up ny telecommunication services excise tax credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 640 start up ny telecommunication services excise tax credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year?

Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year is a tax form used by eligible businesses in New York to claim tax credits for telecommunication services. This form helps businesses reduce their tax liabilities by leveraging credits specifically allocated for start-ups in the telecommunication sector.

-

Who is eligible to file the Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year?

Eligibility for filing Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year generally includes newly established businesses that provide telecommunication services in New York. Businesses must meet specific criteria outlined by the state to ensure they qualify for the associated tax credits.

-

How can airSlate SignNow assist in completing Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year?

airSlate SignNow provides an intuitive platform for eSigning and managing documents. Users can easily upload, fill out, and eSign Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year, ensuring a seamless tax filing process without the hassle of paper documentation.

-

Is using airSlate SignNow for tax form signing secure?

Yes, using airSlate SignNow for signing Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year is highly secure. The platform employs advanced encryption and compliance with industry standards, providing peace of mind that your sensitive information remains protected.

-

Are there any costs associated with using airSlate SignNow for filing Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year?

While airSlate SignNow offers various pricing plans, many users find the service to be cost-effective. Depending on your business needs and the features you choose, there may be nominal fees involved, but the efficiencies gained can often outweigh these costs, especially when filing Form IT 640.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow boasts features such as customized templates, automated workflows, and powerful integrations with other business applications. These features facilitate the efficient management of documents like Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year, ensuring quick and effective handling of tax paperwork.

-

Can I integrate airSlate SignNow with other software when preparing Form IT 640?

Yes, airSlate SignNow seamlessly integrates with various business software, enhancing your workflow. By integrating with platforms like CRM software or accounting tools, you can streamline the process of preparing and submitting Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year.

Get more for Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year

Find out other Form IT 640 START UP NY Telecommunication Services Excise Tax Credit Tax Year

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now