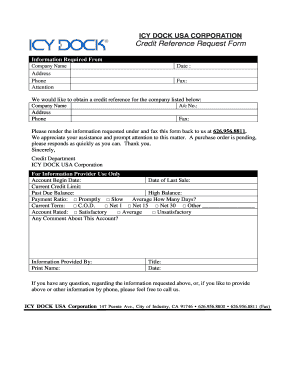

Credit Reference Request Form

What is the credit reference request form

The credit reference request form is a document used to request information about an individual's or business's credit history from a financial institution or credit agency. This form typically includes details such as the name of the person or entity requesting the credit reference, the purpose of the request, and the consent of the individual whose credit information is being sought. It serves as a formal way to verify creditworthiness, which is essential for lenders, landlords, and other entities that require assurance of an individual's financial reliability.

Key elements of the credit reference request form

Understanding the key elements of the credit reference request form is crucial for accurate completion. Essential components often include:

- Requester Information: Name, address, and contact details of the individual or organization requesting the credit reference.

- Subject Information: Name, address, and other identifying details of the person or business whose credit information is being requested.

- Purpose of Request: A clear statement explaining why the credit reference is needed, such as for loan applications or rental agreements.

- Consent: A section where the individual whose credit information is being requested must provide their signature or initials, indicating their consent for the release of their credit details.

Steps to complete the credit reference request form

Completing the credit reference request form involves several straightforward steps:

- Gather Required Information: Collect all necessary details about both the requester and the subject.

- Fill Out the Form: Accurately enter all required information in the designated fields of the form.

- Obtain Consent: Ensure that the individual whose credit information is being requested signs the form to provide consent.

- Submit the Form: Send the completed form to the appropriate financial institution or credit agency, either electronically or via mail.

Legal use of the credit reference request form

The legal use of the credit reference request form is governed by various regulations, including the Fair Credit Reporting Act (FCRA) in the United States. This law mandates that any request for credit information must be made with the consent of the individual whose credit is being checked. Additionally, the requester must have a legitimate purpose for obtaining the information, such as evaluating creditworthiness for loans or rental agreements. Failure to comply with these legal requirements can result in penalties and legal repercussions.

Examples of using the credit reference request form

There are several scenarios in which the credit reference request form is commonly utilized:

- Loan Applications: Lenders often require a credit reference to assess the risk of lending money to an individual or business.

- Rental Agreements: Landlords may request a credit reference to evaluate a potential tenant's financial reliability before signing a lease.

- Business Partnerships: Companies may seek credit references when entering into partnerships to ensure financial stability and trustworthiness.

How to obtain the credit reference request form

The credit reference request form can typically be obtained from various sources, including:

- Financial Institutions: Many banks and credit unions provide their own version of the form, which can often be downloaded from their websites.

- Credit Reporting Agencies: Agencies like Experian, TransUnion, and Equifax may offer templates or guidelines for completing the request.

- Online Resources: Various legal and financial websites provide downloadable templates that can be customized for specific needs.

Quick guide on how to complete credit reference request form

Effortlessly Prepare Credit Reference Request Form on Any Device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and store it securely online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents swiftly without unnecessary delays. Manage Credit Reference Request Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and Electronically Sign Credit Reference Request Form with Ease

- Find Credit Reference Request Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you prefer to send your form: via email, SMS, or an invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Credit Reference Request Form while ensuring effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit reference request form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a credit reference letter?

A credit reference letter is a document provided by a financial institution or lender that verifies a borrower's creditworthiness. It typically includes details regarding the borrower's credit history, current loans, and payment habits. This letter is essential for individuals or businesses seeking to secure loans or leasing agreements.

-

How can airSlate SignNow help me create a credit reference letter?

With airSlate SignNow, you can easily create and customize your credit reference letter using our user-friendly templates. Our electronic signature feature allows you to send the letter directly to recipients for secure signing. This streamlines the process, ensuring your document is professional and ready for submission.

-

Is there a cost associated with using airSlate SignNow for credit reference letters?

airSlate SignNow offers competitive pricing plans suitable for businesses of all sizes. While signing up, you can access various features that included unlimited document signing and storage for your credit reference letters. Visit our pricing page to find the best plan that fits your needs.

-

What benefits do I get from using airSlate SignNow for my credit reference letter?

Using airSlate SignNow for your credit reference letter adds efficiency and security to your documentation process. You can digitally sign documents from anywhere, access them anytime, and reduce the need for printing and mailing. This not only saves time but also enhances the overall experience for your clients or lenders.

-

Can I integrate airSlate SignNow with other applications for my credit reference letters?

Yes, airSlate SignNow offers seamless integrations with various applications, including CRM systems and document management tools. This enables you to streamline your workflow and effortlessly manage your credit reference letters alongside other important documents. Our API also allows for further customization based on your needs.

-

Are there templates available for credit reference letters in airSlate SignNow?

Absolutely! airSlate SignNow provides a variety of templates for credit reference letters tailored to different industries and purposes. These templates can be easily customized, allowing you to personalize the content to suit your specific requirements while saving time on document drafting.

-

How secure are my credit reference letters when using airSlate SignNow?

Security is a top priority at airSlate SignNow. Your credit reference letters are protected by industry-standard encryption and secure storage protocols. We also offer options for password protection and access controls to ensure that only authorized users can view or sign your documents.

Get more for Credit Reference Request Form

Find out other Credit Reference Request Form

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free