Ohio Tax Schedule J 2018

What is the Ohio Tax Schedule J

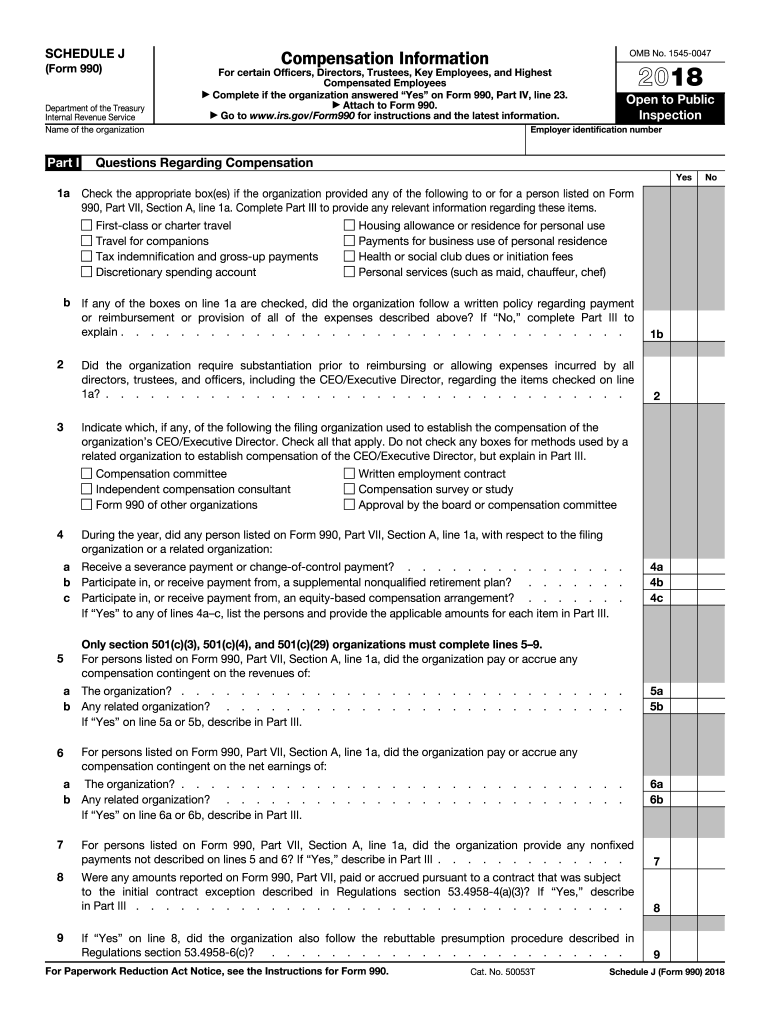

The Ohio Tax Schedule J is a specific tax form used by individuals and businesses to report certain types of income and deductions. This schedule is particularly relevant for taxpayers who need to detail their income from various sources, including partnerships, S corporations, and trusts. Understanding this form is crucial for ensuring compliance with state tax regulations and accurately reporting financial information.

How to use the Ohio Tax Schedule J

Using the Ohio Tax Schedule J involves several steps to ensure accurate reporting. Taxpayers should first gather all necessary financial documents, including income statements and any relevant deductions. Next, complete the schedule by entering income details in the appropriate sections. It is important to follow the instructions carefully to avoid errors. Once completed, attach the schedule to your main tax return form before submission.

Steps to complete the Ohio Tax Schedule J

Completing the Ohio Tax Schedule J requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, such as W-2s, 1099s, and K-1s.

- Fill in your personal information at the top of the form.

- Report income from each source accurately in the designated sections.

- Include any deductions applicable to your situation.

- Review the completed schedule for accuracy before submission.

Legal use of the Ohio Tax Schedule J

The legal use of the Ohio Tax Schedule J is essential for compliance with state tax laws. Taxpayers must ensure that they are using the most current version of the form and that all information provided is accurate and truthful. Failure to comply with the legal requirements can result in penalties or audits by the Ohio Department of Taxation.

Filing Deadlines / Important Dates

Filing deadlines for the Ohio Tax Schedule J are typically aligned with the general state tax return deadlines. Taxpayers should be aware that the deadline for filing is usually April 15 of each year, unless it falls on a weekend or holiday. It is advisable to check for any updates or changes in deadlines to avoid late filing penalties.

Required Documents

To complete the Ohio Tax Schedule J, taxpayers will need several key documents, including:

- Income statements such as W-2s and 1099s.

- Documentation of any deductions claimed.

- Records of any relevant financial transactions.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the Ohio Tax Schedule J through various methods. The form can be filed online using the Ohio Department of Taxation's e-filing system, which offers a secure and efficient way to submit tax returns. Alternatively, taxpayers may choose to mail their completed forms to the appropriate address or submit them in person at designated tax offices. It is important to verify the submission method that best suits your needs and complies with state regulations.

Quick guide on how to complete 2017 schedule j 2018 form

Discover the simplest method to complete and endorse your Ohio Tax Schedule J

Are you still spending time on creating your official documents in hard copy instead of online? airSlate SignNow presents a superior approach to fill out and authorize your Ohio Tax Schedule J and associated forms for public services. Our intelligent electronic signature platform equips you with all the essentials to handle documents swiftly and in accordance with official standards - powerful PDF editing, managing, securing, signing, and sharing functionalities all available within an intuitive interface.

There are just a few steps required to fill out and endorse your Ohio Tax Schedule J:

- Upload the editable template to the editor using the Get Form button.

- Review what information needs to be inputted in your Ohio Tax Schedule J.

- Move between the fields using the Next feature to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Enhance the content with Text boxes or Images from the top menu.

- Emphasize what is important or Obscure sections that are no longer relevant.

- Select Sign to create a legally enforceable electronic signature using your preferred method.

- Add the Date adjacent to your signature and finalize your task with the Done button.

Store your finished Ohio Tax Schedule J in the Documents folder in your profile, download it, or transfer it to your chosen cloud service. Our solution also offers versatile form sharing. There’s no need to print your templates when filing them at the correct public office – do it via email, fax, or by requesting a USPS “snail mail” shipment from your account. Try it out now!

Create this form in 5 minutes or less

Find and fill out the correct 2017 schedule j 2018 form

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

If I was unable to fill SSC Cgl 2017, can I fill SSC Cgl 2018 form?

Don’t wait till the last date, apply your form well in advance. If still you are unable to fill your form, you may fill in 2018.

-

How do I fill out the JEE Advanced 2017 application form?

JEE Advanced Application Form 2017 is now available for all eligible candidates from April 28 to May 2, 2017 (5 PM). Registrations with late fee will be open from May 3 to May 4, 2017. The application form of JEE Advanced 2017 has been released only in online mode. visit - http://www.entrancezone.com/engi...

Create this form in 5 minutes!

How to create an eSignature for the 2017 schedule j 2018 form

How to make an eSignature for the 2017 Schedule J 2018 Form online

How to create an eSignature for your 2017 Schedule J 2018 Form in Chrome

How to create an electronic signature for putting it on the 2017 Schedule J 2018 Form in Gmail

How to create an electronic signature for the 2017 Schedule J 2018 Form from your smart phone

How to generate an electronic signature for the 2017 Schedule J 2018 Form on iOS devices

How to generate an electronic signature for the 2017 Schedule J 2018 Form on Android devices

People also ask

-

What is Ohio Tax Schedule J and how does it work?

Ohio Tax Schedule J is a form used by taxpayers to report income from partnerships, S corporations, and estates. It helps you determine the amount of income that is subject to Ohio taxes. Using airSlate SignNow, you can easily eSign and submit your Ohio Tax Schedule J efficiently and securely.

-

How can airSlate SignNow help with Ohio Tax Schedule J submissions?

airSlate SignNow streamlines the process of completing and submitting your Ohio Tax Schedule J by enabling electronic signatures and secure document sharing. This means you can quickly gather necessary signatures and submit your tax documents without the hassle of printing and mailing. Our platform ensures compliance and simplifies your tax filing experience.

-

Is there a cost associated with using airSlate SignNow for Ohio Tax Schedule J?

Yes, airSlate SignNow offers a variety of pricing plans to suit different business needs. You can choose a plan that fits your budget while gaining access to features that simplify your Ohio Tax Schedule J submissions and other document management tasks. Check our pricing page for detailed information on the available plans.

-

What features does airSlate SignNow offer for managing Ohio Tax Schedule J?

airSlate SignNow offers features such as electronic signature capabilities, document templates, and secure cloud storage, all of which are beneficial for managing your Ohio Tax Schedule J. Additionally, our platform allows for easy collaboration and tracking of document statuses, ensuring you stay organized throughout the tax filing process.

-

Can I integrate airSlate SignNow with other tools for Ohio Tax Schedule J handling?

Absolutely! airSlate SignNow integrates seamlessly with a variety of tools and applications, enhancing your workflow for Ohio Tax Schedule J. Whether you use accounting software or document management systems, our integrations help streamline your processes and improve efficiency.

-

How secure is the submission of Ohio Tax Schedule J with airSlate SignNow?

Security is a top priority at airSlate SignNow. When submitting your Ohio Tax Schedule J, your documents are encrypted and stored securely. We comply with industry standards to ensure that your sensitive information remains protected throughout the signing and submission process.

-

What benefits can I expect from using airSlate SignNow for Ohio Tax Schedule J?

By using airSlate SignNow for your Ohio Tax Schedule J, you can expect increased efficiency, reduced paperwork, and faster turnaround times. Our platform simplifies the entire process, allowing you to focus on your business while ensuring compliance with Ohio tax regulations.

Get more for Ohio Tax Schedule J

Find out other Ohio Tax Schedule J

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now