Form 8922

What is the Form 8922

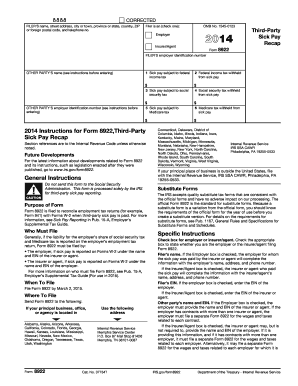

The Form 8922 is an Internal Revenue Service (IRS) document specifically designed for employers to report sick pay. This form is essential for ensuring that sick pay is accurately reported to the IRS and that the correct tax obligations are met. By using this form, employers can provide necessary information about sick pay distributions, which helps in maintaining compliance with federal tax regulations. Understanding the purpose and requirements of the form is crucial for employers to avoid potential penalties and ensure proper tax reporting.

How to use the Form 8922

Using the Form 8922 involves several steps to ensure accurate completion and submission. First, employers should gather all relevant information regarding sick pay distributions, including the total amount paid and the names of recipients. Next, the form must be filled out with precise details, including employer identification information and the tax year for which the sick pay is being reported. Once completed, the form can be submitted electronically or via mail to the appropriate IRS address, depending on the employer's preference and the guidelines set forth by the IRS.

Steps to complete the Form 8922

Completing the Form 8922 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including total sick pay amounts and employee details.

- Download the latest version of the Form 8922 from the IRS website.

- Fill in the employer's name, address, and Employer Identification Number (EIN).

- Report the total sick pay distributed during the tax year.

- Double-check all entries for accuracy before submission.

- Submit the completed form electronically or by mail, adhering to IRS submission guidelines.

Legal use of the Form 8922

The legal use of the Form 8922 is defined by IRS regulations that mandate accurate reporting of sick pay. Employers must ensure that the information provided is truthful and complete to avoid legal repercussions. The form serves as an official record of sick pay distributions, which can be audited by the IRS. Compliance with the legal requirements surrounding this form is essential for maintaining good standing with tax authorities and avoiding fines or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8922 are crucial for employers to adhere to in order to avoid penalties. The form must typically be submitted by the last day of February for the previous tax year if filed on paper, or by March 31 if filed electronically. Employers should keep track of these dates and ensure timely submission to the IRS, as late filings can result in fines and complications with tax reporting.

Required Documents

To complete the Form 8922, employers need several key documents. These include:

- Records of sick pay distributions made during the tax year.

- Employee identification details, including Social Security Numbers.

- Employer Identification Number (EIN) for accurate reporting.

- Previous tax documents that may be relevant for cross-referencing sick pay amounts.

Examples of using the Form 8922

Employers may use the Form 8922 in various scenarios, such as:

- When an employee receives sick pay due to a temporary disability.

- In cases where sick pay is provided through a third-party administrator.

- For reporting sick pay that exceeds a certain threshold, which may have different tax implications.

Quick guide on how to complete form 8922

Effortlessly complete Form 8922 on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any delays. Manage Form 8922 across any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to edit and eSign Form 8922 with ease

- Obtain Form 8922 and click on Get Form to begin.

- Use the tools available to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you'd like to share your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you select. Edit and eSign Form 8922 to ensure seamless communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8922

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8922 and how do I use it with airSlate SignNow?

Form 8922 is used to claim a refund of certain fees paid to the IRS. With airSlate SignNow, you can easily fill out and eSign form 8922 online, streamlining the submission process while ensuring compliance and accuracy.

-

Is there a cost associated with using airSlate SignNow for form 8922?

airSlate SignNow offers various pricing plans, making it cost-effective for businesses of all sizes. You can start with a free trial and choose a plan that fits your needs, which includes unlimited access to eSigning documents like form 8922.

-

What features does airSlate SignNow provide for eSigning form 8922?

airSlate SignNow includes features like custom workflows, reusable templates, and secure document storage. These tools enhance the eSigning experience for form 8922, ensuring you can complete it quickly and efficiently without sacrificing security.

-

How does airSlate SignNow ensure the security of form 8922 submissions?

Security is a priority at airSlate SignNow, which employs bank-level encryption and compliance with industry standards. All your signed documents, including form 8922, are stored securely to protect sensitive information from unauthorized access.

-

Can I integrate airSlate SignNow into my existing software for handling form 8922?

Yes, airSlate SignNow offers integrations with popular business tools such as Google Drive, Dropbox, and other CRM platforms. These integrations make it easy to manage your documents, including form 8922, within your current workflows seamlessly.

-

What are the benefits of using airSlate SignNow for form 8922?

Using airSlate SignNow for form 8922 allows you to maximize efficiency by eliminating the need for printing and physical signatures. Additionally, it enhances tracking capabilities, so you can monitor when form 8922 is signed and completed, promoting faster processing.

-

What support options are available for users of airSlate SignNow handling form 8922?

airSlate SignNow provides extensive support through various channels, including live chat, email, and a comprehensive knowledge base. If you have questions regarding form 8922 or any functionality, our support team is ready to assist you.

Get more for Form 8922

Find out other Form 8922

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document