Form it 135 Sales and Use Tax Report for Purchases of 2023

Understanding the Form IT-135 Sales and Use Tax Report

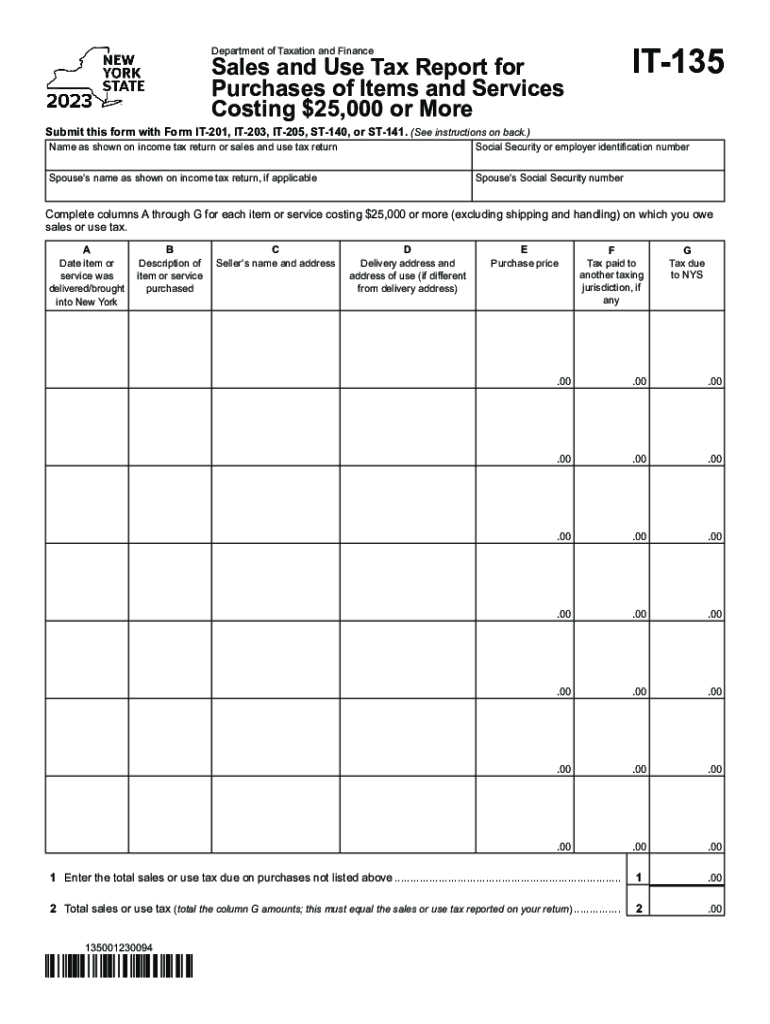

The Form IT-135 is used to report sales and use tax for purchases made in the state. It is essential for businesses and individuals who have made taxable purchases and need to report these transactions to the state tax authority. This form helps ensure compliance with state tax laws and provides a clear record of taxable purchases.

Steps to Complete the Form IT-135

Completing the Form IT-135 involves several key steps:

- Gather all receipts and documentation for taxable purchases.

- Fill in your personal or business information at the top of the form.

- List each taxable purchase, including the date, description, and amount spent.

- Calculate the total sales and use tax owed based on the applicable tax rate.

- Review the completed form for accuracy before submission.

Filing Deadlines for the Form IT-135

It is crucial to be aware of the filing deadlines for the Form IT-135 to avoid penalties. Typically, the form must be submitted by the end of the month following the end of the reporting period. For example, if you are reporting for the month of January, the form is due by the end of February. Always check for any updates or changes to deadlines that may occur annually.

Legal Use of the Form IT-135

The Form IT-135 is legally required for reporting sales and use tax. Failing to file this form or providing inaccurate information can result in penalties. It is important to understand the legal implications of submitting this form accurately and on time, as it helps maintain compliance with state tax regulations.

Required Documents for the Form IT-135

To complete the Form IT-135, you will need several documents:

- Receipts for all taxable purchases.

- Previous tax returns, if applicable.

- Any correspondence from the state tax authority regarding your tax status.

Examples of Using the Form IT-135

Examples of when to use the Form IT-135 include:

- Purchasing equipment for a business that is subject to sales tax.

- Acquiring materials for construction projects.

- Buying goods for resale that were not taxed at the point of sale.

Who Issues the Form IT-135

The Form IT-135 is issued by the state tax authority. It is important to ensure that you are using the most current version of the form, as regulations and requirements can change. Always refer to the official state tax authority website for the latest updates and resources related to the form.

Quick guide on how to complete form it 135 sales and use tax report for purchases of

Complete Form IT 135 Sales And Use Tax Report For Purchases Of seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Form IT 135 Sales And Use Tax Report For Purchases Of on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and electronically sign Form IT 135 Sales And Use Tax Report For Purchases Of effortlessly

- Obtain Form IT 135 Sales And Use Tax Report For Purchases Of and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form IT 135 Sales And Use Tax Report For Purchases Of and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 135 sales and use tax report for purchases of

Create this form in 5 minutes!

How to create an eSignature for the form it 135 sales and use tax report for purchases of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 796 att. feature in airSlate SignNow?

The it 796 att. feature in airSlate SignNow streamlines document management by allowing users to easily send and eSign documents. This feature enhances productivity and helps businesses manage their documentation efficiently while maintaining legal compliance.

-

How much does airSlate SignNow cost for the it 796 att. package?

The pricing for the it 796 att. package is competitive and offers various plans to fit different business needs. Customers can choose from monthly or annual subscriptions, which provide flexibility based on the volume of documents processed.

-

What are the benefits of using it 796 att. with airSlate SignNow?

Using the it 796 att. feature in airSlate SignNow allows businesses to enhance their workflow efficiency. It provides secure eSigning, reduces paper waste, and ensures faster turnaround times for document approvals, contributing to overall operational effectiveness.

-

Can I integrate it 796 att. with other software solutions?

Yes, airSlate SignNow offers seamless integration capabilities with various software applications, enhancing the it 796 att. feature. This allows businesses to connect their existing tools, such as CRM systems or project management software, ensuring smooth workflow transitions.

-

Is the it 796 att. supported on mobile devices?

Absolutely! The it 796 att. feature in airSlate SignNow is fully optimized for mobile devices, enabling users to send and eSign documents on-the-go. This mobile compatibility ensures that you can manage important documents anytime, anywhere, enhancing your business's flexibility.

-

What types of documents can I manage with the it 796 att. feature?

With the it 796 att. feature, users can manage a wide range of document types, including contracts, agreements, and forms. This versatility makes it an ideal solution for various industries looking to streamline their document management processes.

-

Is there a trial available for it 796 att. in airSlate SignNow?

Yes, airSlate SignNow offers a free trial for the it 796 att. package, allowing potential customers to explore its features and benefits. This trial period helps businesses assess how the it 796 att. feature can meet their document management needs before committing.

Get more for Form IT 135 Sales And Use Tax Report For Purchases Of

Find out other Form IT 135 Sales And Use Tax Report For Purchases Of

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form