T5013 Slip Box Form

What is the T5013 Slip Box

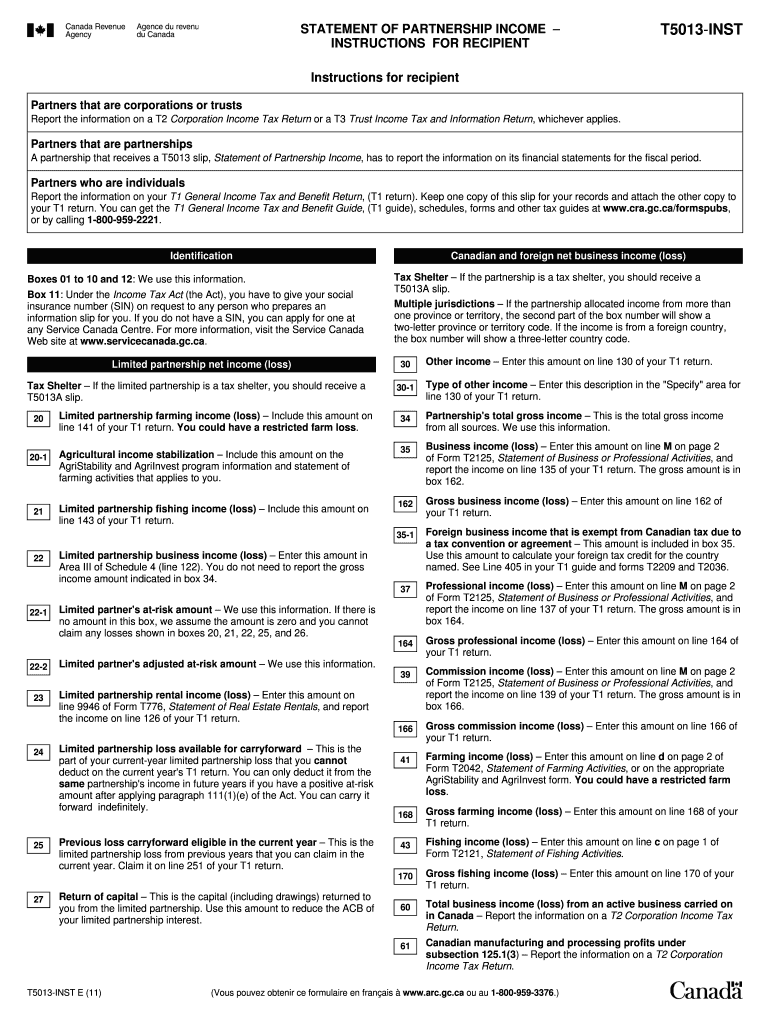

The T5013 slip box is a crucial component in the Canadian tax system, specifically designed for reporting income earned by partnerships. This slip provides detailed information about the income, deductions, and credits allocated to each partner. Understanding the T5013 slip is essential for taxpayers who are part of a partnership, as it ensures accurate reporting of their share of the partnership's income on their personal tax returns.

How to use the T5013 Slip Box

Using the T5013 slip box involves several steps. First, you need to receive the T5013 slip from the partnership in which you are involved. This slip will contain various boxes that need to be filled out accurately. Each box corresponds to specific types of income or deductions. After obtaining the slip, you should carefully review the information provided and ensure it matches your records. Finally, report the information from the T5013 slip on your personal tax return, ensuring compliance with IRS guidelines.

Steps to complete the T5013 Slip Box

Completing the T5013 slip box requires attention to detail. Start by gathering all necessary documents related to your partnership income. Next, locate the relevant boxes on the T5013 slip. Fill in your share of the income, deductions, and any other applicable information. It is important to double-check your entries for accuracy. Once completed, keep a copy for your records and submit the slip as part of your tax return. This process ensures that you report your income correctly and avoid potential penalties.

Key elements of the T5013 Slip Box

The T5013 slip box includes several key elements that are essential for accurate tax reporting. These elements typically include:

- Box 135: This box reports your share of the partnership's income.

- Box 140: This box indicates your share of any capital gains.

- Box 141: This box is used for reporting capital losses.

- Box 150: This box details any other income or deductions specific to your partnership.

Each box serves a specific purpose and must be filled out according to the information provided by the partnership.

Legal use of the T5013 Slip Box

The legal use of the T5013 slip box is governed by tax regulations that require accurate reporting of partnership income. It is essential for partners to use the information from the T5013 slip to report their income correctly to avoid issues with the IRS. Failure to accurately report income can result in penalties or audits. Therefore, understanding the legal implications and ensuring compliance with tax laws is vital for all taxpayers involved in partnerships.

Filing Deadlines / Important Dates

Filing deadlines for the T5013 slip box are critical for compliance. Typically, partnerships must issue T5013 slips to their partners by the end of March each year. Partners then have until April 30 to file their personal tax returns, including the information from the T5013 slip. It is important to be aware of these deadlines to avoid late filing penalties and ensure timely processing of tax returns.

Quick guide on how to complete t5013 information about slip

Effortlessly prepare T5013 Slip Box on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents swiftly without delays. Handle T5013 Slip Box on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign T5013 Slip Box with ease

- Obtain T5013 Slip Box and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign T5013 Slip Box to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill out a deposit slip?

You go to the bank of your choice, preferably where you have an account, and ask for a deposit slip. You then technically do a “fill in the blank” and then write the number of notes of relevant denomination note. Like thisCredit: http://mindpowerindia.com/sbi.phpNow go and deposit your Rs. 500 and Rs. 1000 notes, if you are in India :-)EDIT: As rightly pointed out by Lara Taylor sorry for being judgemental.

-

How can I fill out a savings deposit slip?

“How can I fill out a savings deposit slip?”Do you have some savings to deposit?Do you have a savings account?Do you know the savings account number?Do you have a way to obtain a savings deposit slip?Do you have a pen with which to fill out the savings deposit slip?Are you physically able to enter the appropriate information on the slip?When you’ve answered these questions, then someone can probably provide an appropriate answer to your question.

-

How do I fill out a bank deposit slip?

You would have to show up in person at a branch location that belongs to your bank where your bank account is open. Most banks have a lines for the customers to get in line and wait for their turn to talk to the bank teller. Most banks will have a section in the middle of this section where they have a bunch of blank documents and a deposit slip is included there.There is specific information that you need to know in order to fill the bank deposit slip correctly and you don't have to spend time memorizing it or take documents of that information with you. All you have to do is just write it down in a piece of paper and then reap into pieces the paper when you are done. The information that you need to fill out the deposit slip is your account number. What is it that you are depositing a check or cash and what is the exact amount to be deposited. The deposit slip should include your name and your signature.In type of deposit slip, you would have to also check whether you are depositing the funds into your bank checkings account or into your bank savings account and your address. The signature section is a part that can only be signed in the presence of a bank teller. You would also have to write the date on which this deposit takes place.Some deposit slips differ in one or two things from the others but for the most part they all are very similar in many ways. In this deposit slip, you would not have to write the date or your address or whether it goes to a savings or checking accounts but all other information still applies.Note that in the two types of the deposits samples there is a section that says “subtotal” and another that says “less cash”. Those two sections are only applicable when you present a check to be cash but you also want part of that check to deposit into your account. For example, let us say that you present a check with the total funds of 1458 but you want to receive 800 in cash and the remaining balance is two be deposited. In that case, the subtotal would say “1458” and the “less cash” section would say “800” the the “total” section would say “658”. Those types of deposit slips are provided to you free of charge at the bank.The deposit slip shown above is another type of bank deposit slip which is more convenient and you have less possibilities of making entry errors because those types of deposit slips are already personalized and they already have your bank account, name and address printed on them. All you have to do is fill out the amount that you depositing into your bank account and whether it is a check or cash. However, the personalized deposit slips costs money.At the end of the successful deposit transaction, you should received from the bank teller a deposit receipt which summarizes the how much was deposited and your new bank account balance. Some advanced banks will even print a receipt with an image of the check that was deposited.

-

What are the steps to fill out a deposit slip?

There are following steps to fillout a deposit slip:1.fill your branch name in which you have maintained your account.2. your name3.Your bank account no.4.Rupees with denominations and then in words5.your mobile no.6.your signature

-

Is the information I fill out about myself on the PSAT/SAT tests sold to colleges?

A lot of these questions are used in the Student Search Service for colleges who are looking to signNow out to a specific group of students. If you opted in for that, you will definitely get a considerable amount of mail/email.

-

How do I sell my car in California? What do I need to have filled out in the pink slip?

If the pink slip is in the seller’s name, the seller needs only:Release interest (sign and date line 1a). If there are two registered owners separated by the word AND, then you’ll need line 1b as well.Complete the odometer disclosure (reading, sign and date as seller). If the car is more than 10 years old, this portion is not required.Tear off the Notice of Transfer and Release of Liability. Collect the buyer’s information using this form. You could mail it in, but I recommend filing online instead.There’s no need for the seller to do anything else to the title. The back is for the buyer to worry about.If you have adequate time to prepare in advance, I recommend visiting DMV (or an auto club) to obtain two original watermarked REG 262 forms. These are transfer forms with signature lines for both buyer and seller. Complete and sign two originals, crossing out the power of attorney section. Each party keeps a fully executed original.If you can’t get hold of REG 262, you can download REG 135 instead, but these do not have signature lines for the buyer. Less than ideal, but better than nothing. Leave the DL number blank though. You don’t need to share that information.

Create this form in 5 minutes!

How to create an eSignature for the t5013 information about slip

How to make an electronic signature for your T5013 Information About Slip in the online mode

How to make an eSignature for your T5013 Information About Slip in Chrome

How to generate an eSignature for putting it on the T5013 Information About Slip in Gmail

How to generate an eSignature for the T5013 Information About Slip right from your mobile device

How to generate an electronic signature for the T5013 Information About Slip on iOS devices

How to create an eSignature for the T5013 Information About Slip on Android

People also ask

-

What is a T5013 Slip Box?

The T5013 Slip Box is a specialized document format used in Canada for reporting income from partnerships and certain investment entities. It provides essential information about the earnings, deductions, and taxes withheld for each partner. Using airSlate SignNow, you can easily manage and electronically sign your T5013 Slip Box documents, streamlining your tax reporting process.

-

How can airSlate SignNow help with T5013 Slip Box management?

airSlate SignNow simplifies the management of your T5013 Slip Box by allowing you to upload, edit, and electronically sign your documents with ease. This cloud-based solution ensures that your files are securely stored and accessible from anywhere. Additionally, the platform offers automated workflows to keep your T5013 Slip Box documents organized and up-to-date.

-

Is there a cost associated with using airSlate SignNow for T5013 Slip Box documents?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including options for managing T5013 Slip Box documents. You can choose a plan that best fits your budget and requirements, ensuring that you have the necessary tools for efficient document management without overspending.

-

What features does airSlate SignNow offer for T5013 Slip Box users?

airSlate SignNow provides a range of features for T5013 Slip Box users, including customizable templates, electronic signatures, and real-time tracking. These features enhance your document workflow by making it easier to collaborate with partners and ensure compliance with tax regulations. The platform also supports cloud storage for secure access to your T5013 Slip Box files.

-

Are there integrations available for T5013 Slip Box processes?

Yes, airSlate SignNow offers seamless integrations with popular business applications to enhance your T5013 Slip Box processes. You can connect it with accounting software, CRM systems, and other tools to streamline data entry and minimize manual work. This integration capability ensures a more efficient workflow for handling your T5013 Slip Box documents.

-

Can I track the status of my T5013 Slip Box documents with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for your T5013 Slip Box documents, allowing you to see when they are viewed, signed, or completed. This feature helps you maintain accountability and ensures that all necessary parties are informed throughout the signing process.

-

Is airSlate SignNow secure for handling T5013 Slip Box documents?

Yes, security is a top priority at airSlate SignNow. The platform uses advanced encryption and compliance measures to protect your T5013 Slip Box documents and sensitive information. You can trust that your data is secure while you create, sign, and manage your tax-related documents.

Get more for T5013 Slip Box

Find out other T5013 Slip Box

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement