SBA Requires You to Complete the IRS Form 4506 T as a Part of Your Disaster Loan Application

Understanding the SBA Requirement for IRS Form 4506-T

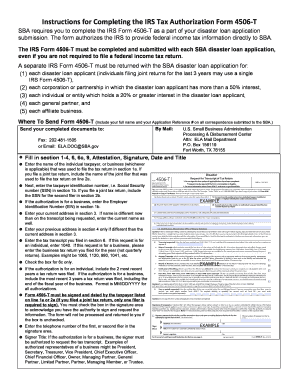

The SBA requires the completion of IRS Form 4506-T as part of the disaster loan application process. This form allows the SBA to obtain tax return information directly from the IRS, which is crucial for verifying the applicant's income and financial status. By providing access to this information, the SBA can ensure that loans are granted based on accurate financial data, helping to streamline the approval process for disaster relief.

Steps to Complete IRS Form 4506-T for SBA Applications

Completing IRS Form 4506-T involves several straightforward steps:

- Download the form from the IRS website or access it through a trusted platform.

- Fill in your personal information, including your name, Social Security number, and address.

- Indicate the type of return you want the IRS to provide, typically the most recent tax return.

- Sign and date the form, ensuring that all information is accurate.

- Submit the completed form to the SBA as part of your disaster loan application package.

Legal Use of IRS Form 4506-T in SBA Applications

The legal validity of IRS Form 4506-T is supported by federal regulations that govern electronic signatures and documents. When using a digital platform to fill out and submit the form, it is essential to ensure compliance with the ESIGN Act and UETA. These laws affirm that electronic signatures hold the same legal weight as traditional handwritten signatures, provided that the signer's intent is clear and the process meets specific security standards.

Required Documents for IRS Form 4506-T Submission

When submitting IRS Form 4506-T for an SBA disaster loan application, you may need to provide additional documentation to support your request. This may include:

- Proof of identity, such as a driver’s license or passport.

- Recent pay stubs or bank statements to verify income.

- Any other financial documents that demonstrate your current economic situation.

Form Submission Methods for IRS Form 4506-T

IRS Form 4506-T can be submitted through various methods, ensuring flexibility for applicants. These methods include:

- Online submission via a secure digital platform that supports eSignatures.

- Mailing the completed form directly to the IRS, which may take longer for processing.

- In-person submission at designated IRS offices, if necessary.

Eligibility Criteria for SBA Disaster Loans Requiring IRS Form 4506-T

To qualify for an SBA disaster loan that requires IRS Form 4506-T, applicants must meet specific eligibility criteria. These criteria generally include:

- Being a small business or a private non-profit organization.

- Demonstrating economic injury due to a declared disaster.

- Providing accurate financial information through the IRS Form 4506-T to support the loan application.

Quick guide on how to complete sba requires you to complete the irs form 4506 t as a part of your disaster loan application

Complete SBA Requires You To Complete The IRS Form 4506 T As A Part Of Your Disaster Loan Application effortlessly on any device

Online document management has become prevalent among companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides you with all the resources required to create, alter, and eSign your documents promptly without delays. Handle SBA Requires You To Complete The IRS Form 4506 T As A Part Of Your Disaster Loan Application on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

The easiest method to modify and eSign SBA Requires You To Complete The IRS Form 4506 T As A Part Of Your Disaster Loan Application without hassle

- Locate SBA Requires You To Complete The IRS Form 4506 T As A Part Of Your Disaster Loan Application and click on Get Form to begin.

- Utilize the features we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you prefer. Alter and eSign SBA Requires You To Complete The IRS Form 4506 T As A Part Of Your Disaster Loan Application and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sba requires you to complete the irs form 4506 t as a part of your disaster loan application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS Form 4506T SBA, and why is it important?

The IRS Form 4506T SBA is a document that allows businesses to request a transcript of their tax return information from the IRS. This form is crucial for small businesses seeking financial assistance through the SBA, as it verifies income and ensures eligibility for loans. Using airSlate SignNow to eSign and send the form helps expedite the process.

-

How can airSlate SignNow help me with IRS Form 4506T SBA?

airSlate SignNow provides a streamlined platform for businesses to easily complete and eSign the IRS Form 4506T SBA. Our intuitive interface allows users to fill out the form digitally, ensuring accuracy and compliance. This simplifies the submission process to the IRS, making it faster and more efficient.

-

Is there a cost associated with using airSlate SignNow for IRS Form 4506T SBA?

Yes, airSlate SignNow has various pricing plans that cater to different business needs, including those that require assistance with IRS Form 4506T SBA. Our cost-effective solutions help businesses manage their document workflows without breaking the bank. Detailed pricing information can be found on our website.

-

What features does airSlate SignNow offer for handling IRS Form 4506T SBA?

airSlate SignNow offers features like customizable templates, secure eSignatures, and real-time tracking for IRS Form 4506T SBA. Additionally, our solution integrates seamlessly with other applications, streamlining document management. This makes it easy for users to manage their submissions efficiently and effectively.

-

Can I track my submissions of IRS Form 4506T SBA with airSlate SignNow?

Absolutely! With airSlate SignNow, users can track the status of their IRS Form 4506T SBA submissions in real time. This feature provides peace of mind by ensuring that you remain informed about your document's progress and any actions needed. Tracking your submissions helps you stay organized and proactive.

-

Are there integrations available for IRS Form 4506T SBA with airSlate SignNow?

Yes, airSlate SignNow offers various integrations with popular business applications to facilitate the handling of IRS Form 4506T SBA. These integrations enable seamless data transfer, enhancing workflow efficiency. You can easily connect with tools like CRM systems, accounting software, and more.

-

What are the benefits of using airSlate SignNow for IRS Form 4506T SBA?

Using airSlate SignNow for IRS Form 4506T SBA provides numerous benefits, including faster processing times, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored safely and accessible whenever needed. By leveraging our eSigning capabilities, you can simplify your overall application process.

Get more for SBA Requires You To Complete The IRS Form 4506 T As A Part Of Your Disaster Loan Application

Find out other SBA Requires You To Complete The IRS Form 4506 T As A Part Of Your Disaster Loan Application

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure