Form 8949 2018

What is the Form 8949

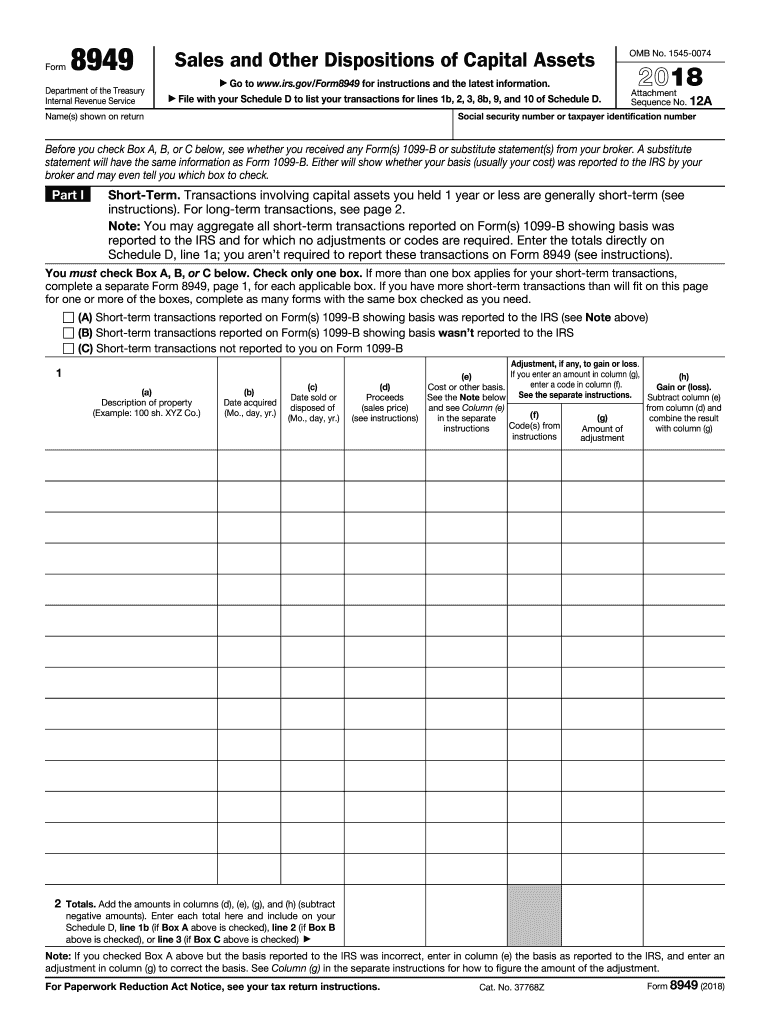

The Form 8949 is a tax form used in the United States for reporting sales and exchanges of capital assets. It is essential for individuals who have sold stocks, bonds, or other investments during the tax year. This form helps taxpayers calculate their capital gains and losses, which are then transferred to Schedule D of the IRS Form 1040. Understanding how to properly fill out the Form 8949 is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Form 8949

Using the Form 8949 involves several steps. First, you need to gather all relevant information regarding your capital asset transactions, including purchase dates, sale dates, proceeds from sales, and the cost basis of the assets. Next, you will categorize your transactions into short-term and long-term sales based on the holding period. Each transaction must be reported individually on the form, providing details such as the asset description, dates acquired and sold, and the gain or loss for each transaction. Finally, the totals from the Form 8949 are summarized on Schedule D, which is submitted along with your tax return.

Steps to complete the Form 8949

Completing the Form 8949 requires careful attention to detail. Start by downloading the correct version of the form for the tax year you are filing. Next, follow these steps:

- Enter your name and Social Security number at the top of the form.

- Separate your transactions into two sections: short-term (held for one year or less) and long-term (held for more than one year).

- For each transaction, fill in the asset description, dates acquired and sold, proceeds, cost basis, and the resulting gain or loss.

- Ensure that all calculations are accurate and that totals are carried over to Schedule D.

- Review the completed form for any errors before submission.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 8949. It is important to refer to the latest IRS instructions for the form, which detail how to report different types of transactions, such as those involving cryptocurrency or like-kind exchanges. Additionally, the IRS outlines requirements for supporting documentation, which may include brokerage statements or transaction records. Adhering to these guidelines ensures compliance and helps avoid potential penalties.

Filing Deadlines / Important Dates

For the tax year 2018, the deadline for filing your Form 8949 is typically April 15 of the following year, unless that date falls on a weekend or holiday, in which case the deadline may be extended. It is essential to keep track of any changes to filing dates and to ensure that all forms, including the Form 8949, are submitted on time to avoid late fees or penalties. Taxpayers should also be aware of any extensions that may be available for filing their returns.

Form Submission Methods (Online / Mail / In-Person)

The Form 8949 can be submitted through various methods. Taxpayers have the option to file their returns electronically using tax preparation software, which often simplifies the process and reduces errors. Alternatively, you can print the completed form and mail it to the IRS. If you prefer to file in person, you may visit a local IRS office, although this option may require an appointment. Each submission method has its own advantages, so it is important to choose the one that best suits your needs.

Quick guide on how to complete printable irs tax form 8949 2018

Discover the simplest method to complete and endorse your Form 8949

Are you still spending time preparing your official documents on paper instead of handling them online? airSlate SignNow provides a superior way to complete and endorse your Form 8949 and similar forms for public services. Our advanced electronic signature solution equips you with everything necessary to manage documentation swiftly and in compliance with official standards - robust PDF editing, management, protection, endorsement, and sharing tools are available within a user-friendly interface.

Only a few steps are needed to complete and endorse your Form 8949:

- Upload the editable template to the editor using the Get Form button.

- Review the information you need to provide in your Form 8949.

- Move between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the fields with your information.

- Modify the content with Text boxes or Images from the top toolbar.

- Emphasize what is essential or Conceal areas that are no longer relevant.

- Click on Sign to create a legally binding electronic signature using your preferred method.

- Add the Date next to your signature and conclude your task with the Done button.

Store your finished Form 8949 in the Documents folder of your profile, download it, or transfer it to your chosen cloud storage. Our solution also offers versatile file sharing options. There’s no need to print your forms when you have to submit them to the appropriate public office - do it via email, fax, or by asking for a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct printable irs tax form 8949 2018

FAQs

-

Can I use broker statements to fill out form 8949 instead of a 1099-B?

Yes you can. Should you? Perhaps, but remember that the 1099 is what the IRS is going to receive. There could be differences.You may receive a 1099 which is missing basis information. You will indicate that, and use your records to fill in the missing information.My suggestion is to use the 1099, cross-referencing to your statements.

-

Do I need to submit a 1099B to the IRS if I fill out the 8949 with broker summaries?

The IRS receives copies of any of your 1099s, you don’t need to submit them. However you do need to fill out the 8949 with all transactions, not summaries. Most tax programs like Turbotax will allow you to import the transactions and save you a lot of time. Tradelog ( specialty program) is by far the best trader’s tax program.As to the 400 pages, you can submit them by efile through Turbotax or by mail. It doesn’t matter.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

How many tax forms does a small startup usually have to fill for the IRS?

It depends. Have you set up a separate legal entity, such as a C corporation or an LLC? Are you operating as a sole proprietor? Are you referring specifically to income tax returns? Depending on what kind of business you have, you may include additional schedules, election statements, informational forms to supplement your income tax returns.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

Create this form in 5 minutes!

How to create an eSignature for the printable irs tax form 8949 2018

How to make an electronic signature for the Printable Irs Tax Form 8949 2018 in the online mode

How to make an electronic signature for the Printable Irs Tax Form 8949 2018 in Google Chrome

How to make an eSignature for signing the Printable Irs Tax Form 8949 2018 in Gmail

How to generate an electronic signature for the Printable Irs Tax Form 8949 2018 straight from your smartphone

How to generate an eSignature for the Printable Irs Tax Form 8949 2018 on iOS

How to generate an electronic signature for the Printable Irs Tax Form 8949 2018 on Android

People also ask

-

What is Form 8949 2018 and why is it important for tax filing?

Form 8949 2018 is a tax form used by individuals to report the sale and exchange of capital assets. It is essential for accurately calculating capital gains and losses, ensuring compliance with IRS regulations during tax filing. Properly completing Form 8949 2018 can help taxpayers avoid penalties and maximize deductions.

-

How does airSlate SignNow help with completing Form 8949 2018?

airSlate SignNow provides an easy-to-use platform for creating and managing Form 8949 2018 electronically. Users can efficiently fill out, eSign, and share the form with clients or tax professionals, streamlining the tax filing process. Our solution ensures that all necessary information is accurately captured and securely stored.

-

Is there a cost associated with using airSlate SignNow for Form 8949 2018?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, allowing users to choose the plan that fits their budget. Each plan includes features like unlimited document signing and cloud storage, making it a cost-effective choice for filing Form 8949 2018. Consider starting with a free trial to explore all functionalities.

-

What features of airSlate SignNow can enhance the filing process for Form 8949 2018?

AirSlate SignNow offers features such as customizable templates, in-document commenting, and real-time collaboration, which can signNowly enhance the filing process for Form 8949 2018. Automated reminders and tracking ensure that all parties complete their signatures on time, reducing delays in tax submissions.

-

Can I integrate airSlate SignNow with other applications for managing Form 8949 2018?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including accounting and CRM software, to facilitate managing Form 8949 2018 and other documents. These integrations help streamline workflows, making it easier to transfer data and maintain organization across platforms.

-

What are the benefits of using airSlate SignNow for eSigning Form 8949 2018?

Using airSlate SignNow for eSigning Form 8949 2018 offers numerous benefits, including speed, security, and ease of use. The platform ensures that all electronic signatures are legally binding and compliant with regulations, reducing the hassle of physical paperwork and accelerating the document flow.

-

How can I ensure that my Form 8949 2018 is completed accurately using airSlate SignNow?

To ensure accuracy when completing Form 8949 2018 using airSlate SignNow, utilize our template features and guided workflows. These tools help you systematically fill out each section while minimizing the risk of errors. Additionally, all documents can be reviewed and edited collaboratively, providing an extra layer of assurance.

Get more for Form 8949

- Cs019 mva 2009 form

- Maryland motor vehicle administration form is109 2005

- Massachusetts crossbow permit form

- 91 license form

- Massachusetts non resident driver statement form

- Fp 290 form

- Fp 290r form

- Schedule nec form 1040 nr tax on income not effectively connected with a u s trade or business 794317740

Find out other Form 8949

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document