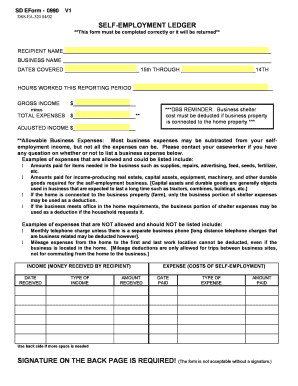

Self Employment Ledger State Sd Form

What is the self employment ledger in South Dakota?

The self employment ledger in South Dakota serves as a crucial document for individuals who are self-employed. It is designed to track income and expenses, providing a clear overview of financial activity. This ledger is particularly important for tax purposes, allowing self-employed individuals to demonstrate their earnings and deductions accurately. By maintaining a detailed record, users can ensure compliance with state regulations and facilitate the filing of their taxes.

Key elements of the self employment ledger in South Dakota

When filling out the self employment ledger, several key elements must be included to ensure completeness and accuracy:

- Date: Record the date of each transaction to maintain a chronological order.

- Description: Provide a brief description of the income or expense, detailing its nature.

- Income Amount: Clearly state the amount earned from self-employment activities.

- Expense Amount: Document any business-related expenses incurred during the period.

- Net Income: Calculate the net income by subtracting total expenses from total income.

These elements collectively help in creating a comprehensive financial picture for self-employed individuals.

Steps to complete the self employment ledger in South Dakota

Completing the self employment ledger involves a systematic approach to ensure that all necessary information is accurately captured:

- Gather all relevant financial documents, including receipts and invoices.

- Start with the current date and enter it in the ledger.

- For each transaction, fill in the description, income amount, and expense amount as they occur.

- Regularly update the ledger to reflect ongoing financial activities.

- At the end of the reporting period, calculate the total income, total expenses, and net income.

By following these steps, individuals can maintain an organized and effective self employment ledger.

Legal use of the self employment ledger in South Dakota

The self employment ledger is not only a practical tool but also holds legal significance. It can serve as proof of income for various purposes, including applying for loans or verifying income for healthcare marketplaces. To ensure its legal validity, it is essential to keep the ledger updated and accurate. Additionally, compliance with applicable laws, such as tax regulations, is crucial to avoid potential penalties.

Examples of using the self employment ledger in South Dakota

There are various scenarios where the self employment ledger proves beneficial:

- Tax Filing: Individuals can use the ledger to prepare their tax returns, ensuring that all income and deductions are accurately reported.

- Loan Applications: When applying for a loan, lenders may require proof of income, which can be substantiated through the ledger.

- Business Planning: Analyzing the ledger can help self-employed individuals make informed decisions about future business strategies and investments.

These examples highlight the versatility and importance of maintaining a self employment ledger.

Required documents for the self employment ledger in South Dakota

To effectively complete the self employment ledger, certain documents are necessary:

- Receipts: Keep all receipts for business-related purchases to document expenses.

- Invoices: Maintain copies of invoices sent to clients for income tracking.

- Bank Statements: Use bank statements to verify transactions and ensure accuracy in reporting.

Having these documents on hand will facilitate the completion of the self employment ledger and support any claims made during tax filing or financial assessments.

Quick guide on how to complete self employment ledger state sd

Complete Self Employment Ledger State Sd effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage Self Employment Ledger State Sd on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Self Employment Ledger State Sd with ease

- Obtain Self Employment Ledger State Sd and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device of your choosing. Modify and eSign Self Employment Ledger State Sd and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the self employment ledger state sd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an employment ledger and how does it work with airSlate SignNow?

An employment ledger is a document that tracks employment details for individuals, such as positions held and duration. With airSlate SignNow, you can easily create, send, and electronically sign employment ledgers, streamlining the process while ensuring compliance and security.

-

What features does airSlate SignNow offer for managing employment ledgers?

airSlate SignNow offers robust features for managing employment ledgers, including customizable templates, eSignature capabilities, and secure cloud storage. These features help ensure that your employment ledgers are accurate, easily accessible, and compliant with industry standards.

-

How does airSlate SignNow enhance the efficiency of handling employment ledgers?

airSlate SignNow enhances efficiency by automating the document workflow for employment ledgers. You can easily track who has signed, send follow-up reminders, and reduce the time spent on paperwork, allowing your HR team to focus on more strategic initiatives.

-

Is airSlate SignNow affordable for small businesses needing employment ledgers?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses managing employment ledgers. Our pricing plans offer flexibility, allowing you to choose a plan that best fits your budget and document management needs.

-

What integrations does airSlate SignNow support for employment ledger processes?

airSlate SignNow supports integrations with popular business tools such as Google Workspace, Microsoft Office, and more. These integrations enable you to streamline the management of employment ledgers by seamlessly connecting your existing workflows and enhancing productivity.

-

Can airSlate SignNow ensure the security of sensitive employment ledger information?

Absolutely! airSlate SignNow prioritizes security and compliance, providing encryption and secure storage for your employment ledger data. We adhere to strict data protection regulations to ensure that all sensitive information remains safe and accessible only to authorized users.

-

How does airSlate SignNow improve collaboration on employment ledgers?

With airSlate SignNow, collaboration on employment ledgers becomes effortless. Multiple users can access and sign documents simultaneously, and real-time updates ensure that everyone involved is on the same page, minimizing delays and enhancing team productivity.

Get more for Self Employment Ledger State Sd

- Dialectical journal template pdf form

- Agreement to provide insurance pdf 5462361 form

- State of california health and human services agency department of child support services visitation verification dcss 0053 form

- Eligibility certificate format

- Solve by factoring worksheet form

- El verbo ir explanation and practice 1 st joseph hill academy stjosephhill form

- Record keeping as a form of risk management farm business

- Artist manager contract template form

Find out other Self Employment Ledger State Sd

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word